Your Old 401k Can Help Defend Freedom!

If you’re like most people…

You pay very little attention to your 401k…

And probably even less attention to the 401ks you still have at your prior employers.

First the bad news.

Many 401k plans offer only a small list of mutual funds to choose from. Typically, these funds are managed by the likes of Vanguard, BlackRock, etc.

That’s right, the same financial firms that are using the voting power of the stock held in their funds to push a “woke” liberal agenda on corporate America.

Let me repeat that – they’re using your 401ks to advance their agenda.

Now the good news.

Employees today are likely to work for several employers over the course of their career and did you know that once you leave your employer you can move your 401k to a rollover IRA?

While there are pros & cons to consider before rolling over a 401k*, one positive is you have more investment options. Much more.

In an IRA account you can select from a large selection of Mutual Funds & ETFs, not to mention, individual stocks and Bonds, to construct a diversified portfolio tailored to your goals.

And the best part?

You can retain the voting rights over the shares of stock held in your IRA, unlike investing through funds in your 401k.

So, next time you get your old 401k statement, don’t just throw it away. Instead, contact one of our financial advisors here at Constitution Wealth to see what options are available to you!

It may end up doing more for your future, and freedom, than you realize.

* Speak with a financial advisor to determine what the best course of action is for you.

Constitution Wealth 2024 Q2 Review: When Loved Ones Pass

At Constitution Wealth, our experienced financial advisors work with families and business owners for holistic financial advice and investment planning, but we don’t stop there. Integrated within our expertise is our commitment to aligning our services with your core values and patriotic sentiments.

You are creating your legacy for today and the future of your family and it’s important to align your legacy and life mission with your values. And of course, it just doesn’t make sense to align yourself with people and companies that don’t like or agree with your ideas and faith.

This is a real-world story that occurred this quarter that one of Constitution Wealth’s financial advisors wanted to reflect on and share; I hope you find it helpful.

The Rolling Stones classic “Time Waits For No One” is a reflection on the passing of time, the passing of friends, and the passing of loved ones. It’s a wonderful song with a precise and beautifully crafted guitar solo by Mick Taylor, one of my favorite guitarists. The chorus sums it up: “Time waits for no one, and it won’t wait for me…”

Over the past few years I’ve had several friends and acquaintances pass away but also spouses of clients. Most recently the wife of a client passed away and I was moved by the words at her memorial service and came to know both my client and his spouse in a new light. Let’s call them Mike and Mary, both 79 years old in 2024.

First let me say that Mike gave me permission to share my thoughts on their situation prior to writing this. In this advisory relationship, I did not interact with Mary at all, only Mike. At the service Mary was lovingly described as a “persnickety” character full of energy and a motive force and focal point for the family and community for social activities. She also had a history of health issues being one of the first successful recipients of a kidney transplant in the U.S. decades ago and continued to be challenged by health issues up until the time of her passing.

Over the years working with Mike, I found him to be thoughtful and informed with meticulous attention to detail. He is also very aware of the big picture inherent in holistic financial planning I did for him and investment strategies and cash flow management. We had recently, prior to Mary’s passing, fine tuned a few planning scenarios wherein they would sell their home and move into a very nice retirement facility. The point being, Mike was on a mission to take care of his family and although very astute he was wise enough to have a financial advisor to sanitize his thoughts and implement a strategy on a long term basis. As it turns out, life happened and things changed for Mike and his family very quickly but thanks to his good decision making and advanced planning as a family steward, he will at least not have the added stress of estate and financial issues moving forward despite a challenging future without a spouse that he has loved and cared for, for decades.

Contrast this to some other folks I’ve spoken with who have and continue to do everything by themselves because that’s how they’ve always done it. Others might want a quick one-time plan they can take with them and utilize on their own, not fully understanding that a static plan is somewhat useless as life-circumstances and the investment environment literally changes daily. Usually they have the mindset of either not trusting other folks, thinking they know how to do everything better, have done things the same way for years and think that they will continue to have the time, energy, and mental acuity to continue. Unfortunately some of these folks are just in denial that life changing and life ending changes are on the horizon. My clear and simple observation to this is that these folks have a high probability of putting their families financial success and peace of mind at risk.

As we get older, it becomes more difficult to manage fear and risk, and of course more difficult to recover from mistakes. Managing the emotional aspects of losing a spouse is a challenge of a lifetime. If financial stress is piled on top of that, it can turn into an unrecoverable situation. Mike got it right. As I said to him after the memorial service, “Mission accomplished”. My meaning was that he had his family covered regardless of what life threw at him. Now he can have some peace of mind financially as he navigates the next phase of his life and finds a new mission.

At the end of the day, this real-world scenario reminds me that my role as a financial advisor is more impactful than just numbers on a report and that it takes foresight and wisdom for family stewards to understand that as well.

2024 Q2 Review

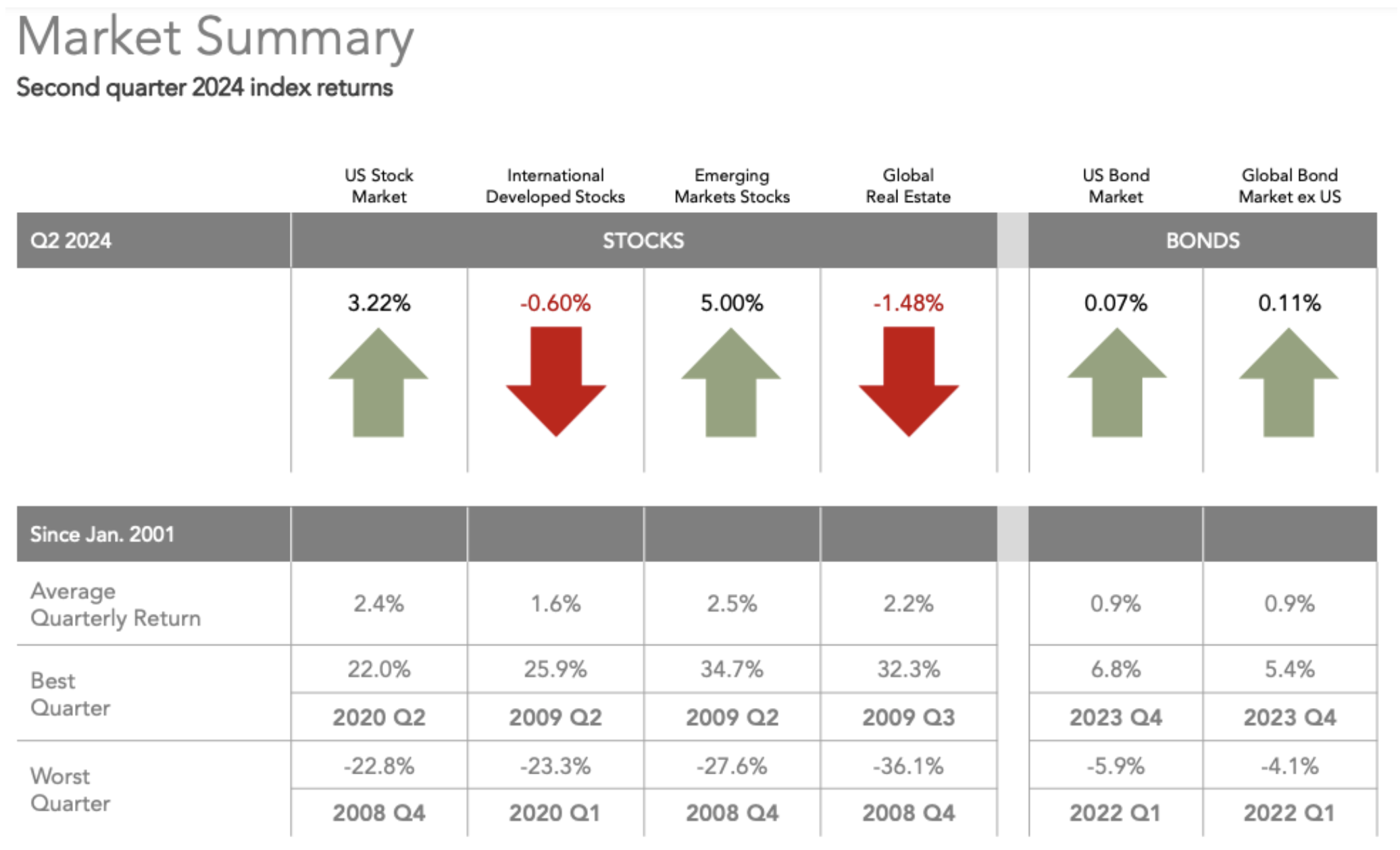

Overall the markets were mixed but steady.

Global equities were mixed for the second quarter. For the listed indexes, Emerging Markets performed the best with a 5% return followed by the U.S. Stock Market returning 3.22%. International Developed and Global Real Estate were down slightly at -0.60% and -1.48% respectively.

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio.

Market segment (index representation) as follows: US Stock Market (Russell 3000 Index), International Developed Stocks (MSCI World ex USA Index [net dividends]), Emerging Markets (MSCI Emerging Markets Index [net dividends]), Global Real Estate (S&P Global REIT Index [net dividends]), US Bond Market (Bloomberg US Aggregate Bond Index), and Global Bond Market ex US (Bloomberg Global Aggregate ex-USD Bond Index [hedged to USD]). S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2024, all rights reserved. Bloomberg data provided by Bloomberg.

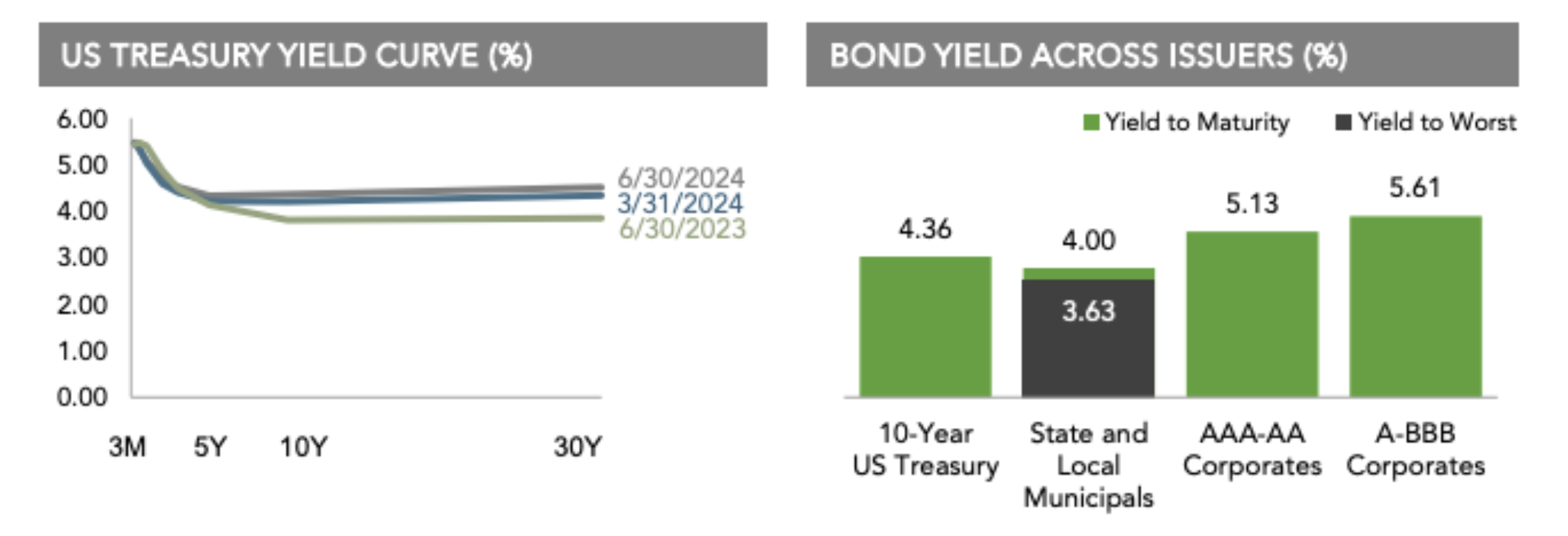

Bonds

Interest rates generally increased in the US Treasury market for the quarter.

On the short end of the yield curve, the 1-Month US Treasury Bill yield decreased 2 basis points (bps) to +5.47%, while the 1-Year US Treasury Bill yield increased 6 bps to +5.09%. The yield on the 2-Year US Treasury Note increased 12 bps to +4.71%.

The yield on the 5-Year US Treasury Note increased 12 bps to +4.33%. The yield on the 10-Year US Treasury Note increased 16 bps to +4.36%. The yield on the 30-Year US Treasury Bond increased 17 bps to +4.51%.

In terms of total returns, short-term US treasury bonds returned +0.77% while intermediate-term US treasury bonds returned +0.58%. Short-term corporate bonds returned +0.96% and intermediate-term corporate bonds returned +0.74%.1

The total returns for short- and intermediate-term municipal bonds were +0.35% and -0.92%, respectively. Within the municipal fixed income market, general obligation bonds returned -0.30% while revenue bonds returned +0.07%.2

Period Returns (%)

1. Bloomberg US Treasury and US Corporate Bond Indices. 2. Bloomberg Municipal Bond Index.

One basis point (bps) equals 0.01%. Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Yield curve data from Federal Reserve. State and local bonds and the Yield to Worst are from the S&P National AMT-Free Municipal Bond Index. AAA-AA Corporates represent the ICE BofA US Corporates, AA-AAA rated. A-BBB Corporates represent the ICE BofA Corporates, BBB-A rated. Bloomberg data provided by Bloomberg. US long-term bonds, bills, inflation, and fixed income factor data © Stocks, Bonds, Bills, and Inflation (SBBI) Yearbook™, Ibbotson Associates, Chicago (annually updated work by Roger G. Ibbotson and Rex A. Sinquefield). FTSE fixed income indices © 2024 FTSE Fixed Income LLC, all rights reserved. ICE BofA index data © 2024 ICE Data Indices, LLC. S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Bloomberg data provided by Bloomberg.

Morgan H Smith Jr. is an investment advisor with Constitution Wealth. Constitution Wealth is a registered investment adviser in Wyoming. Constitution Wealth is registered with the Securities and Exchange Commission (SEC). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the commission. Constitution Wealth only transacts business in states in which the firm is properly registered or is excluded or exempted from registration. A copy of Constitution Wealth’s current written disclosure brochure filed with the SEC, which discusses among other things, Constitution Wealth’s business practices, services, and fees, is available through the SEC’s website at www.adviserinfo.sec.gov.

Please note, the information provided in this document is for informational purposes only and investors should determine for themselves whether a particular service or product is suitable for their investment needs. Please refer to the disclosure and offering documents for further information concerning specific products or services.

Any hypothetical, backtested performance has been provided for illustrative purposes only, and is not necessarily, and does not purport to be, indicative, or a guarantee, of future results or the adviser’s skill. Hypothetical, backtested performance does not represent actual performance. The results are prepared by retroactive application of a model, with the benefit of hindsight, and actual results may vary substantially. The preparation of such information is based on underlying assumptions, and does not represent the actual performance of any fund, portfolio, or investor, it is subject to risk and limitations that are not applicable to non-hypothetical performance presentations. Although advisor believes any hypothetical, backtested performance calculations described herein are based on reasonable assumptions, the use of different assumptions would produce different results. For the foregoing and other similar reasons, the comparability of hypothetical, backtested performance to the prior (or future) actual performance of a fund is limited, and prospective investors should not unduly rely on any such information in making an investment decision.

Nothing provided in this document constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation or an offer to sell (or solicitation of an offer to buy) securities in the U.S. or in any other jurisdiction.

This document may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions; changing levels of competition within certain industries and markets; changes in interest rates; changes in legislation or regulation; and other economic, competitive, governmental, regulatory, and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of Constitution Wealth or any of its affiliates or principals or any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events, or any other circumstances. All statements made herein speak only as of the date they were made.

Any indices and other financial benchmarks shown are provided for illustrative purposes only, are unmanaged, reflect reinvestment of income and dividends, and do not reflect the impact of advisory fees. Investors cannot invest directly in an index. Comparisons to indexes have limitations because indexes have volatility and other material characteristics that may differ from a particular hedge fund.

Texas Takes a Stand: Why All Conservative Investors Should Consider Ditching BlackRock

In a bold move, the mighty state of Texas has fired BlackRock, the world’s largest asset manager, from its investment portfolio. The decision came as a result of the company’s left-leaning political stance and its focus on Environmental, Social, and Governance (ESG) factors, diversity equity, and inclusion (DEI), and the corporate equality index (CEI) in its investment decisions. Texas’s bold decision has sparked a nationwide debate on whether other conservative investors should follow suit.

We will examine the reasons behind Texas’s decision and argue why all conservative investors should consider ditching BlackRock.

BlackRock’s ESG/DEI/CEI Focus: A Threat to Traditional Values?

The primary reason Texas severed ties with BlackRock is the company’s increasing focus on ESG/DEI/CEI factors in its investment decisions. ESG/DEI/CEI criteria prioritize environmental sustainability, social justice, and corporate governance over traditional financial metrics. While these goals may seem admirable, they often come at the expense of shareholder value and can be used to further a liberal political agenda.

BlackRock’s ESG/DEI/CEI initiatives have been criticized for their potential to harm the energy industry, a vital sector in Texas’s economy. By divesting from oil and gas companies, BlackRock is effectively punishing these businesses for not adhering to its preferred environmental standards. This approach not only threatens job security but also ignores the economic benefits these industries provide to the state and its residents.

Furthermore, BlackRock’s emphasis on social justice has raised concerns about the company’s commitment to traditional American and free-market principles. Some argue that the company’s investments in renewable energy and other “green” initiatives are driven more by political ideology than sound financial analysis.

This raises questions about whether BlackRock is truly serving the best interests of its clients, or if it is merely using its vast resources to promote a left-leaning political agenda.

Texas’s decision to fire BlackRock sends a clear message that the state will not tolerate investments that prioritize leftist political ideology over financial returns. By taking this stand, Texas has ignited a conversation about the role of asset managers in shaping the American economy and the importance of preserving free-market principles and traditional American values.

A Wake-Up Call for Conservative Investors

For politically conservative investors, Texas’s move should serve as a wake-up call to reevaluate their own investment portfolios. If you share Texas’s concerns about BlackRock’s ESG/DEI/CEI focus and political leanings, it may be time to consider alternative investment options that better align with your values and financial goals. If you want to know how, here’s another blog discussion: How to Execute on Values Driven Investing.

The state of Texas’s decision to fire BlackRock has sparked an important conversation about the role of asset managers in shaping the future of the country. If you are a conservative investor concerned about the impact of ESG/DEI/CEI factors and political ideology on your investments, it may be time to reevaluate your portfolio and consider alternative options that better align with your values and financial goals. By taking a stand against companies like BlackRock, like the State of Texas, conservative investors can help ensure that the American economy remains a bastion of traditional values, free-market principles and financial prosperity for all.

Navigating Legal Challenges: How DEI Initiatives Pose Risks for Investors

In the pursuit of fostering diversity, equity, and inclusion (DEI) within the corporate landscape, companies are treading a delicate legal path. As investors, it’s crucial to explore how DEI initiatives may inadvertently lead to legal challenges, potentially casting shadows on investment returns.

The Legal Landscape:

At the heart of the matter are concerns that certain DEI initiatives might inadvertently violate the Civil Rights Act Section 7 and the Equal Protection Clause of the U.S. Constitution. Let’s delve into the legal complexities that could impact investors.

Reverse Discrimination Concerns: Some argue that DEI initiatives, while well-intentioned, may inadvertently lead to reverse discrimination against majority groups. This raises questions about compliance with the Civil Rights Act Section 7, which prohibits discrimination based on protected characteristics such as race and gender.

Equal Protection Clause Scrutiny: The Equal Protection Clause, designed to ensure equal treatment under the law, may come into play if DEI initiatives result in preferential treatment based on race, gender, or other protected attributes. This constitutional scrutiny introduces an additional layer of legal complexity.

Legal Jeopardy for Companies:

Companies navigating the DEI landscape may find themselves in legal jeopardy, potentially impacting the interests of their investors.

Discrimination Lawsuits: As DEI initiatives unfold, the risk of discrimination lawsuits becomes a looming concern. Employees who feel adversely affected may pursue legal action, resulting in financial implications for the companies involved and, consequently, impacting investor returns.

Regulatory Scrutiny: Regulatory bodies are increasingly scrutinizing corporate DEI efforts. If these initiatives are perceived as discriminatory or inconsistent with existing anti-discrimination laws, companies may face fines and legal consequences, further influencing the financial stability of the organizations and affecting investors.

Public Relations Risks: Negative public perception of DEI initiatives could lead to reputational damage for companies and their brands (Bud Light and Disney, for example). This, in turn, may affect customer loyalty and, crucially for investors, impact stock values as the public and stakeholders reassess their relationship with the company.

The Harvard Case and Investor Concerns:

The recent Students for Fair Admissions v. Harvard case introduces another layer of consideration for investors.

Affirmative Action Precedent: The case, revolving around affirmative action in education, may set a precedent for similar discussions in the corporate sector. Investors should be attuned to how this legal precedent might impact DEI initiatives within companies and subsequently influence their investment returns.

Impact on Investor Returns:

Investors should be mindful of the potential negative impacts on investment returns resulting from legal challenges associated with DEI initiatives.

Litigation Costs: Legal battles are inherently costly. If companies implementing DEI initiatives become embroiled in discrimination lawsuits, investors may witness a drain on financial resources, impacting the bottom line and, consequently, their returns.

Reputational Damage: A tarnished corporate image resulting from legal controversies surrounding DEI initiatives could erode consumer trust and investor confidence. This may translate to diminished stock values, negatively affecting the returns of those who hold investments in these companies.

Regulatory Compliance Costs: Increased regulatory scrutiny may necessitate compliance measures, incurring additional costs for companies. Investors may witness a reduction in profit margins, impacting overall returns.

Conclusion:

As investors and investment advisers, it is imperative to acknowledge the potential legal risks associated with DEI initiatives and their subsequent impact on investment returns. For companies, mitigating legal challenges is crucial for aiming to navigate the complexities of the DEI landscape without compromising the interests of their stakeholders, including investors. In this evolving legal environment, staying informed and vigilant is key to making sound investment decisions.

If your investment adviser is recommending companies who are pushing DEI, it may be wise to ask them about it… or find a new adviser.

Navigating Your Financial Journey: One Advisor or Many?

Embarking on a journey toward financial security and prosperity is a significant step that requires careful planning, expert guidance, and informed decision-making. One of the most crucial choices you’ll face is whether to work with a single financial advisor or multiple advisors.

Both approaches have their merits and drawbacks, and in this blog, we’ll explore the considerations for becoming a small client to multiple advisors or a large client to a single advisor.

The Role of Financial Advisors

Financial advisors play a pivotal role in helping individuals and businesses manage their finances, investments, and long-term goals. They offer insights, strategies, and personalized recommendations to navigate the complex world of money management. Whether you’re saving for retirement, investing in the stock market, or planning for major life events, a financial advisor can provide invaluable expertise to guide you.

Working with Multiple Advisors

- Diversification of Expertise: One of the main benefits of working with multiple advisors is gaining access to a diverse range of expertise. Different advisors may specialize in various areas, such as retirement planning, tax optimization, or estate planning. This approach allows you to tap into specialized knowledge for each specific aspect of your financial life.

- Avoiding Bias: By consulting multiple advisors, you can avoid potential bias and receive a broader range of perspectives. This can be particularly helpful when making complex decisions that involve a mix of investment options or strategies.

- Customization: Each advisor may offer unique insights tailored to your financial situation, enabling you to create a well-rounded financial plan that aligns with your goals and risk tolerance.

However, there are challenges to consider:

- Coordination: Managing relationships with multiple advisors requires effective communication and coordination to ensure that your financial strategies are aligned and complementary.

- Potential Conflicts: Advisors may offer differing advice, causing confusion and potential conflicts if their recommendations contradict each other.

- Time and Cost: Working with multiple advisors may consume more of your time and increase costs due to multiple fee structures. Most financial advisors use a decreasing marginal fee structure. So you’ll pay the most total fees to all of your advisors while remaining a small client to each of them. You may be assigned to a less experienced advisor as a result.

Becoming a Large Client to One Advisor

- Holistic Approach: Having a single advisor allows for a more holistic approach to financial planning. They can develop a comprehensive strategy that takes into account your entire financial picture, ensuring that all elements work harmoniously together.

- Relationship Building: A long-term relationship with a single advisor fosters trust and familiarity, enabling them to understand your evolving financial needs and adapt your plan accordingly. Additionally, by placing all of your investments with one advisor, you become a large client to that advisor and he may be able to dedicate more time and expertise to you.

- Streamlined Communication: Dealing with a single point of contact simplifies communication and decision-making, making it easier to implement and adjust your financial strategies.

Potential downsides include:

- Limited Expertise: A single advisor might not possess specialized knowledge in every financial area, potentially leading to missed opportunities or suboptimal strategies.

- Confirmation Bias: Depending solely on one advisor’s perspective might result in confirmation bias, where you’re more likely to accept advice that aligns with your existing beliefs.

- Dependency: Relying solely on one advisor means that if their approach falters, you may face significant financial consequences.

Making Your Choice

The decision to work with multiple advisors or a single advisor depends on your unique circumstances, preferences, and goals. Some individuals find comfort in diversifying their advisory team, while others value the convenience and trust that comes with a long-term relationship with a single advisor.

Ultimately, consider the complexity of your financial situation, your comfort level with managing multiple relationships, and your need for specialized advice when making your choice. Whichever path you choose, remember that open communication, due diligence, and a clear understanding of your financial goals are key to a successful advisory relationship.

The journey toward financial success is both exciting and challenging. Working with financial advisors can provide the guidance and expertise needed to navigate this complex landscape.

Whether you opt for a team of specialists or a single trusted advisor, remember that your financial well-being is at the heart of the decision. Take the time to assess your needs, do your research, and choose the approach that aligns best with your goals, values, and aspirations.

Unveiling "America’s Most Woke Companies" Investment Strategy: Investing with a Conscience

In the world of conscious investing, where financial decisions are driven by ethical considerations, “America’s Most Woke Companies” strategy has emerged as a compelling approach for investors seeking to align their portfolios with their values. This investment strategy involves purposefully excluding the 12 largest, most woke corporations from one’s investment options. In this blog, we will delve into the concept behind “The America’s Most Woke Companies,” explore the rationale behind its adoption, and highlight the potential benefits it offers to conscientious investors.

Understanding the “America’s Most Woke Companies” Investment Strategy

The “America’s Most Woke Companies” strategy involves meticulously scrutinizing and excluding the 12 corporations perceived to be the most excessively engaged in political or social activism. The term “woke” in this context refers to companies that prioritize liberal social and political causes over their core business objectives. By intentionally avoiding investment in such companies, proponents of this strategy aim to create a portfolio that better reflects their principles and convictions.

Rationale Behind Excluding the “America’s Most Woke Companies” strategy:

- Preserving Financial Performance: Critics of overly woke corporations argue that excessive political activism may divert resources and attention from a company’s primary focus, potentially leading to compromised financial performance and shareholder returns.

- Reputational Risks: Companies that take polarizing stances on social and political issues risk alienating a portion of their customer base. This can result in reputational damage and adverse effects on stock prices over the long term.

- Value Alignment: Conscious investors prioritize companies whose values align with their own. By excluding the “America’s Most Woke Companies,” investors can direct their funds toward businesses that better reflect their principles, promoting positive change through their investment choices.

- Reducing Legal and Regulatory Risks: Corporations heavily engaged in political activism may attract increased scrutiny from regulators and lawmakers. Investing in such companies could expose investors to legal and regulatory risks.

The Selection Process for “America’s Most Woke Companies”:

Choosing the 12 corporations to exclude from an investment portfolio requires careful research and analysis. Investors can start by evaluating each company’s public statements, campaigns, and activities related to social and political causes. Additionally, they may consult third-party research reports and organizations that assess corporate behavior concerning social responsibility.

The companies must be continually monitored so that their presence on the exclusion list can be maintained, or not. If another company is more problematic, it should be rotated onto the list in place of a less culturally destructive firm.

Implementing the “America’s Most Woke Companies” Strategy

Simply exclude them from your universe of investment options.

The “America’s Most Woke Companies” investment strategy empowers conscientious investors to take control of their financial choices and align their portfolios with their deeply held values. While the strategy may not guarantee superior financial returns, it offers the satisfaction of knowing that investments are actively promoting causes and companies in line with personal principles. As with any investment approach, research is paramount, and seeking professional advice is advisable to achieve both financial and ethical objectives.

Remember, investment decisions should always be tailored to individual circumstances and values, as each investor’s journey is unique.

Is Aligning Your Investment Portfolio with Your Conservative Investment Values Worth It?

In an era where personal values are increasingly influencing our choices, aligning investment portfolios with our patriotic values has become a significant consideration. However, some folks may question the impact of their individual investments, feeling that they are too small to make a difference. It is essential to recognize that collective action can be a game-changer. In this blog, we delve into the importance of aligning your investment portfolio with your values and highlight the need for collective action to influence corporate behavior.

It is understandable to feel overwhelmed by the magnitude of global challenges and doubt the impact of individual actions. However, collective action has proven time and again to be a catalyst for change. When we unite and align our investment choices with our values, we amplify our impact. Each individual contribution may appear small, but when combined, they create a substantial force for positive change.

While some may argue against aligning investments with values, it is crucial to recognize that there are forces working against our traditions. We believe that Countless left-wing organizations and individuals are invested in diminishing our American heritage. By acting collectively and aligning our investment portfolios with our values, we can counteract these opposing forces and work towards maintaining our freedoms.

Collective action not only has the power to counter opposition but also creates a ripple effect that extends beyond our individual investments. By supporting companies that prioritize the family, God-given rights, and national sovereignty/freedoms, we send a strong signal to the market. The demand for responsible business practices increases, leading more companies to adopt these values to remain competitive. As the market shifts, industries as a whole are compelled to adapt, creating a domino effect that reverberates throughout the economy and culture.

Consider the influence of a massive collective effort. Imagine if millions of people chose to align their investments with their values. The cumulative impact would be tremendous. Companies that neglect ethical considerations and our history would be pressured to change their ways or risk losing substantial support. By acting collectively, we can shape the investment landscape and promote positive change on a much larger scale.

Let’s take Target for example. Recently this company has been promoting transsexualism to children in its stores. Many customers and investors have revolted and as of this writing, their stock is down approximately $12 billion in value. As a result, they have also issued a new policy offering to move their offensive displays to the back of the stores in red states. More change could be forthcoming in response to their anti-conservative behavior.

In a similarly disastrous move, the managers of the Bud Light brand decided to hire a transexual spokesperson named Dylan Mulvaney. Drinkers of Bud Light tend to be rather conservative and the beer was immediately boycotted by their customers and investors. As of today the stock is down 20% and the executive in charge has been relieved of her duties. This is another example of Americans acting together to produce a powerful counterforce to the left in the culture war.

Acting collectively does not mean standing alone. There are communities, groups, businesses, and platforms dedicated to connecting like-minded investors. By joining forces, sharing information, and pooling resources, we can amplify our individual voices and create a unified front. These networks provide a sense of solidarity and support, enabling individuals to contribute to causes they care about and work together towards common goals.

In a world where personal values are increasingly shaping our decisions, we believe aligning investment portfolios with our values is not only worth it, but necessary to preserve the American way of life. While it is understandable to question the impact of individual investments, collective action holds the potential for substantial change. By uniting and aligning our investments with our values, we counteract opposing forces and create a ripple effect that extends far beyond our individual actions. Together, we can shape the investment landscape, promote responsible practices, and work towards a better future. The other side certainly is acting collectively, and it is up to us to join forces and make a difference.

How Working with a CFP Professional or Wealth Manager is Like Using a General Contractor

The Role of a Certified Financial Planner

Much like a general contractor, a CFP professional isn’t a specialist in every specific area but possesses a deep understanding of the larger financial landscape. They have the skills and experience to guide you through the process of achieving your financial goals.

The process begins with the CFP helping you outline the vision for your finances, understanding your goals, aspirations, and financial circumstances. Together, you’ll identify your short-term and long-term objectives, which could range from saving for retirement to funding your child’s education or even starting a business. Based on this understanding, the CFP assists you in creating a comprehensive financial plan.

Implementing the Plan

With the vision and plan in place, your CFP becomes the focal point who identifies and collaborates with the necessary specialists. This parallels how a general contractor hires plumbers, electricians, roofers, and other professionals for specific tasks. In the financial sphere, the CFP collaborates with estate planning lawyers, tax specialists, investment advisors, insurance agents, and other professionals.

The CFP also acts as a conduit between you and these specialists, ensuring their efforts align with your overarching financial vision. They communicate your goals, provide necessary information, and facilitate collaboration among the specialists, preventing fragmentation and ensuring a unified approach towards your objectives.

Monitoring and Updating

A CFP, much like a general contractor overseeing a building project, consistently monitors and updates the progress towards your financial vision. They regularly review your financial plan, assess the performance of the involved specialists, and make necessary adjustments. They also keep you informed about the progress, address any concerns, and offer guidance on potential modifications to accommodate changing circumstances or goals.

A Holistic Approach to Your Financial Well-Being

By acting as your financial quarterback, the CFP professional or wealth manager allows you to focus on your overall financial health while they handle the details. This holistic approach guarantees that all aspects of your financial life are considered and incorporated into a cohesive strategy. The ultimate goal of a CFP is to help you construct a robust financial foundation and guide you towards achieving your vision of financial success.

Conclusion

Just as a well-built house starts with a vision and the right team, your financial success relies on a comprehensive plan and the guidance of a certified financial planner. With their help, you can turn your financial dreams into a tangible reality.

Building an Ideal Conservative Investment Portfolio: A Comprehensive Approach

Investing in the right portfolio is crucial for long-term financial success. It requires careful consideration of various factors, including diversification, factor exposures, bond quality and duration, expenses, taxes, and ethical alignment.

In this blog post, we will explore the key elements to look for in an investment portfolio to ensure optimal returns while staying aligned with your conservative values and ethical beliefs.

Diversification: Spreading Risk Wisely

- Diversification is a fundamental principle of investing. A well-diversified portfolio may reduce the risk associated with individual investments by allocating resources across different asset classes, sectors, and geographies. A diverse portfolio may also mitigate the impact of market volatility and helps protect against potential losses. When evaluating a portfolio, analyze the range of assets it holds and ensure there is a healthy mix of stocks, bonds, real estate.

Factor Exposures: Identifying Drivers of Returns.

- Factor exposures refer to the underlying characteristics that drive investment returns. Common factors include value, growth, size, profitability, and momentum. Understanding the factor exposures in your portfolio can help you gauge how it may perform under different market conditions and, more importantly, over the long term. Consider analyzing the portfolio’s exposure to various factors and ensure they align with your investment goals and risk appetite.

Bonds: Short Duration and High Credit Quality

- Bonds can play a vital role in diversifying a portfolio and reducing its overall risk. When evaluating the bond portion of a portfolio, two key factors to consider are duration and credit quality. Short-duration bonds are typically less sensitive to interest rate changes, reducing the impact of rising rates on the portfolio’s value. Additionally, high-credit-quality bonds typically provide greater stability and lower default risk. Ensure that the portfolio holds bonds with favorable duration and credit quality characteristics. Constitution Wealth believes that bonds are an inferior source of risk-adjusted returns to stocks. Therefore, the proper role of bonds, in our opinion, is to reduce portfolio volatility (the ups and downs) during difficult times.

Reasonable Expenses: Maximizing Returns

- The expenses associated with managing an investment portfolio can significantly impact your overall returns. Higher expenses can eat into your investment gains over time. Look for portfolios with reasonable expense ratios, which reflect the percentage of assets deducted annually to cover administrative and management costs. Compare the expenses of different portfolios and opt for ones that offer a balance between cost and value. Make sure that the expenses you are paying are delivering the value you expect.

Taxes and Turnover: Minimizing Costs

- Taxes and portfolio turnover can erode investment returns. High turnover can generate taxable events, resulting in increased tax liabilities. Consider portfolios with low turnover, as they tend to generate fewer taxable events. Additionally, explore tax-efficient investment strategies, such as tax-loss harvesting or utilizing tax-advantaged accounts like IRAs or 401(k)s, to minimize the impact of taxes on your portfolio. Low turnover also decreases trading costs, which may increase returns.

Values and Ethical Alignment: Investing with a Purpose

- Investing in alignment with your values and ethical beliefs is becoming increasingly important for many investors. Consider portfolios that integrate conservative values screens or factors into their investment approach. Look for companies with strong ethical practices and a commitment to individual freedoms. Investing in companies whose values align with your own not only provides financial returns but also creates a positive impact on society.

Conclusion

Constructing an investment portfolio that meets your objectives requires careful consideration of several key factors.

A diversified portfolio with appropriate factor exposures, short-duration and high credit quality bonds, reasonable expenses, low taxes and turnover, and ethical alignment can provide a strong foundation for long-term financial success.

Take the time to evaluate these elements when choosing your portfolio to maximize returns while staying true to your patriotic values and beliefs. Remember, investing is a journey, and periodic portfolio reviews and adjustments are necessary to ensure it remains in line with your evolving goals and market conditions.

Who’s Managing your Shareholder Vote?

Did you know that when you buy a share of stock, it comes with a vote?

You can show up at shareholder meetings and vote (even speak to management), or you can use an easier method called a proxy vote.

Proxy voting is a mechanism that allows shareholders of a company to vote on corporate matters without physically attending the shareholders’ meeting. Instead, shareholders can appoint a proxy to vote on their behalf. The proxy can be an individual, such as a friend or family member, or an institution, like a mutual fund, ETF, or pension fund.

When a company issues a proxy statement before a shareholders’ meeting, it includes details about the issues to be voted upon and provides shareholders with voting instructions. Shareholders can review the proxy statement, make their voting decisions, and then authorize their proxy to vote accordingly.

This can be done through various methods, such as completing a proxy card, voting online, or providing written instructions.

Proxy voting is important for several reasons:

- First, it allows shareholders who are unable to attend the meeting, either due to logistical constraints or lack of time, to still participate in the decision-making process. It ensures that the voices of all shareholders are considered, regardless of their physical presence.

- Second, proxy voting empowers individual shareholders by giving them a say in matters that affect the company’s governance and direction. This could include ESG initiatives, diversity equity and inclusion (DIE), critical race theory (CRT), political involvement that may run counter to the interests of shareholders. By exercising their vote, investors can express their support or opposition to proposals such as electing woke directors, approving race and gender based quotas, executive compensation, or approving mergers and acquisitions. This helps shape the company’s decisions and holds management accountable.

- Furthermore, proxy voting is crucial for maintaining a healthy corporate democracy. It promotes transparency, accountability, and checks and balances within a company. When shareholders actively participate in voting, it reduces the risk of decisions being made without proper oversight, and it encourages responsible corporate behavior.

Most investors are not even aware of this important responsibility.

In fact, they are delegating this power to fund companies and brokerages without realizing it. Many of these firms hold left-wing extremist views, in our opinion, and are using their client’s votes to push unethical social policies via your investments.

What can you do about it?

First, you can vote your proxies by informing your brokerage of this desire. It’s usually a form to fill out. This will work for shares you own directly. It won’t work if you own your investments inside mutual funds or ETFs.

Those votes will be exercised by the fund companies themselves and you have no direct say in the proxy voting. Be sure that your funds are managed by people whose values are aligned with your own. If they aren’t aligned, you may wish to sell the fund and buy something else.

The other option is to work with an investment advisor who is attuned to your values. Your advisor can then, at your direction, vote your proxies for you and/or choose fund companies who have a world view close to yours.

This will save you time and give you a potentially louder voice when your vote is combined with other shareholders with whom the advisor works.

In summary, proxy voting enables shareholders to participate in corporate decision-making by appointing a proxy to vote on their behalf.

It is important for investors to exercise their vote as it allows them to have a say in company matters, influence corporate governance, and promote transparency and accountability.