At Constitution Wealth, our experienced financial advisors work with families and business owners for holistic financial advice and investment planning, but we don’t stop there. Integrated within our expertise is our commitment to aligning our services with your core values and patriotic sentiments.

You are creating your legacy for today and the future of your family and it’s important to align your legacy and life mission with your values. And of course, it just doesn’t make sense to align yourself with people and companies that don’t like or agree with your ideas and faith.

This is a real-world story that occurred this quarter that one of Constitution Wealth’s financial advisors wanted to reflect on and share; I hope you find it helpful.

The Rolling Stones classic “Time Waits For No One” is a reflection on the passing of time, the passing of friends, and the passing of loved ones. It’s a wonderful song with a precise and beautifully crafted guitar solo by Mick Taylor, one of my favorite guitarists. The chorus sums it up: “Time waits for no one, and it won’t wait for me…”

Over the past few years I’ve had several friends and acquaintances pass away but also spouses of clients. Most recently the wife of a client passed away and I was moved by the words at her memorial service and came to know both my client and his spouse in a new light. Let’s call them Mike and Mary, both 79 years old in 2024.

First let me say that Mike gave me permission to share my thoughts on their situation prior to writing this. In this advisory relationship, I did not interact with Mary at all, only Mike. At the service Mary was lovingly described as a “persnickety” character full of energy and a motive force and focal point for the family and community for social activities. She also had a history of health issues being one of the first successful recipients of a kidney transplant in the U.S. decades ago and continued to be challenged by health issues up until the time of her passing.

Over the years working with Mike, I found him to be thoughtful and informed with meticulous attention to detail. He is also very aware of the big picture inherent in holistic financial planning I did for him and investment strategies and cash flow management. We had recently, prior to Mary’s passing, fine tuned a few planning scenarios wherein they would sell their home and move into a very nice retirement facility. The point being, Mike was on a mission to take care of his family and although very astute he was wise enough to have a financial advisor to sanitize his thoughts and implement a strategy on a long term basis. As it turns out, life happened and things changed for Mike and his family very quickly but thanks to his good decision making and advanced planning as a family steward, he will at least not have the added stress of estate and financial issues moving forward despite a challenging future without a spouse that he has loved and cared for, for decades.

Contrast this to some other folks I’ve spoken with who have and continue to do everything by themselves because that’s how they’ve always done it. Others might want a quick one-time plan they can take with them and utilize on their own, not fully understanding that a static plan is somewhat useless as life-circumstances and the investment environment literally changes daily. Usually they have the mindset of either not trusting other folks, thinking they know how to do everything better, have done things the same way for years and think that they will continue to have the time, energy, and mental acuity to continue. Unfortunately some of these folks are just in denial that life changing and life ending changes are on the horizon. My clear and simple observation to this is that these folks have a high probability of putting their families financial success and peace of mind at risk.

As we get older, it becomes more difficult to manage fear and risk, and of course more difficult to recover from mistakes. Managing the emotional aspects of losing a spouse is a challenge of a lifetime. If financial stress is piled on top of that, it can turn into an unrecoverable situation. Mike got it right. As I said to him after the memorial service, “Mission accomplished”. My meaning was that he had his family covered regardless of what life threw at him. Now he can have some peace of mind financially as he navigates the next phase of his life and finds a new mission.

At the end of the day, this real-world scenario reminds me that my role as a financial advisor is more impactful than just numbers on a report and that it takes foresight and wisdom for family stewards to understand that as well.

2024 Q2 Review

Overall the markets were mixed but steady.

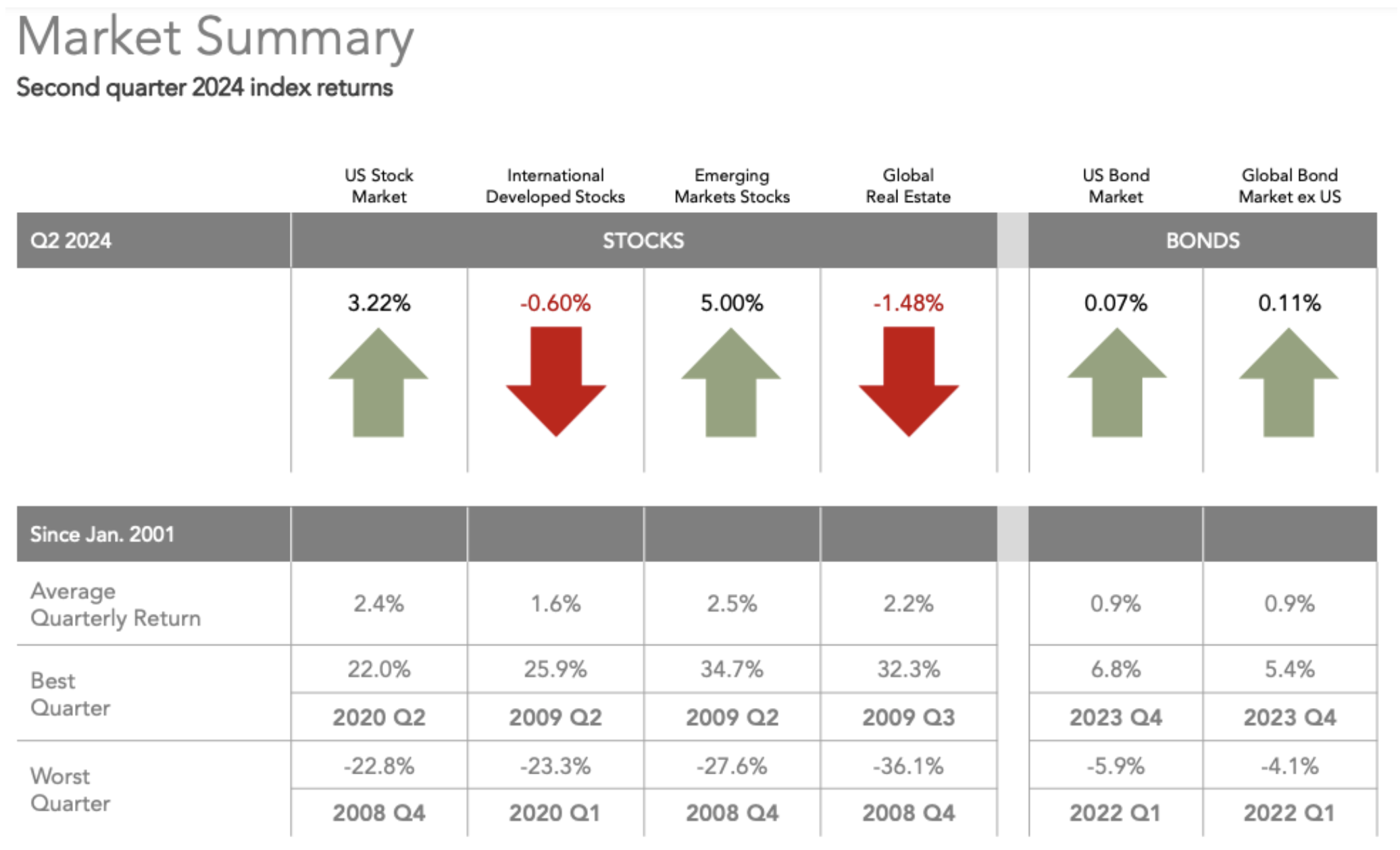

Global equities were mixed for the second quarter. For the listed indexes, Emerging Markets performed the best with a 5% return followed by the U.S. Stock Market returning 3.22%. International Developed and Global Real Estate were down slightly at -0.60% and -1.48% respectively.

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio.

Market segment (index representation) as follows: US Stock Market (Russell 3000 Index), International Developed Stocks (MSCI World ex USA Index [net dividends]), Emerging Markets (MSCI Emerging Markets Index [net dividends]), Global Real Estate (S&P Global REIT Index [net dividends]), US Bond Market (Bloomberg US Aggregate Bond Index), and Global Bond Market ex US (Bloomberg Global Aggregate ex-USD Bond Index [hedged to USD]). S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2024, all rights reserved. Bloomberg data provided by Bloomberg.

Bonds

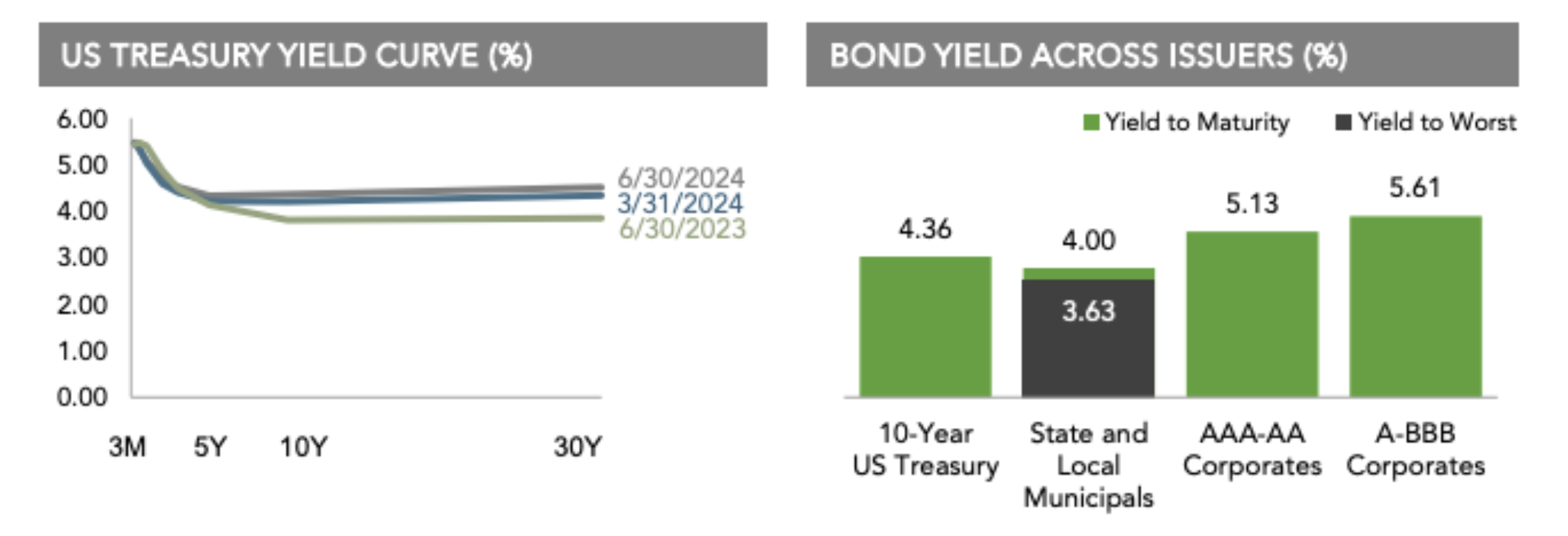

Interest rates generally increased in the US Treasury market for the quarter.

On the short end of the yield curve, the 1-Month US Treasury Bill yield decreased 2 basis points (bps) to +5.47%, while the 1-Year US Treasury Bill yield increased 6 bps to +5.09%. The yield on the 2-Year US Treasury Note increased 12 bps to +4.71%.

The yield on the 5-Year US Treasury Note increased 12 bps to +4.33%. The yield on the 10-Year US Treasury Note increased 16 bps to +4.36%. The yield on the 30-Year US Treasury Bond increased 17 bps to +4.51%.

In terms of total returns, short-term US treasury bonds returned +0.77% while intermediate-term US treasury bonds returned +0.58%. Short-term corporate bonds returned +0.96% and intermediate-term corporate bonds returned +0.74%.1

The total returns for short- and intermediate-term municipal bonds were +0.35% and -0.92%, respectively. Within the municipal fixed income market, general obligation bonds returned -0.30% while revenue bonds returned +0.07%.2

Period Returns (%)

1. Bloomberg US Treasury and US Corporate Bond Indices. 2. Bloomberg Municipal Bond Index.

One basis point (bps) equals 0.01%. Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Yield curve data from Federal Reserve. State and local bonds and the Yield to Worst are from the S&P National AMT-Free Municipal Bond Index. AAA-AA Corporates represent the ICE BofA US Corporates, AA-AAA rated. A-BBB Corporates represent the ICE BofA Corporates, BBB-A rated. Bloomberg data provided by Bloomberg. US long-term bonds, bills, inflation, and fixed income factor data © Stocks, Bonds, Bills, and Inflation (SBBI) Yearbook™, Ibbotson Associates, Chicago (annually updated work by Roger G. Ibbotson and Rex A. Sinquefield). FTSE fixed income indices © 2024 FTSE Fixed Income LLC, all rights reserved. ICE BofA index data © 2024 ICE Data Indices, LLC. S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Bloomberg data provided by Bloomberg.

Morgan H Smith Jr. is an investment advisor with Constitution Wealth. Constitution Wealth is a registered investment adviser in Wyoming. Constitution Wealth is registered with the Securities and Exchange Commission (SEC). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the commission. Constitution Wealth only transacts business in states in which the firm is properly registered or is excluded or exempted from registration. A copy of Constitution Wealth’s current written disclosure brochure filed with the SEC, which discusses among other things, Constitution Wealth’s business practices, services, and fees, is available through the SEC’s website at www.adviserinfo.sec.gov.

Please note, the information provided in this document is for informational purposes only and investors should determine for themselves whether a particular service or product is suitable for their investment needs. Please refer to the disclosure and offering documents for further information concerning specific products or services.

Any hypothetical, backtested performance has been provided for illustrative purposes only, and is not necessarily, and does not purport to be, indicative, or a guarantee, of future results or the adviser’s skill. Hypothetical, backtested performance does not represent actual performance. The results are prepared by retroactive application of a model, with the benefit of hindsight, and actual results may vary substantially. The preparation of such information is based on underlying assumptions, and does not represent the actual performance of any fund, portfolio, or investor, it is subject to risk and limitations that are not applicable to non-hypothetical performance presentations. Although advisor believes any hypothetical, backtested performance calculations described herein are based on reasonable assumptions, the use of different assumptions would produce different results. For the foregoing and other similar reasons, the comparability of hypothetical, backtested performance to the prior (or future) actual performance of a fund is limited, and prospective investors should not unduly rely on any such information in making an investment decision.

Nothing provided in this document constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation or an offer to sell (or solicitation of an offer to buy) securities in the U.S. or in any other jurisdiction.

This document may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions; changing levels of competition within certain industries and markets; changes in interest rates; changes in legislation or regulation; and other economic, competitive, governmental, regulatory, and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of Constitution Wealth or any of its affiliates or principals or any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events, or any other circumstances. All statements made herein speak only as of the date they were made.

Any indices and other financial benchmarks shown are provided for illustrative purposes only, are unmanaged, reflect reinvestment of income and dividends, and do not reflect the impact of advisory fees. Investors cannot invest directly in an index. Comparisons to indexes have limitations because indexes have volatility and other material characteristics that may differ from a particular hedge fund.