Constitution Wealth 2025 Q1 Review: A Tale of Two Countries

We are all emotional creatures with a touch of what we like to think of as data-driven logic sprinkled in. But you have to admit that there are differences across the population as to the ratio of the mix. Some are more emotional to the point of hysterics at their worst. Some are more logical to the point of heartless analysis-paralysis at their worst.

To wit, we all have biases, many unknown, that imbue an emotional taint into our thoughts and decision making. One of my most important duties is to help investors keep a balance between emotion and logic in an environment of trust and integrity. This essentially means keeping you on track during times of over-exuberance and times of under-enthusiasm.

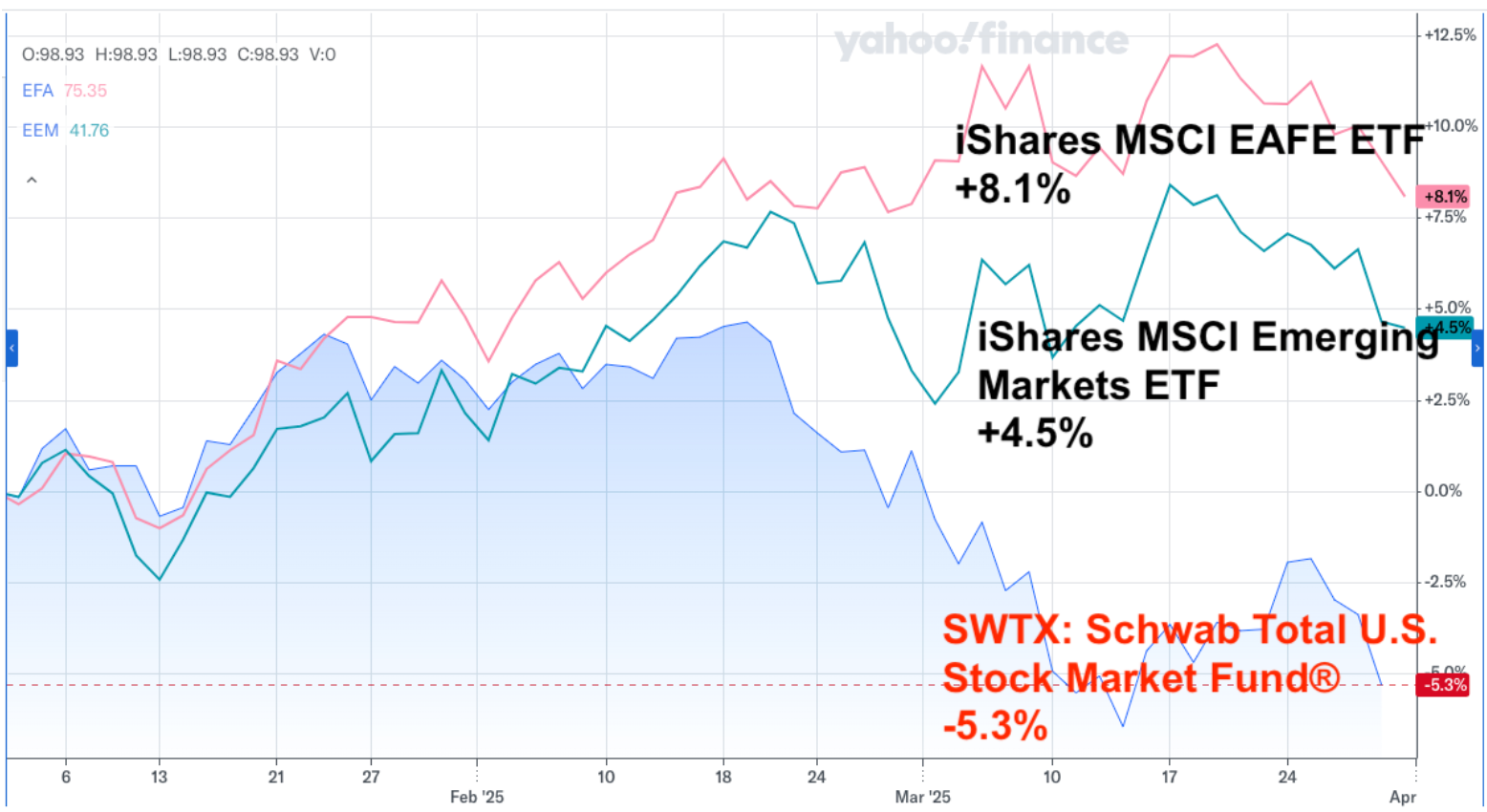

This quarter, let’s take a look at “home” bias and how it affects many investors. Investors often get focused on domestic events, forgetting that there is a world of opportunity often not reflected in their investment portfolios. Over the last several years, the U.S. market had indeed performed well to the point that many investors forgot about opportunities abroad. Let’s take a look at some indexes for the quarter.

Chart Note: “EAFE” refers to developed international markets and stands for “Europe Asia Far East”

01/01/2025 through 03/31/2025 © Past performance is no guarantee of future results. Any fund holdings shown should not be considered a recommendation of any security by the investment adviser. Chart © 2025 Yahoo. All rights reserved. In partnership with ChartIQ. https://www.schwabassetmanagement.com/products/swtsx, https://www.ishares.com/us/products/239637/ishares-msci-emerging-markets-etf, https://www.ishares.com/us/products/239623/ishares-msci-eafe-etf

As can be seen from the chart, SWTX (representative of the overall U.S. stock market) performed at a negative -5.3% for Q1 2025. For those investors who were home-biased and focused on U.S. markets, this trend would have negatively influenced their portfolio significantly and perhaps solidified a negative sentiment moving forward.

On the other hand, iShares MSCI EAFE ETF returned +8.3% while iShares Emerging Markets ETF returned +4.5% for the quarter. So those investors with globally diversified portfolios would most likely have benefited from the strong YTD push from international markets allocations.

I titled this article as “A Tale of Two Countries” for obvious reasons, but it’s also “A Tale of Two Investors” for the quarter. This quarter was a perfect example of why we want to structure our investment allocation based on sound academics and instill discipline over time to take advantage of global opportunities that can benefit us when we least expect them to.

Market Review: 2025 Q1

The Fed kept the federal-funds rate unchanged in the 4.25%–4.5% range in March, citing elevated inflation and an uncertain economic outlook.1 On inflation, the US core consumer price index, which excludes more-volatile food and energy items, showed prices rose 3.1% from a year earlier in February, the most recent data available, which is more than a percentage point higher than the Fed’s target of 2%.2 Meanwhile, the unemployment rate edged slightly higher, to 4.1%, in February.3

1. The federal-funds rate is the overnight interest rate at which one depository institution (like a bank) lends to another institution some of its funds that are held at the Federal Reserve. “Federal Reserve Issues FOMC Statement,” Federal Reserve, March 19, 2025.

2. Inflation data as defined by the consumer price index (CPI) from the US Bureau of Labor Statistics; the core CPI is an aggregate of prices paid by urban consumers for a typical basket of goods that excludes food and energy; Megan Leonhardt, “Markets Celebrate Softer Inflation, but Fed Will Remain on Pause,” Barron’s, March 12, 2025.

3. Derek Saul, “US Added 151,000 Jobs as Unemployment Rose to 4.1% in February,” Forbes, March 7, 2025.

Tariff Trepidation

The threat of tariffs is liable to loom over markets for the foreseeable future, with levies on China already in place and those on Canada and Mexico set to take effect in early April and there’s no assurance as to what the results of any coming actions will be.

One period offering perspective on this issue is President Trump’s first term in office. Beginning in 2017, the administration eyed China as a target and, by 2018, began imposing tariffs across a range of products. The next couple of years saw back and forth trade discussions that eventually led to an agreement, though pre-existing tariffs remained in place. Despite all this uncertainty, both China and the US posted higher cumulative returns than the MSCI World ex USA Index over the four years of Trump’s term.

Past performance is not a guarantee of future results. Tariffs are only one of many factors that can impact security prices. Investors may be better off sticking with the plan rather than trying to outguess the market based on potential tariff policy changes.

And finally, I’ve been seeing headlines pop up on “stagflation” which in my view is most likely click-bait, feeding on investor fears. But, let’s hypothesize for a moment that we are in fact in for a period of stagflation. Should investors act on this concern with their investments?

Since 1930, the US has seen 12 years when negative GDP growth coincided with positive changes in the consumer price index (CPI). The US stock market’s real return—its return in excess of inflation—was positive in nine out of those 12. That hit rate is close to the frequency of positive real returns across all years between 1930 and 2024, which is 68%.

This is another example demonstrating how concerns over the economy shouldn’t drive investment decisions. Predictions about the direction of the economy are continuously forming, but the market itself remains the best predictor of the future. That means market prices are set to levels to deliver positive expected returns even amid concerns over future economic outcomes.

In USD. Sources: Bureau of Labor Statistics, US Bureau of Economic Analysis, S&P 500 Index: January 1990–Present, Standard & Poor’s Index Services Group; January 1930–December 1989, Ibbotson data courtesy of © Stocks, Bonds, Bills, and Inflation Yearbook® Stocks, Bonds, Bills, and Inflation Yearbook®, Ibbotson Associates, Chicago. S&P data © 2025 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. US inflation is the annual rate of change in the consumer price index for all urban consumers (CPI-U, not seasonally adjusted) from the Bureau of Labor Statistics. Annual GDP growth rates obtained from the US Bureau of Economic Analysis. GDP growth numbers are adjusted to 2012 USD terms to remove the effects of inflation. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

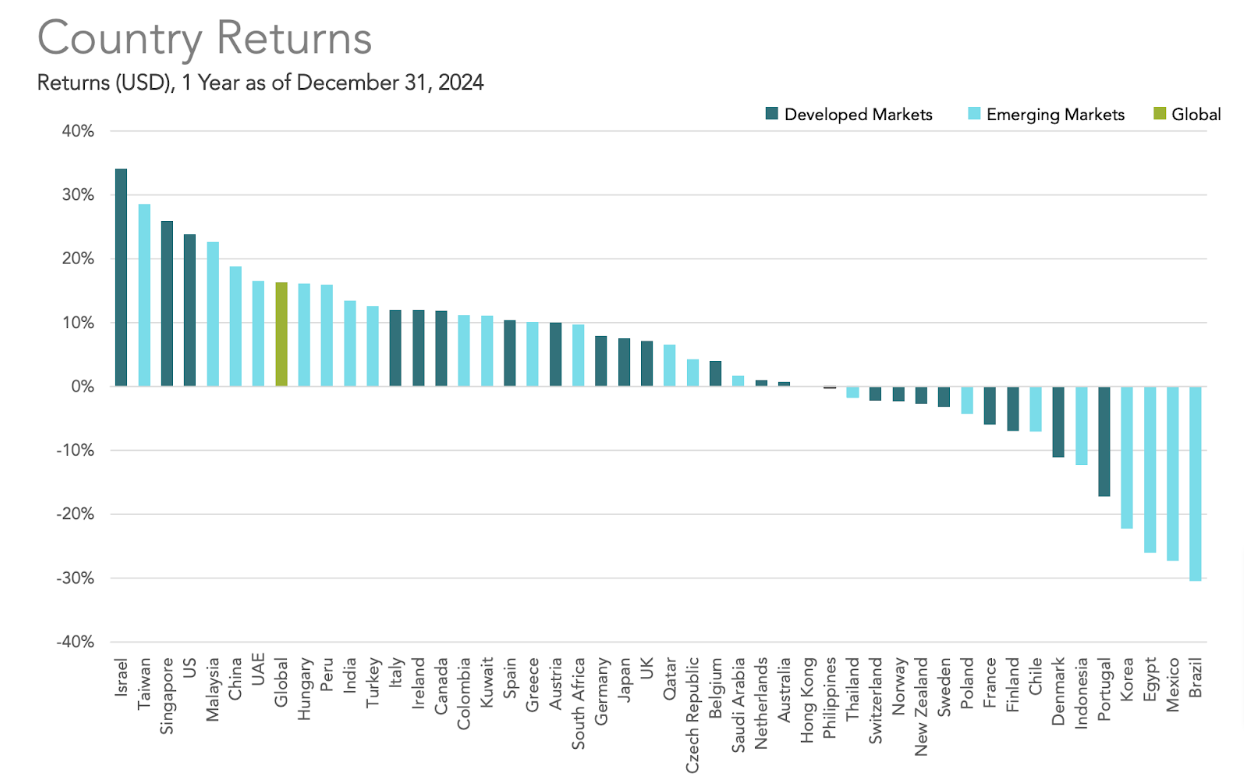

To wrap things up, the theme at the beginning of this report was about global opportunities and I think this graphic of country returns for the first quarter helps bolster the idea of global diversification.

Past performance is no guarantee of future results. Country returns are the country component indices of the MSCI All Country World IMI Index for all countries except the United States, where the Russell 3000 Index is used instead. Global is the return of the MSCI All Country World IMI Index. MSCI index returns are net dividend. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. MSCI data © MSCI 2025, all rights reserved.

Morgan H Smith Jr. is an investment advisor with Constitution Wealth. Constitution Wealth is a registered investment adviser in Wyoming. Constitution Wealth is registered with the Securities and Exchange Commission (SEC). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the commission. Constitution Wealth only transacts business in states in which the firm is properly registered or is excluded or exempted from registration. A copy of Constitution Wealth’s current written disclosure brochure filed with the SEC, which discusses among other things, Constitution Wealth’s business practices, services, and fees, is available through the SEC’s website at www.adviserinfo.sec.gov.

Please note, the information provided in this document is for informational purposes only and investors should determine for themselves whether a particular service or product is suitable for their investment needs. Please refer to the disclosure and offering documents for further information concerning specific products or services.

Any hypothetical, backtested performance has been provided for illustrative purposes only, and is not necessarily, and does not purport to be, indicative, or a guarantee, of future results or the adviser’s skill. Hypothetical, backtested performance does not represent actual performance. The results are prepared by retroactive application of a model, with the benefit of hindsight, and actual results may vary substantially. The preparation of such information is based on underlying assumptions, and does not represent the actual performance of any fund, portfolio, or investor, it is subject to risk and limitations that are not applicable to non-hypothetical performance presentations. Although advisor believes any hypothetical, backtested performance calculations described herein are based on reasonable assumptions, the use of different assumptions would produce different results. For the foregoing and other similar reasons, the comparability of hypothetical, backtested performance to the prior (or future) actual performance of a fund is limited, and prospective investors should not unduly rely on any such information in making an investment decision.

Nothing provided in this document constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation or an offer to sell (or solicitation of an offer to buy) securities in the U.S. or in any other jurisdiction.

This document may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions; changing levels of competition within certain industries and markets; changes in interest rates; changes in legislation or regulation; and other economic, competitive, governmental, regulatory, and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of Constitution Wealth or any of its affiliates or principals or any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events, or any other circumstances. All statements made herein speak only as of the date they were made.

Any indices and other financial benchmarks shown are provided for illustrative purposes only, are unmanaged, reflect reinvestment of income and dividends, and do not reflect the impact of advisory fees. Investors cannot invest directly in an index. Comparisons to indexes have limitations because indexes have volatility and other material characteristics that may differ from a particular hedge fund.

Trump Rescues Conservative-Values Investors? Problem solved? Not so fast...

Under the leadership of President Donald Trump, we believe significant strides have been made in reversing the insidious Diversity, Equity, and Inclusion (DEI) policies that have infiltrated our society.

In our opinion, these policies, which have been woven into the fabric of corporate HR departments, government agencies, and university bureaucracies, pose a direct threat to the conservative principles that we feel form the bedrock of our nation.

Despite what we see as progress made by the Trump administration, it is crucial to recognize that we think the fight against DEI is far from over, and aligning one’s investments with conservative values remains an ongoing challenge. In our view, the pervasive nature of DEI policies cannot be underestimated, as they have been strategically embedded in key institutions over the course of several years.

This calculated approach has allowed DEI to gain a strong foothold, we believe, making it difficult to completely eradicate its influence. As conservatives, we aim to remain vigilant and committed to the cause of dismantling these policies, which we feel seek to undermine our traditional values and promote a leftist agenda.

While the political road ahead may be arduous, we believe it is imperative that we strive to align our investments with our conservative principles.

By actively seeking out and supporting companies, organizations, and initiatives that share our values, we believe we can contribute to the gradual erosion of DEI’s influence. This process will require patience, determination, and an unwavering commitment to our beliefs, but the end result – a society free from the shackles of DEI – is well worth the effort, in our view.

As we navigate this challenging landscape, let us remember that our collective actions, no matter how small, can make a significant difference in the fight against what we see as the insidious spread of DEI policies.

Ask yourself this…

Can you trust your investments and your family’s legacy with a firm that has supported DEI and what you may view as anti-family and anti-faith-based policies for years and all of a sudden have switched their stance due to political expediency?

Or, would you prefer to work with a trusted advisor at a firm that has been committed to conservative-values based investors from day one?

At Constitution Wealth, we have always believed that your financial decisions should be a reflection of your personal values.

When you invest in alignment with your beliefs, you not only have the potential to grow your wealth, but you can also stay true to what matters most—your integrity.

That’s why we’re dedicated to helping you build a portfolio that strives to support your core conservative values, allowing you to invest with purpose and pride. That mission statement has never changed, and never will.

Morgan H Smith Jr. is an investment advisor with Constitution Wealth. Constitution Wealth is a registered investment adviser in Wyoming. Constitution Wealth is registered with the Securities and Exchange Commission (SEC). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the commission. Constitution Wealth only transacts business in states in which the firm is properly registered or is excluded or exempted from registration. A copy of Constitution Wealth’s current written disclosure brochure filed with the SEC, which discusses among other things, Constitution Wealth’s business practices, services, and fees, is available through the SEC’s website at www.adviserinfo.sec.gov.

Please note, the information provided in this document is for informational purposes only and investors should determine for themselves whether a particular service or product is suitable for their investment needs. Please refer to the disclosure and offering documents for further information concerning specific products or services.

Any hypothetical, backtested performance has been provided for illustrative purposes only, and is not necessarily, and does not purport to be, indicative, or a guarantee, of future results or the adviser’s skill. Hypothetical, backtested performance does not represent actual performance. The results are prepared by retroactive application of a model, with the benefit of hindsight, and actual results may vary substantially. The preparation of such information is based on underlying assumptions, and does not represent the actual performance of any fund, portfolio, or investor, it is subject to risk and limitations that are not applicable to non-hypothetical performance presentations. Although advisor believes any hypothetical, backtested performance calculations described herein are based on reasonable assumptions, the use of different assumptions would produce different results. For the foregoing and other similar reasons, the comparability of hypothetical, backtested performance to the prior (or future) actual performance of a fund is limited, and prospective investors should not unduly rely on any such information in making an investment decision.

Nothing provided in this document constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation or an offer to sell (or solicitation of an offer to buy) securities in the U.S. or in any other jurisdiction.

This document may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions; changing levels of competition within certain industries and markets; changes in interest rates; changes in legislation or regulation; and other economic, competitive, governmental, regulatory, and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of Constitution Wealth or any of its affiliates or principals or any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events, or any other circumstances. All statements made herein speak only as of the date they were made.

Any indices and other financial benchmarks shown are provided for illustrative purposes only, are unmanaged, reflect reinvestment of income and dividends, and do not reflect the impact of advisory fees. Investors cannot invest directly in an index. Comparisons to indexes have limitations because indexes have volatility and other material characteristics that may differ from a particular hedge fund.

Constitution Wealth 2024 Q4 Review: When Stats & Facts Don't Add Up

Our mission at Constitution Wealth is to align your conservative values with your family wealth strategies. But of course, we don’t want to do that at the expense of sound investment principles.

This quarter’s report will be a little different. We’ll provide you with some interesting statistics and facts on the overall economy that may give you perspective as we head into 2025. In truth, we find this type of information to be very interesting and intellectually stimulating and thought it might be helpful for our readers as we begin the new year.

So, let’s have a look at some of the current economic indicators from sources that we deem reliable. Rather than publish a stack of graphs, I’ll list the economic data in a table and link to the data.

| Indicator | Description | Value | Link To Chart/Data/Description |

| 5 Year Breakeven Inflation Rate | represents a measure of expected inflation | 2.40% | Click here to see data. |

| 2024 Q4 Real GDP Growth | forecast the growth of real GDP | 1.21% | Click here to see data. |

| Consumer Price Index | price index of a basket of goods and services paid by urban consumer | rising | Click here to see data. |

| Credit Card Debt Tops $1 Trillion | In 2023, outstanding credit card balances in the United States surpassed $1 trillion for the first time. | Click here to see data. | |

| Unemployment Rate | the number of unemployed as a percentage of the labor force | 4.20% | Click here to see data. |

| Economic News Sentiment | measure of economic sentiment based on lexical analysis of economics-related news articles | positive | Click here to see data. |

| VIX Volatility Index | a popular measure of the stock market’s expectation of volatility based on S&P 500 index options. | lower vs year | Click here to see data. |

| Mortgage Rates | Freddi Mac 30 & 15 Year Fixed | rising Q4 | Click here to see data. |

The catch is, if one were not educated and wise to the academics of investing, you might be inclined to start making changes in your portfolio based on this information. The markets are forward thinking and it is very difficult to take advantage of information like this as a basis for investment decisions because as far as the market is concerned, this data, although interesting, is stale and the markets have most likely reacted to it already. Another way to say this is that all of the information you can read will have already been incorporated into the pricing of securities in the markets.

How so? Remember, the market is an effective information-processing machine. Each day, the world equity markets process billions of dollars in trades between buyers and sellers—and the real-time information they bring helps set prices. Per the graphic below, there was $633.9 BILLION worth of world equity DAILY trading volume in 2023. I think you’d have to be somewhat delusional to think that you could outsmart that amount of sellers and buyers consistently over time.

Exhibit 1: In USD. Source: Dimensional, using data from Bloomberg LP. Includes primary and secondary exchange trading volume globally for equities. Funds are excluded. Daily averages were computed by calculating the trading volume of each stock daily as the closing price multiplied by shares traded that day. All such trading volume is summed up and divided by 252 as an approximate number of annual trading days.

The moral of this article is this: don’t try to make predictions on what will happen with the markets in 2025 based on current data and indicators. Rather, construct your strategic investment strategy such that it is based on your personal situation and has historically been shown to be resilient over time through unpredicted cycles despite the news and data. And of course – Happy New Year. I hope it is a happy, healthy, and wealthy 2025 for you and your family.

Market Review: 2024 Q4

Past performance is no guarantee of future results. Market segment (index representation) as follows: US Stock Market (Russell 3000 Index), Developed ex US Stocks (MSCI World ex USA IMI Index [net div.]), Emerging Markets (MSCI Emerging Markets IMI Index [net div.]), Global REITs (S&P Global REIT Index [net div.]), US Bond Market (Bloomberg US Aggregate Bond Index), and Global Bond Market ex US (Bloomberg Global Aggregate ex-USD Bond Index [hedged to USD]). S&P data © 2025 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2025, all rights reserved. Bloomberg data provided by Bloomberg. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio.

The fourth quarter saw Developed ex US, Emerging Markets, and Global REIT’s pull back by -7.49%, -7.89%, and -9.02% respectively although these markets did provide positive returns for the year. Another way to say this is that the U.S. market was the only market listed to provide a positive return for Q4 albeit a modest 2.63%.

Past performance is no guarantee of future results. Country returns are the country component indices of the MSCI All Country World IMI Index for all countries except the United States, where the Russell 3000 Index is used instead. Global is the return of the MSCI All Country World IMI Index. MSCI index returns are net dividend. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. MSCI data © MSCI 2025, all rights reserved

For the year, there were more countries whose markets had positive returns than negative. Interestingly the U.S. was not the best country market with Israel being the highest with Brazil being the lowest. This is yet another indicator that global diversification can be a good thing over time.

Within the US Treasury market, interest rates generally increased during the quarter.

On the short end of the yield curve, the 1-Month US Treasury Bill yield decreased 53 basis points (bps) to 4.40%, while the 1-Year US Treasury Bill yield increased 18 bps to 4.16%. The yield on the 2-Year US Treasury Note increased 59 bps to 4.25%.

In terms of total returns, short-term US treasury bonds returned -0.83% while intermediate-term US treasury bonds returned -1.70%. Short-term corporate bonds returned -0.40% and intermediate-term corporate bonds returned -1.40%.1

1. Bloomberg US Treasury and US Corporate Bond Indices.

2. Bloomberg Municipal Bond Index.

One basis point (bps) equals 0.01%. Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Yield curve data from Federal Reserve. State and local bonds and the Yield to Worst are from the S&P National AMT-Free Municipal Bond Index. AAA-AA Corporates represent the ICE BofA US Corporates, AA-AAA rated. A-BBB Corporates represent the ICE BofA Corporates, BBB-A rated. Bloomberg data provided by Bloomberg. US long-term bonds, bills, inflation, and fixed income factor data © Stocks, Bonds, Bills, and Inflation (SBBI) Yearbook™, Ibbotson Associates, Chicago (annually updated work by Roger G. Ibbotson and Rex A. Sinquefield). FTSE fixed income indices © 2025 FTSE Fixed Income LLC, all rights reserved. ICE BofA index data © 2025 ICE Data Indices, LLC. S&P data © 2025 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Bloomberg data provided by Bloomberg.

A final note on commodities and gold. The Bloomberg Commodity Total Return Index returned -0.45% for the fourth quarter of 2024. Sugar and Nickel were the worst performers, returning -14.29% and -13.81% during the quarter, respectively. Coffee and WTI Crude Oil were the best performers, returning +18.51% and +7.10% during the quarter, respectively with gold being slightly negative for the quarter

Past performance is not a guarantee of future results. Index is not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Commodities returns represent the return of the Bloomberg Commodity Total Return Index. Individual commodities are sub-index values of the Bloomberg Commodity Total Return Index. Data provided by Bloomberg.

Morgan H Smith Jr. is an investment advisor with Constitution Wealth. Constitution Wealth is a registered investment adviser in Wyoming. Constitution Wealth is registered with the Securities and Exchange Commission (SEC). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the commission. Constitution Wealth only transacts business in states in which the firm is properly registered or is excluded or exempted from registration. A copy of Constitution Wealth’s current written disclosure brochure filed with the SEC, which discusses among other things, Constitution Wealth’s business practices, services, and fees, is available through the SEC’s website at www.adviserinfo.sec.gov.

Please note, the information provided in this document is for informational purposes only and investors should determine for themselves whether a particular service or product is suitable for their investment needs. Please refer to the disclosure and offering documents for further information concerning specific products or services.

Any hypothetical, backtested performance has been provided for illustrative purposes only, and is not necessarily, and does not purport to be, indicative, or a guarantee, of future results or the adviser’s skill. Hypothetical, backtested performance does not represent actual performance. The results are prepared by retroactive application of a model, with the benefit of hindsight, and actual results may vary substantially. The preparation of such information is based on underlying assumptions, and does not represent the actual performance of any fund, portfolio, or investor, it is subject to risk and limitations that are not applicable to non-hypothetical performance presentations. Although advisor believes any hypothetical, backtested performance calculations described herein are based on reasonable assumptions, the use of different assumptions would produce different results. For the foregoing and other similar reasons, the comparability of hypothetical, backtested performance to the prior (or future) actual performance of a fund is limited, and prospective investors should not unduly rely on any such information in making an investment decision.

Nothing provided in this document constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation or an offer to sell (or solicitation of an offer to buy) securities in the U.S. or in any other jurisdiction.

This document may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions; changing levels of competition within certain industries and markets; changes in interest rates; changes in legislation or regulation; and other economic, competitive, governmental, regulatory, and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of Constitution Wealth or any of its affiliates or principals or any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events, or any other circumstances. All statements made herein speak only as of the date they were made.

Any indices and other financial benchmarks shown are provided for illustrative purposes only, are unmanaged, reflect reinvestment of income and dividends, and do not reflect the impact of advisory fees. Investors cannot invest directly in an index. Comparisons to indexes have limitations because indexes have volatility and other material characteristics that may differ from a particular hedge fund.

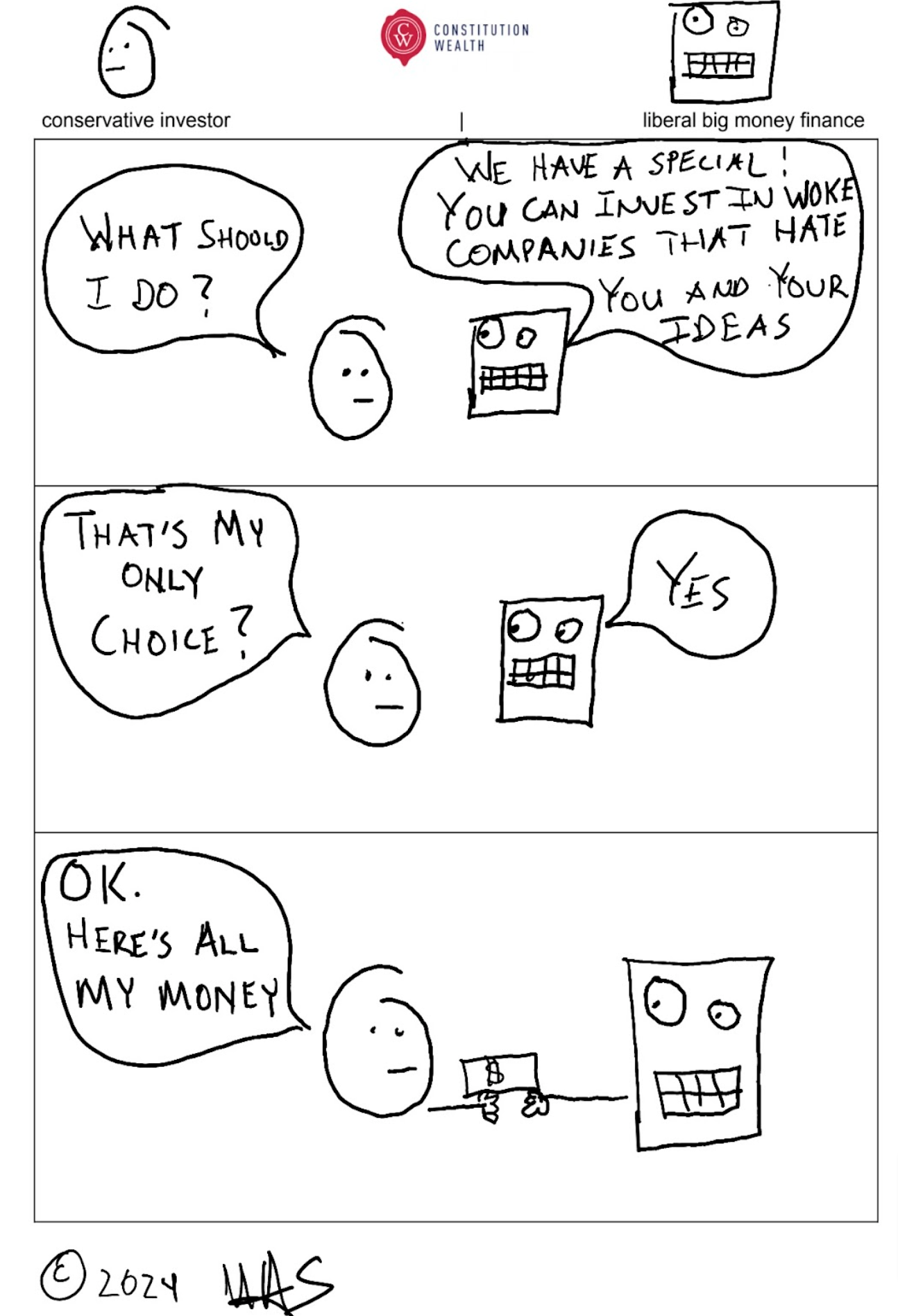

The Worst Thing An Investor With Conservative Values Can Do

A good rule of thumb in life is to never provide your adversary with additional resources they could use against you. But you may be doing just that if you are investing with the status quo investment firms.

You may not know it, but when you invest in public companies either directly by purchasing stock or indirectly through funds, you might just be giving these organizations more resources to fight against your conservative values.

You may think that your investment portfolio is not significant in the grand scheme of things but collectively across many conservative investors, the amount of self-sabotage they can inflict in terms of dollars is astounding.

For example, According to OpenSecrets.org, in the 2020 election cycle, the top 100 contributors to liberal PACs donated a total of $96.9 million. The exact breakdown of individual contributions can vary, but this data provides a rough estimate of the annual contribution amount from public U.S. companies to liberal PACs.

According to OpenSecrets.org, in 2020, businesses and other private sector interests spent a total of $3.3 billion on lobbying in the United States. This includes contributions from public U.S. companies. The exact amount contributed by each company can vary, but this figure provides a rough estimate of the annual contribution amount from public U.S. companies for lobbying purposes.

According to a study by the National Association of Corporate Directors, 86% of public companies in the United States have Corporate Social Responsibility (CSR) programs. This equates to approximately 4,000 companies, considering there are around 4,650 publicly traded companies in the U.S. However, the exact number can vary based on the specific criteria used to define CSR programs. And it doesn’t stop there.

Companies often use their profits to support liberal policies through various means. This includes:

- Political Contributions: Many companies donate money directly to political candidates, parties, or PACs that support liberal policies. This can include donations to Democratic candidates, progressive causes, or organizations that advocate for liberal policies.

- Lobbying: Companies may hire lobbyists to influence legislation in their favor or to promote liberal policies. These lobbyists can be former politicians, government officials, or other influential figures who can sway public opinion or decision-makers.

- Charitable Donations: Companies may donate money to non-profit organizations that support liberal causes, such as environmental groups, civil rights organizations, or social justice initiatives.

- Corporate Social Responsibility (CSR) Programs: Some companies implement CSR programs that focus on promoting liberal policies or addressing social issues. This can include initiatives related to diversity, inclusion, sustainability, or social justice.

- Public Relations and Marketing: Companies may use their marketing and public relations efforts to promote liberal policies or portray themselves as socially responsible entities. This can include sponsoring events, creating advertisements, or engaging in public relations campaigns that align with liberal values.

- Employee Advocacy: Companies may encourage their employees to support liberal policies through volunteer programs, employee resource groups, or other initiatives that foster a culture of activism within the organization.

The cartoon above represents the status quo and how things used to be. But, conservative investors are becoming better educated and are finding the fortitude to stand up to the liberal status quo. Most importantly, they are discovering that they do have choices when it comes to their investments, which collectively, can have a powerful impact.

We at Constitution Wealth are proud to be helping those investors better align their investments and life legacies with their conservative values.

A Veteran's Message

As a veteran, I look back at my time in the military and know that the experience was different than some organizations I’ve been involved with in civilian life but what does the difference boil down to? Four characteristics come to mind:

- A true sense of shared values and a cohesive team enhanced by operational missions whose success or failure often meant the difference between life and death.

- Extremely high standards with personalities who were committed to professional excellence.

- A “get ‘er done” attitude that recognized the need for efficient action but was built on years of intense academic and practical learning.

- The understanding that simple things like showing up on time and being prepared is not the exception but a minimum requirement.

Of course, this is my experience, yours might be different. I happened to be in one of the most alpha competitive environments in the midst of legends where any perceived weakness would be exploited just for the fun of it. Flying out of “Fightertown USA” at Naval Air Station Miramar in the F-14 Tomcat after the original Top Gun movie had been released necessitated a level of self-confidence and proficiency most could not achieve or sustain.

After three deployments on the USS Kitty Hawk, about 150 carrier landings, and combat operations in the Persian Gulf, I decided to transition out of the military. On that journey, my last stop was teaching naval engineering and weapon systems and leadership at the University of San Diego as a professor of Naval Science and earning my MBA.

And then I was a civilian, entered the workforce, and realized very quickly that I was wired differently than many. Finding myself in the corporate world floating in a large global systems integration firm with a lot of politics and bureaucracy was not the place I wanted to be.

Fast forward to Constitution Wealth and I’m lucky enough to be involved with a firm that also embodies the four points listed above. As a partner and financial advisor I’ve got ownership in, and a commitment to, an organization that shares a true sense of shared values and a cohesive mission. We are all committed to leveraging our values and expertise to help our clients align their life and financial affairs with their conservative values as well.

As a kid, I never imagined I’d be launched off an aircraft carrier in an F-14 Tomcat at 150 mph into the pitch black night on my way to missions in the Persian Gulf with the best of the best. After I got out of the Navy, I never imagined I’d be involved with an organization that came close to those high standards. But I did with Constitution Wealth. What we propose to our clients is simple, imagine aligning your conservative values with your financial life with a team that holds the same values as yours with the education experience, and expertise to follow through.

So, happy Veteran’s Day to all of my fellow-veterans and to those of you who support the values our country was founded on. And for the veterans out there who are working in the civilian world, I encourage you to join a firm that shares the same values and standards you have set for yourself and if you can’t find one, start one, and carry on with your life mission.

Constitution Wealth 2024 Q3 Review: Waiting on a President

Looks like you’re a little stuck not doing anything. What are you up to?”

“Well, I’m just waiting on a friend…”

That tends to be the state of mind for many folks that are trying to make investment decisions. They are waiting for some new information (their “friend”) that they think is essential and will determine their ability to accurately predict the future which will of course, in their minds, help garner a successful outcome. From an investment standpoint, that “friend” could be new economic data, legal decisions, global socio-political dynamics, insight from a guru, or yes, even a new president.

As a financial advisor every four years I often hear the following: “I want to wait on making an investment decision until after the presidential election.”

As an experienced listener, it’s important to peel back the onion on statements like this so you can really understand what kind of potential biases might be baked into someone’s decision making process. Some assumptions might be valid, some may not. One goal of a good financial advisor is to help investors reflect upon their assumptions to help them make better decisions and thus hopefully have better outcomes.

I think we can all agree that being engaged in the political process is very important if you have any desire to help further your personal values locally or nationally. The President of the United States can have a significant influence on the direction of not only the executive branch, but the judicial and legislative branches as well. But, as you’ll see, the stock market tends to beat to its own drum despite our preconceived notions otherwise.

So let’s look at one assumption baked into the statement “I want to wait on making an investment decision until after the presidential election.”, namely, that the stock market will behave significantly different depending on which person (political party) is elected president.

Is this true? Well, the best question we can ask to test it is, “Has this ever been true?”. Cutting to the chase, the answer is no. Let’s look at how we know this.

The table below shows the frequency of monthly returns (expressed in 1% increments) for a broad-market index of US stocks from January 1926–December 2023. Each horizontal dash represents one month, and each vertical bar shows the cumulative number of months for which returns were within a given 1% range (e.g., the tallest bar shows all months in which returns were between 0% and 1%). The blue and red horizontal lines represent months during which a presidential election was held, with red meaning a Republican won the White House and blue representing the same for Democrats. This graphic illustrates that election month returns have been well dispersed throughout the range of outcomes, with no clear pattern based on which party won the presidency.

In USD. Dashes representing returns for a given month are stacked in ascending order of return within each column, with highest return within that range on top. S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.

So, there you have it, history tells us that there would have been no consistently predictable advantage as an investor to waiting until after a presidential election. For those of you who understand this intuitively and have already structured your portfolio with strategically allocated long-term investments, this data hopefully gives you some validation that you are doing the right thing.

For those of you who are worried or waiting, the real question for you is whether or not you will be stubborn in your ways despite the evidence in front of you. I suppose that is a challenge for all of us in many aspects of our lives but somehow especially prevalent with investors.

It’s natural for investors to look for a connection between who wins the White House and which way stocks will go. But shareholders are investing in companies, not a political party. And companies focus on serving their customers and helping their businesses grow, regardless of who is in the White House.

Stocks have rewarded disciplined investors over the long term, through Democratic and Republican presidencies. Making investment decisions based on the outcome of elections, or how investors think they might unfold, is unlikely to result in reliable excess returns. On the contrary, it may lead to costly mistakes. Accordingly, there is a strong case for investors to rely on a consistent approach to asset allocation—making a long-term plan and sticking to it.

2024 Q3 Review

With everything else going on these days, it can certainly be said that it was a positive Q3 for investors across all indexes shown below.

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio.

Market segment (index representation) as follows: US Stock Market (Russell 3000 Index), International Developed Stocks (MSCI World ex USA Index [net dividends]), Emerging Markets (MSCI Emerging Markets Index [net dividends]), Global Real Estate (S&P Global REIT Index [net dividends]), US Bond Market (Bloomberg US Aggregate Bond Index), and Global Bond Market ex US (Bloomberg Global Aggregate ex-USD Bond Index [hedged to USD]). S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2024, all rights reserved. Bloomberg data provided by Bloomberg.

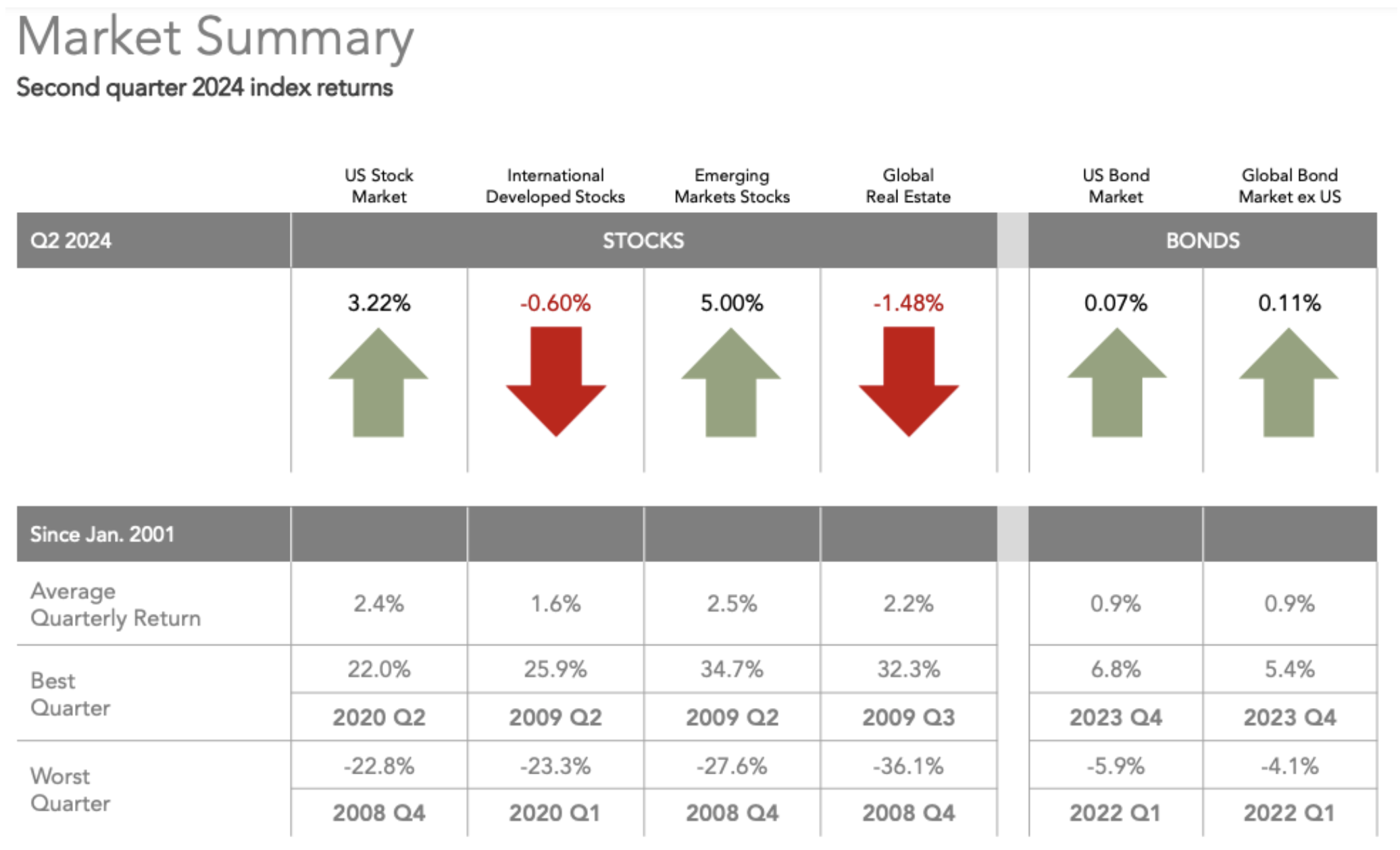

The biggest surprise was Global Real Estate. Last quarter this index was the worst performing index for the quarter at -1.48%. This quarter it was the best performing index by a country mile at 16.04%. This is a very good example as to why it pays to be diversified across multiple global asset classes and why chasing only recently well-performing asset classes can be a significant oversight.

It seems like it’s been awhile but the International Developed Stock Market index outperformed the U.S. Stock Market index at 7.76% vs 6.23% respectively. With all of the noise of the S&P 500 in the media, it’s sometimes hard to remember that other asset classes even exist outside of big companies in the U.S.

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Market segment (index representation) as follows: Marketwide (Russell 3000 Index), Large Cap (Russell 1000 Index), Large Value (Russell 1000 Value Index), Large Growth (Russell 1000 Growth Index), Small Cap (Russell 2000 Index), Small Value (Russell 2000 Value Index), and Small Growth (Russell 2000 Growth Index). World Market Cap represented by Russell 3000 Index, MSCI World ex USA IMI Index, and MSCI Emerging Markets IMI Index. Russell 3000 Index is used as the proxy for the US market. Dow Jones US Select REIT Index used as proxy for the US REIT market. MSCI data © MSCI 2024, all rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes.

Specifically in the U.S., the Small Value index had more than 3X the return of the Large Growth index (10.15% vs 3.19% respectively) which is good news for the patient investor. The US stock market has been on a winning streak, so some investors may have not been jolted when the S&P 500 fell more than 6% from July 31 to August 5. The Cboe VIX Index, a measure of US stock market volatility, reached 65.7 on August 5. This was its highest level since the COVID-19 pandemic and the largest one-day increase since 1990. Investors with more diversified portfolios appropriately allocated to include smaller and value companies, as opposed to large growth, would most likely have been “jolted” like investors heavily weighted towards the S&P 500.

Interest rates decreased in the US Treasury market for the quarter as the yield curve lowered. Both the U.S. and Global Bond Indexes had a fine quarter delivering 5.2% and 3.48% respectively as noted in the first chart above.

Period Returns (%)

1. Bloomberg US Treasury and US Corporate Bond Indices. 2. Bloomberg Municipal Bond Index.

One basis point (bps) equals 0.01%. Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Yield curve data from Federal Reserve. State and local bonds and the Yield to Worst are from the S&P National AMT-Free Municipal Bond Index. AAA-AA Corporates represent the ICE BofA US Corporates, AA-AAA rated. A-BBB Corporates represent the ICE BofA Corporates, BBB-A rated. Bloomberg data provided by Bloomberg. US long-term bonds, bills, inflation, and fixed income factor data © Stocks, Bonds, Bills, and Inflation (SBBI) Yearbook™, Ibbotson Associates, Chicago (annually updated work by Roger G. Ibbotson and Rex A. Sinquefield). FTSE fixed income indices © 2024 FTSE Fixed Income LLC, all rights reserved. ICE BofA index data © 2024 ICE Data Indices, LLC. S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Bloomberg data provided by Bloomberg.

Morgan H Smith Jr. is an investment advisor with Constitution Wealth. Constitution Wealth is a registered investment adviser in Wyoming. Constitution Wealth is registered with the Securities and Exchange Commission (SEC). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the commission. Constitution Wealth only transacts business in states in which the firm is properly registered or is excluded or exempted from registration. A copy of Constitution Wealth’s current written disclosure brochure filed with the SEC, which discusses among other things, Constitution Wealth’s business practices, services, and fees, is available through the SEC’s website at www.adviserinfo.sec.gov.

Please note, the information provided in this document is for informational purposes only and investors should determine for themselves whether a particular service or product is suitable for their investment needs. Please refer to the disclosure and offering documents for further information concerning specific products or services.

Any hypothetical, backtested performance has been provided for illustrative purposes only, and is not necessarily, and does not purport to be, indicative, or a guarantee, of future results or the adviser’s skill. Hypothetical, backtested performance does not represent actual performance. The results are prepared by retroactive application of a model, with the benefit of hindsight, and actual results may vary substantially. The preparation of such information is based on underlying assumptions, and does not represent the actual performance of any fund, portfolio, or investor, it is subject to risk and limitations that are not applicable to non-hypothetical performance presentations. Although advisor believes any hypothetical, backtested performance calculations described herein are based on reasonable assumptions, the use of different assumptions would produce different results. For the foregoing and other similar reasons, the comparability of hypothetical, backtested performance to the prior (or future) actual performance of a fund is limited, and prospective investors should not unduly rely on any such information in making an investment decision.

Nothing provided in this document constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation or an offer to sell (or solicitation of an offer to buy) securities in the U.S. or in any other jurisdiction.

This document may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions; changing levels of competition within certain industries and markets; changes in interest rates; changes in legislation or regulation; and other economic, competitive, governmental, regulatory, and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of Constitution Wealth or any of its affiliates or principals or any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events, or any other circumstances. All statements made herein speak only as of the date they were made.

Any indices and other financial benchmarks shown are provided for illustrative purposes only, are unmanaged, reflect reinvestment of income and dividends, and do not reflect the impact of advisory fees. Investors cannot invest directly in an index. Comparisons to indexes have limitations because indexes have volatility and other material characteristics that may differ from a particular hedge fund.

Your Old 401k Can Help Defend Freedom!

If you’re like most people…

You pay very little attention to your 401k…

And probably even less attention to the 401ks you still have at your prior employers.

First the bad news.

Many 401k plans offer only a small list of mutual funds to choose from. Typically, these funds are managed by the likes of Vanguard, BlackRock, etc.

That’s right, the same financial firms that are using the voting power of the stock held in their funds to push a “woke” liberal agenda on corporate America.

Let me repeat that – they’re using your 401ks to advance their agenda.

Now the good news.

Employees today are likely to work for several employers over the course of their career and did you know that once you leave your employer you can move your 401k to a rollover IRA?

While there are pros & cons to consider before rolling over a 401k*, one positive is you have more investment options. Much more.

In an IRA account you can select from a large selection of Mutual Funds & ETFs, not to mention, individual stocks and Bonds, to construct a diversified portfolio tailored to your goals.

And the best part?

You can retain the voting rights over the shares of stock held in your IRA, unlike investing through funds in your 401k.

So, next time you get your old 401k statement, don’t just throw it away. Instead, contact one of our financial advisors here at Constitution Wealth to see what options are available to you!

It may end up doing more for your future, and freedom, than you realize.

* Speak with a financial advisor to determine what the best course of action is for you.

Constitution Wealth 2024 Q2 Review: When Loved Ones Pass

At Constitution Wealth, our experienced financial advisors work with families and business owners for holistic financial advice and investment planning, but we don’t stop there. Integrated within our expertise is our commitment to aligning our services with your core values and patriotic sentiments.

You are creating your legacy for today and the future of your family and it’s important to align your legacy and life mission with your values. And of course, it just doesn’t make sense to align yourself with people and companies that don’t like or agree with your ideas and faith.

This is a real-world story that occurred this quarter that one of Constitution Wealth’s financial advisors wanted to reflect on and share; I hope you find it helpful.

The Rolling Stones classic “Time Waits For No One” is a reflection on the passing of time, the passing of friends, and the passing of loved ones. It’s a wonderful song with a precise and beautifully crafted guitar solo by Mick Taylor, one of my favorite guitarists. The chorus sums it up: “Time waits for no one, and it won’t wait for me…”

Over the past few years I’ve had several friends and acquaintances pass away but also spouses of clients. Most recently the wife of a client passed away and I was moved by the words at her memorial service and came to know both my client and his spouse in a new light. Let’s call them Mike and Mary, both 79 years old in 2024.

First let me say that Mike gave me permission to share my thoughts on their situation prior to writing this. In this advisory relationship, I did not interact with Mary at all, only Mike. At the service Mary was lovingly described as a “persnickety” character full of energy and a motive force and focal point for the family and community for social activities. She also had a history of health issues being one of the first successful recipients of a kidney transplant in the U.S. decades ago and continued to be challenged by health issues up until the time of her passing.

Over the years working with Mike, I found him to be thoughtful and informed with meticulous attention to detail. He is also very aware of the big picture inherent in holistic financial planning I did for him and investment strategies and cash flow management. We had recently, prior to Mary’s passing, fine tuned a few planning scenarios wherein they would sell their home and move into a very nice retirement facility. The point being, Mike was on a mission to take care of his family and although very astute he was wise enough to have a financial advisor to sanitize his thoughts and implement a strategy on a long term basis. As it turns out, life happened and things changed for Mike and his family very quickly but thanks to his good decision making and advanced planning as a family steward, he will at least not have the added stress of estate and financial issues moving forward despite a challenging future without a spouse that he has loved and cared for, for decades.

Contrast this to some other folks I’ve spoken with who have and continue to do everything by themselves because that’s how they’ve always done it. Others might want a quick one-time plan they can take with them and utilize on their own, not fully understanding that a static plan is somewhat useless as life-circumstances and the investment environment literally changes daily. Usually they have the mindset of either not trusting other folks, thinking they know how to do everything better, have done things the same way for years and think that they will continue to have the time, energy, and mental acuity to continue. Unfortunately some of these folks are just in denial that life changing and life ending changes are on the horizon. My clear and simple observation to this is that these folks have a high probability of putting their families financial success and peace of mind at risk.

As we get older, it becomes more difficult to manage fear and risk, and of course more difficult to recover from mistakes. Managing the emotional aspects of losing a spouse is a challenge of a lifetime. If financial stress is piled on top of that, it can turn into an unrecoverable situation. Mike got it right. As I said to him after the memorial service, “Mission accomplished”. My meaning was that he had his family covered regardless of what life threw at him. Now he can have some peace of mind financially as he navigates the next phase of his life and finds a new mission.

At the end of the day, this real-world scenario reminds me that my role as a financial advisor is more impactful than just numbers on a report and that it takes foresight and wisdom for family stewards to understand that as well.

2024 Q2 Review

Overall the markets were mixed but steady.

Global equities were mixed for the second quarter. For the listed indexes, Emerging Markets performed the best with a 5% return followed by the U.S. Stock Market returning 3.22%. International Developed and Global Real Estate were down slightly at -0.60% and -1.48% respectively.

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio.

Market segment (index representation) as follows: US Stock Market (Russell 3000 Index), International Developed Stocks (MSCI World ex USA Index [net dividends]), Emerging Markets (MSCI Emerging Markets Index [net dividends]), Global Real Estate (S&P Global REIT Index [net dividends]), US Bond Market (Bloomberg US Aggregate Bond Index), and Global Bond Market ex US (Bloomberg Global Aggregate ex-USD Bond Index [hedged to USD]). S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2024, all rights reserved. Bloomberg data provided by Bloomberg.

Bonds

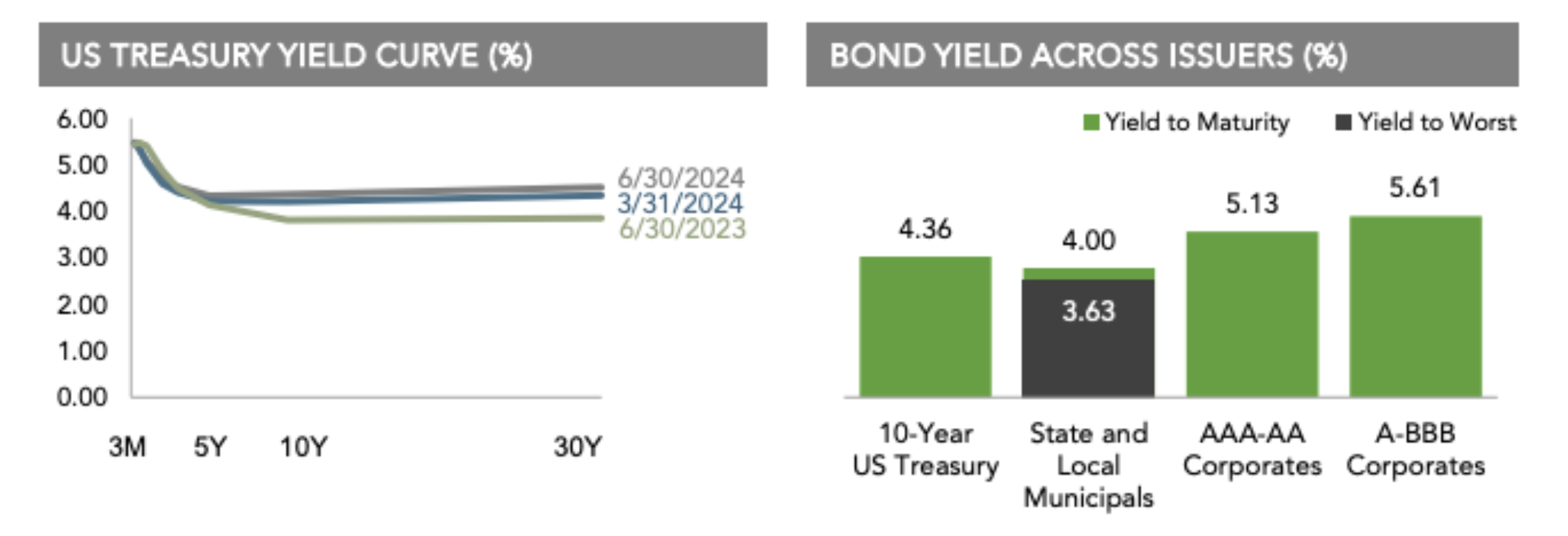

Interest rates generally increased in the US Treasury market for the quarter.

On the short end of the yield curve, the 1-Month US Treasury Bill yield decreased 2 basis points (bps) to +5.47%, while the 1-Year US Treasury Bill yield increased 6 bps to +5.09%. The yield on the 2-Year US Treasury Note increased 12 bps to +4.71%.

The yield on the 5-Year US Treasury Note increased 12 bps to +4.33%. The yield on the 10-Year US Treasury Note increased 16 bps to +4.36%. The yield on the 30-Year US Treasury Bond increased 17 bps to +4.51%.

In terms of total returns, short-term US treasury bonds returned +0.77% while intermediate-term US treasury bonds returned +0.58%. Short-term corporate bonds returned +0.96% and intermediate-term corporate bonds returned +0.74%.1

The total returns for short- and intermediate-term municipal bonds were +0.35% and -0.92%, respectively. Within the municipal fixed income market, general obligation bonds returned -0.30% while revenue bonds returned +0.07%.2

Period Returns (%)

1. Bloomberg US Treasury and US Corporate Bond Indices. 2. Bloomberg Municipal Bond Index.

One basis point (bps) equals 0.01%. Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Yield curve data from Federal Reserve. State and local bonds and the Yield to Worst are from the S&P National AMT-Free Municipal Bond Index. AAA-AA Corporates represent the ICE BofA US Corporates, AA-AAA rated. A-BBB Corporates represent the ICE BofA Corporates, BBB-A rated. Bloomberg data provided by Bloomberg. US long-term bonds, bills, inflation, and fixed income factor data © Stocks, Bonds, Bills, and Inflation (SBBI) Yearbook™, Ibbotson Associates, Chicago (annually updated work by Roger G. Ibbotson and Rex A. Sinquefield). FTSE fixed income indices © 2024 FTSE Fixed Income LLC, all rights reserved. ICE BofA index data © 2024 ICE Data Indices, LLC. S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Bloomberg data provided by Bloomberg.

Morgan H Smith Jr. is an investment advisor with Constitution Wealth. Constitution Wealth is a registered investment adviser in Wyoming. Constitution Wealth is registered with the Securities and Exchange Commission (SEC). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the commission. Constitution Wealth only transacts business in states in which the firm is properly registered or is excluded or exempted from registration. A copy of Constitution Wealth’s current written disclosure brochure filed with the SEC, which discusses among other things, Constitution Wealth’s business practices, services, and fees, is available through the SEC’s website at www.adviserinfo.sec.gov.

Please note, the information provided in this document is for informational purposes only and investors should determine for themselves whether a particular service or product is suitable for their investment needs. Please refer to the disclosure and offering documents for further information concerning specific products or services.

Any hypothetical, backtested performance has been provided for illustrative purposes only, and is not necessarily, and does not purport to be, indicative, or a guarantee, of future results or the adviser’s skill. Hypothetical, backtested performance does not represent actual performance. The results are prepared by retroactive application of a model, with the benefit of hindsight, and actual results may vary substantially. The preparation of such information is based on underlying assumptions, and does not represent the actual performance of any fund, portfolio, or investor, it is subject to risk and limitations that are not applicable to non-hypothetical performance presentations. Although advisor believes any hypothetical, backtested performance calculations described herein are based on reasonable assumptions, the use of different assumptions would produce different results. For the foregoing and other similar reasons, the comparability of hypothetical, backtested performance to the prior (or future) actual performance of a fund is limited, and prospective investors should not unduly rely on any such information in making an investment decision.

Nothing provided in this document constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation or an offer to sell (or solicitation of an offer to buy) securities in the U.S. or in any other jurisdiction.

This document may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions; changing levels of competition within certain industries and markets; changes in interest rates; changes in legislation or regulation; and other economic, competitive, governmental, regulatory, and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of Constitution Wealth or any of its affiliates or principals or any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events, or any other circumstances. All statements made herein speak only as of the date they were made.

Any indices and other financial benchmarks shown are provided for illustrative purposes only, are unmanaged, reflect reinvestment of income and dividends, and do not reflect the impact of advisory fees. Investors cannot invest directly in an index. Comparisons to indexes have limitations because indexes have volatility and other material characteristics that may differ from a particular hedge fund.

Texas Takes a Stand: Why All Conservative Investors Should Consider Ditching BlackRock

In a bold move, the mighty state of Texas has fired BlackRock, the world’s largest asset manager, from its investment portfolio. The decision came as a result of the company’s left-leaning political stance and its focus on Environmental, Social, and Governance (ESG) factors, diversity equity, and inclusion (DEI), and the corporate equality index (CEI) in its investment decisions. Texas’s bold decision has sparked a nationwide debate on whether other conservative investors should follow suit.

We will examine the reasons behind Texas’s decision and argue why all conservative investors should consider ditching BlackRock.

BlackRock’s ESG/DEI/CEI Focus: A Threat to Traditional Values?

The primary reason Texas severed ties with BlackRock is the company’s increasing focus on ESG/DEI/CEI factors in its investment decisions. ESG/DEI/CEI criteria prioritize environmental sustainability, social justice, and corporate governance over traditional financial metrics. While these goals may seem admirable, they often come at the expense of shareholder value and can be used to further a liberal political agenda.

BlackRock’s ESG/DEI/CEI initiatives have been criticized for their potential to harm the energy industry, a vital sector in Texas’s economy. By divesting from oil and gas companies, BlackRock is effectively punishing these businesses for not adhering to its preferred environmental standards. This approach not only threatens job security but also ignores the economic benefits these industries provide to the state and its residents.

Furthermore, BlackRock’s emphasis on social justice has raised concerns about the company’s commitment to traditional American and free-market principles. Some argue that the company’s investments in renewable energy and other “green” initiatives are driven more by political ideology than sound financial analysis.

This raises questions about whether BlackRock is truly serving the best interests of its clients, or if it is merely using its vast resources to promote a left-leaning political agenda.

Texas’s decision to fire BlackRock sends a clear message that the state will not tolerate investments that prioritize leftist political ideology over financial returns. By taking this stand, Texas has ignited a conversation about the role of asset managers in shaping the American economy and the importance of preserving free-market principles and traditional American values.

A Wake-Up Call for Conservative Investors

For politically conservative investors, Texas’s move should serve as a wake-up call to reevaluate their own investment portfolios. If you share Texas’s concerns about BlackRock’s ESG/DEI/CEI focus and political leanings, it may be time to consider alternative investment options that better align with your values and financial goals. If you want to know how, here’s another blog discussion: How to Execute on Values Driven Investing.

The state of Texas’s decision to fire BlackRock has sparked an important conversation about the role of asset managers in shaping the future of the country. If you are a conservative investor concerned about the impact of ESG/DEI/CEI factors and political ideology on your investments, it may be time to reevaluate your portfolio and consider alternative options that better align with your values and financial goals. By taking a stand against companies like BlackRock, like the State of Texas, conservative investors can help ensure that the American economy remains a bastion of traditional values, free-market principles and financial prosperity for all.

Navigating Legal Challenges: How DEI Initiatives Pose Risks for Investors

In the pursuit of fostering diversity, equity, and inclusion (DEI) within the corporate landscape, companies are treading a delicate legal path. As investors, it’s crucial to explore how DEI initiatives may inadvertently lead to legal challenges, potentially casting shadows on investment returns.

The Legal Landscape:

At the heart of the matter are concerns that certain DEI initiatives might inadvertently violate the Civil Rights Act Section 7 and the Equal Protection Clause of the U.S. Constitution. Let’s delve into the legal complexities that could impact investors.

Reverse Discrimination Concerns: Some argue that DEI initiatives, while well-intentioned, may inadvertently lead to reverse discrimination against majority groups. This raises questions about compliance with the Civil Rights Act Section 7, which prohibits discrimination based on protected characteristics such as race and gender.

Equal Protection Clause Scrutiny: The Equal Protection Clause, designed to ensure equal treatment under the law, may come into play if DEI initiatives result in preferential treatment based on race, gender, or other protected attributes. This constitutional scrutiny introduces an additional layer of legal complexity.

Legal Jeopardy for Companies:

Companies navigating the DEI landscape may find themselves in legal jeopardy, potentially impacting the interests of their investors.

Discrimination Lawsuits: As DEI initiatives unfold, the risk of discrimination lawsuits becomes a looming concern. Employees who feel adversely affected may pursue legal action, resulting in financial implications for the companies involved and, consequently, impacting investor returns.

Regulatory Scrutiny: Regulatory bodies are increasingly scrutinizing corporate DEI efforts. If these initiatives are perceived as discriminatory or inconsistent with existing anti-discrimination laws, companies may face fines and legal consequences, further influencing the financial stability of the organizations and affecting investors.

Public Relations Risks: Negative public perception of DEI initiatives could lead to reputational damage for companies and their brands (Bud Light and Disney, for example). This, in turn, may affect customer loyalty and, crucially for investors, impact stock values as the public and stakeholders reassess their relationship with the company.

The Harvard Case and Investor Concerns:

The recent Students for Fair Admissions v. Harvard case introduces another layer of consideration for investors.

Affirmative Action Precedent: The case, revolving around affirmative action in education, may set a precedent for similar discussions in the corporate sector. Investors should be attuned to how this legal precedent might impact DEI initiatives within companies and subsequently influence their investment returns.

Impact on Investor Returns:

Investors should be mindful of the potential negative impacts on investment returns resulting from legal challenges associated with DEI initiatives.

Litigation Costs: Legal battles are inherently costly. If companies implementing DEI initiatives become embroiled in discrimination lawsuits, investors may witness a drain on financial resources, impacting the bottom line and, consequently, their returns.

Reputational Damage: A tarnished corporate image resulting from legal controversies surrounding DEI initiatives could erode consumer trust and investor confidence. This may translate to diminished stock values, negatively affecting the returns of those who hold investments in these companies.

Regulatory Compliance Costs: Increased regulatory scrutiny may necessitate compliance measures, incurring additional costs for companies. Investors may witness a reduction in profit margins, impacting overall returns.

Conclusion:

As investors and investment advisers, it is imperative to acknowledge the potential legal risks associated with DEI initiatives and their subsequent impact on investment returns. For companies, mitigating legal challenges is crucial for aiming to navigate the complexities of the DEI landscape without compromising the interests of their stakeholders, including investors. In this evolving legal environment, staying informed and vigilant is key to making sound investment decisions.

If your investment adviser is recommending companies who are pushing DEI, it may be wise to ask them about it… or find a new adviser.