Constitution Wealth 2025 Q3 Review: Prepare for the Impending Market Collapse

You clicked on this one pretty fast, didn’t you? This is a perfect example of ‘clickbait,’ and it’s a good example of how nefarious actors trying to sell you stuff might cause you to take action with your investments that might hurt you in the long run. It could also have been the opposite, something like “Don’t Miss Out On A Once In A Generation Investment : [Fill in the blank: Bitcoin, A.I., Gold, Quantum Computing, TikTok Marketing]”. As such, I’d like to talk about how biases could hurt your chances of financial success.

If you spend any time on the internet doing what you believe is research, you likely will have been inundated with articles of the same ilk. Unfortunately, many of the articles you read will come from sources with conflicts of interest. They are incentivized, often for money, likes, and clicks, and most likely to incite fear or greed in an effort to make you second-guess your current strategies. In the end, they are often trying to prey on your emotions to sell something. The key is finding impartial, unbiased sources that look to academics for long-term investment solutions.

Behavioral science is an important area of study in finance. Behavioral factors and our emotional state play a very significant role in wealth building and wealth preservation. These factors often become more significant as we age and during personal, political, social, or market turmoil, which, of course, are all constant factors that appear during the course of our lives.

I think we all understand that people have biases, but we often, to our own detriment, rationalize that our own biases are well-managed and our decisions are sound. I would posit that one of my most important duties as a financial advisor at WorthPointe is to manage and strengthen rational decision-making and guide you through times that might otherwise tempt you to make decisions today that would hurt you in the long run. This is done, amongst other ways, by knowing you as a person and investor, intimate knowledge of investment structures and historical market cycles, as well as years of experience.

We, as advisors, know that biases are potentially in play when we hear the following statement from an investor. “I want to [sell/buy] this [security/sector] because of [some reason]. Call it a trigger for us to roll up our sleeves and ramp up the education process. In truth, there may be valid reasons for the sentiment, and we are here to listen and discuss these things with our clients; however, from my experience, it’s often driven by personal biases, often created by headline news, or even valid intellectual curiosity that might make you question or validate your financial path forward.

Here’s a short paper worth reading by Russell Investments that summarizes some of the issues I’m discussing: “How To Avoid Common Behavioral Biases”.

One of the biases identified in the paper is stated as follows:

“Home Bias & Country Specific Risk Humans tend to prefer what is familiar or well-known. One of the common results of this in portfolios around the world is the home country bias: the tendency to allocate a greater portion of one’s portfolio to assets domiciled in your home country. The home country bias limits the amount of diversification in investor portfolios and exposes investors to significant country-specific risk. “

Overcoming this bias really sets the starting point for our investment philosophy and how we build portfolios for long-term opportunities for success and resiliency.

As a basis for resilient portfolio construction, we start by looking at the market capitalization(cap) of countries around the world. Think of market cap as adding up the value of all listed stocks in a country; this gets you the country’s total market cap. Here’s a good visual of the market caps of countries from around the world.

Many investors are 100% or mostly invested in U.S. securities, but as can be seen from the chart above, the U.S. “only” represented 65% of the global market cap as of 12/31/2024. Drilling further down into each country, you will have market weights to large companies, small companies, profitable companies, sectors, etc., so the analysis gets more complex than just country market cap. However, for a global allocation at the country level, having about 65% of your equity exposure in the U.S., and the rest proportionally invested in international and emerging markets, is a good place to start for most investors. There are many reasons to do this beyond the scope of this report, but the point is that we are facilitating strategies that help immunize against biases both today and into the future.

In summary, you want to build a portfolio resilient to future events from the start, rather than letting headlines drive any changes. That’s not to say that changes in investment strategy should not be made based on changes to your personal situation or investment due diligence. Excellent portfolio construction from the start helps breed confidence and peace of mind through headline and real-life volatility prior to the events occurring, and if done within the framework of a good financial plan, can help satisfy a higher probability of success.

Market Review: 2025 Q3

KEY TAKEAWAYS

- The broad market S&P 500 and tech-heavy Nasdaq both hit record highs in September. (Source: Morningstar)

- The Fed lowered interest rates by a quarter point, for the first time since December 2024. (Source: federalreserve.gov)

- Small-cap stocks outpaced large caps in the US and globally, but value lagged growth.

Stocks extended gains in the third quarter, with major indices in the US hitting new records, including the S&P 500 and Nasdaq, as trade negotiations proceeded and the US Federal Reserve cut interest rates.1 The rate reduction in September was the first in nearly a year. Stocks’ rise was a continuation of the gains that had preceded for much of 2025, aside from the market’s sharp fall and quick recovery during a volatile April. Developed international equities lagged the US in the third quarter, but emerging markets were higher, and both remained ahead of the US for the year. In the bond market, US Treasuries were slightly higher, with the benchmark 10-year yield just above 4%.2

The Fed cut the federal funds rate by 25 basis points to a range between 4%–4.25% in September, the first move lower since December.3 In August, the US core consumer price index, which excludes more-volatile food and energy items, was shown rising 3.1% from a year ago.4 That’s above the Fed’s target rate of 2%. The Fed’s September rate cut came with officials referencing their two goals of keeping inflation and unemployment in check but noting that “downside risks to employment have risen.”

Trade negotiations between the United States and other countries continued during the quarter, with the US administration reaching a number of trade deals, including with the European Union, the United Kingdom, and Japan. But questions remained about levies that may be imposed on goods from China, India, Mexico, and elsewhere.5 In the coming months, the US Supreme Court is also set to weigh in on a case to determine the validity of global tariffs that have been imposed by the current administration.6

Against this backdrop, US stocks advanced, with the S&P 500 Index rising 7.7% and the tech-heavy Nasdaq adding 11.3% as of September 19. Shares of NVIDIA stood out as the firm became the first public company to reach a market capitalization of $4 trillion, making it nearly 8% of the S&P 500 Index.7 Global equities, as measured by the MSCI All Country World Index, rose 7.2% as of September 19, trailing the US. Developed international stocks outside the US added 4.8%, as measured by the MSCI World ex USA Index. The MSCI Emerging Markets Index gained 10.2%.8

Small-cap stocks beat large caps in the US and globally through September 19, with US small caps having some of their best returns in recent years.9 Value stocks, or those with low relative prices, did not rise as much as growth stocks in the US and globally. High profitability stocks were outpaced by low profitability stocks in global developed markets as of September 19, while the opposite was true in emerging markets, with high profitability stocks beating their low profitability counterparts.10

In the bond market, US Treasuries were 1.5% higher, sending the yield on the benchmark 10-year Treasury down to 4.14%.11 The broader bond market also gained, with the Bloomberg US Aggregate Bond Index up 2.1% and the Bloomberg Global Aggregate Bond Index (hedged to USD)—a broad benchmark of sovereign and corporate debt—adding 1.2% as of September 19.12

Footnotes

- S&P data © 2025 S&P Dow Jones Indices LLC, a division of S&P Global. The S&P is a market capitalization-weighted index of 500 widely held stocks often used as a proxy for the stock market. Standard & Poor’s chooses the member companies for the S&P based on market size, liquidity, and industry group representation. Included are the common stocks of industrial, financial, utility, and transportation companies. All rights reserved. Data as of September 19, 2025. Indices are not available for direct investment. Connor Smith, “Stocks Hit New Records in a Rate Cut Rally,” Barron’s, September 18, 2025.

- Returns are based on the Bloomberg US Treasury Bond Index as of September 19, 2025. This is a family of indices that measure the performance of different segments of the U.S. Treasury market, including the total U.S. Treasury market (excluding bills) and specific maturity ranges like the 1-3 Year and 7-10 Year segments. These indices track US dollar-denominated, fixed-rate, nominal debt issued by the U.S. Treasury and are widely used as benchmarks for fixed-income investments and financial products like ETFs. Bloomberg data is provided by Bloomberg Finance LP. Source for US Treasuries: US Department of the Treasury.

- The federal-funds rate is the overnight interest rate at which one depository institution (like a bank) lends to another institution some of its funds that are held at the Federal Reserve. Source: “Federal Reserve Issues FOMC Statement,” US Federal Reserve, September 17, 2025; Colby Smith, “Fed Cuts Rates for First Time this Year,” The New York Times, September 17, 2025.

- Inflation data is as defined by the consumer price index from the US Bureau of Labor Statistics; the core CPI is an aggregate of prices paid by urban consumers for a typical basket of goods, excluding food and energy; Colby Smith, “Rise in US Inflation Is Likely to Keep Fed Cautious on Pace of Rate Cuts,” The New York Times, September 11, 2025; Colby Smith, “Fed Cuts Rates for First Time this Year,” The New York Times, September 17, 2025.

- Chao Deng and Drew An-Pham, “Trump’s Tariffs: Where He Started, What He Threatened, Where He Ended Up,” The Wall Street Journal, August 27, 2025.

- Louise Radnofsky, “Supreme Court Agrees to Fast-Track Trump’s Tariff Appeal,” The Wall Street Journal, September 9, 2025.

- Jeff Sommer, “How Long Can This Uncanny Stock Market Prosper?” The New York Times, August 22, 2025. This information should not be considered a recommendation to buy or sell a particular security. Named securities may be held in accounts managed by Dimensional. It should not be assumed that an investment in the securities identified was or would be profitable.

- MSCI data © MSCI 2025, all rights reserved. Data as of September 19, 2025. Indices are not available for direct investment.

- Jacob Sonenshine, “Small-Cap Stocks Are on a Roll. What Could Push Them Higher.” Barron’s, September 10, 2025

- The MSCI All Country World Value Index rose 5.6%, while the MSCI All Country World Growth Index rose 8.7% as of September 19, 2025; the MSCI All Country World Small Cap Index advanced 8.5%, while the larger-cap MSCI All Country World Index rose 7.2% as of September 19, 2025; the Russell 2000 Index of US small cap stocks returned 12.9% through September 19, 2025; Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes; the Fama/French Developed High Profitability Index rose 7.4% versus 9.1% for its low profitability counterpart as of September 19, 2025; the Fama/French Emerging Markets High Profitability Index rose 11.8%, and its low profitability counterpart rose 8.7% as of September 19, 2025. See “Index Descriptions” for descriptions of the Fama/French index data. Past performance is no guarantee of future results. Actual returns may be lower. The Fama/French indices represent academic concepts that may be used in portfolio construction and are not available for direct investment or for use as a benchmark. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment.

- “Daily Treasury Par Yield Curve Rates,” US Department of the Treasury. Data as of September 19, 2025.

- Bloomberg data provided by Bloomberg Finance LP.

Morgan H Smith Jr. is an investment advisor with Constitution Wealth. Constitution Wealth is a registered investment adviser in Wyoming. Constitution Wealth is registered with the Securities and Exchange Commission (SEC). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the commission. Constitution Wealth only transacts business in states in which the firm is properly registered or is excluded or exempted from registration. A copy of Constitution Wealth’s current written disclosure brochure filed with the SEC, which discusses among other things, Constitution Wealth’s business practices, services, and fees, is available through the SEC’s website at www.adviserinfo.sec.gov.

Please note, the information provided in this document is for informational purposes only and investors should determine for themselves whether a particular service or product is suitable for their investment needs. Please refer to the disclosure and offering documents for further information concerning specific products or services.

Any hypothetical, backtested performance has been provided for illustrative purposes only, and is not necessarily, and does not purport to be, indicative, or a guarantee, of future results or the adviser’s skill. Hypothetical, backtested performance does not represent actual performance. The results are prepared by retroactive application of a model, with the benefit of hindsight, and actual results may vary substantially. The preparation of such information is based on underlying assumptions, and does not represent the actual performance of any fund, portfolio, or investor, it is subject to risk and limitations that are not applicable to non-hypothetical performance presentations. Although advisor believes any hypothetical, backtested performance calculations described herein are based on reasonable assumptions, the use of different assumptions would produce different results. For the foregoing and other similar reasons, the comparability of hypothetical, backtested performance to the prior (or future) actual performance of a fund is limited, and prospective investors should not unduly rely on any such information in making an investment decision.

Nothing provided in this document constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation or an offer to sell (or solicitation of an offer to buy) securities in the U.S. or in any other jurisdiction.

This document may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions; changing levels of competition within certain industries and markets; changes in interest rates; changes in legislation or regulation; and other economic, competitive, governmental, regulatory, and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of Constitution Wealth or any of its affiliates or principals or any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events, or any other circumstances. All statements made herein speak only as of the date they were made.

Any indices and other financial benchmarks shown are provided for illustrative purposes only, are unmanaged, reflect reinvestment of income and dividends, and do not reflect the impact of advisory fees. Investors cannot invest directly in an index. Comparisons to indexes have limitations because indexes have volatility and other material characteristics that may differ from a particular hedge fund.

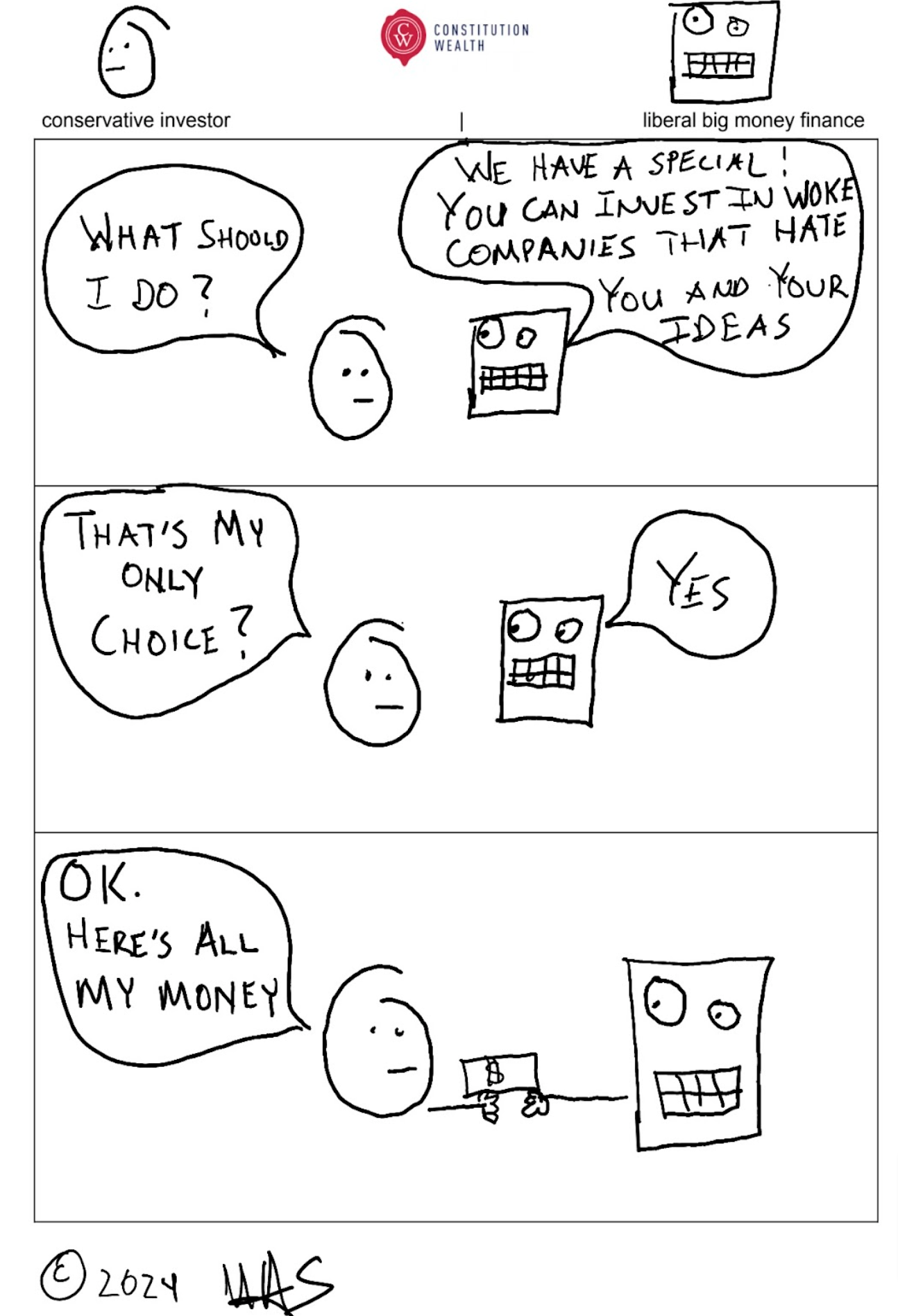

The Great ESG Exodus: Why $22 Billion Fled “Woke” Funds in 2025

If you still have BlackRock in your 401(k), you might want to check which bedside your savings wake up on. At end-July 2025, the market hit a jaw-dropping $22.3 billion in net redemptions from U.S. ESG-labelled funds (1). Almost every dollar swung into vehicles proudly pitched as conservative investment alternatives, we believe the clearest sign yet that the anti-ESG investing wave is no headline cycle but a permanent vote of no-confidence.

The Retail Revolt, Not a Capitol Hill Plot

Between January and March, individual investors moved eight dollars for every one dollar pulled by public-employee systems (2). Most of that $9 billion first-quarter avalanche occurred after BlackRock’s January shareholder letter insisting “climate transition scores” remain a fiduciary necessity (3). The firm’s own July earnings call admitted that subsequent retail hemorrhaging “reflects sentiment more than regulation” (4). By May, redemptions were still running $2–3 billion a month even after Congress stripped federal ESG incentives (5), in our opinion, proving this isn’t political theater, it’s consumer rage.

Geography of the Retreat

Texas again tops the absolute-state ledger: its comptroller tabulated $4.7 billion of public-money outflows (6). Yet per-capita sprint honors go to Florida, Arizona, and, notably, suburban counties in Illinois and California, working-class households everywhere realized that a 0.48 % expense ratio on “sustainability” funds skims an extra $2,250 a year against a 0.03 % plain-index clone on a $500 k rollover (7).

Performance Vindication Came Quick

An S&P-tracked basket of the ten most-despised ESG ETFs is down 6.4 % YTD, while its anti-ESG substitute peers are up 12.1 %, beating both the ESG subset and the S&P 500 itself by 3.40% after stripping the worst offenders (8). In other words, dropping the sermon delivered extra alpha.

How to Finish the House-Cleaning in 15 Minutes

Export your 401(k) holdings to CSV, drag the file through Gab AI’s “ESG Exposé” free dashboard, and swap any flagged tickers into the plain-index equivalent the tool offers. The move is capital-gains-free in a qualified account (9). Just don’t be fooled by newly relabeled “Sustainable Leaders” or “Climate Focus” share classes whose prospectuses still weigh governance scores above cash flow (10).

Bottom line: the $22-billion ESG exodus is a market verdict. Americans picked stewardship over scolding, and Wall Street is learning to adjust, one angry handshake at a time.

Disclaimers:

Constitution Wealth, LLC, a registered investment adviser with the Securities and Exchange Commission (SEC). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the commission. Constitution Wealth only transacts business in states in which the firm is properly registered or is excluded or exempted from registration. A copy of Constitution Wealth’s current written disclosure brochure filed with the SEC, which discusses among other things, Constitution Wealth’s business practices, services, and fees, is available through the SEC’s website at https://adviserinfo.sec.gov/firm/summary/313916. All investments involve risk. Information presented is for illustrative purposes and are not guarantees of, or projections of future performance. Forward-looking statements, such as “may,” “will,” “should,” “expect,” “intend,” “continue,” or “believe,” or the negatives thereof should not be relied upon as a guarantee, assurance or a representation as to the future. Such statements are a belief based on trends, however due to various risks and uncertainties, actual events, results or actual performance may differ. Additionally, investments in the market are influenced by many factors, including, but not limited to general and local economic conditions; changing levels of competition within certain industries and markets; changes in interest rates; changes in legislation or regulation; and other economic, competitive, governmental, regulatory, and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Historical data shown represents past performance and does not imply or guarantee comparable future results. Information and statistical data contained herein have been obtained from sources believed to be reliable but in no way are guaranteed as to accuracy or completeness.

Sources

- Morningstar Direct, “U.S. Sustainable Funds Flow Report – July 2025 Monthly Update”, July 2025.

- ICI, “Quarterly Net Issuance by Fund Category”, Table 3-B: Mutual Fund Retail vs. Institutional Flows, 2Q 2025 prelim., July 15, 2025.

- SEC EDGAR, BlackRock Inc., Form 8-K, Exhibit 99.2 shareholder letter, Jan 26, 2025.

- BlackRock Inc., “Second-Quarter 2025 Earnings Call”, transcript via S&P Global Market Intelligence, Aug 2, 2025.

- U.S. Congressional Budget Office, “Cost Estimate: H.R. 22 – FY 2025 Omnibus”, March 18, 2025.

- Texas State Comptroller, “Texas Treasury 2025 ESG Divestiture Annual Report”, updated Certification letter filed April 3, 2025.

- ICI, “2025 ICI Fee Survey”, median annual expense ratios comparison table, August 2025.

- S&P Dow Jones Indices, “Index Return Spread Analysis: ESG versus Bare-Index”, July 29, 2025 dashboard. Indexes are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

- Gab AI Inc., ESG Exposé Dashboard, free screening tool, accessed July 30, 2025. Constitution Wealth and Gab AI Inc. have no direct affiliation. As with all Artificial Intelligence (AI) platforms, such content is provided for informational purposes only and should not be relied upon for any specific purpose without human verification of its accuracy or completeness.

- SEC Form N-CSR filings, sample “Sustainable Leaders” fund prospectus S-1/A, April 8, 2025 (tickers omitted to preserve generality).

A Billion With a Purpose: Constitution Wealth and Its Affiliate Mark a Major Milestone

From humble beginnings rooted in America’s core values, the story of Constitution Wealth LLC is one of steadfast commitment, strategic growth, and a shared vision for patriotic financial stewardship. Established in Jackson, Wyoming, as an independent registered investment adviser, the firm was founded to address a critical need: providing financial guidance that aligns with conservative principles, allowing clients to invest in ways that support traditional family values, religious freedoms, gun rights, and limited government.

With headquarters initially in Jackson, WY, Constitution Wealth began as a small operation focused on personalized portfolio management and financial planning for individuals and small businesses.

Partners like Brooks Morgan and Matt Addington, along with advisors such as Morgan H. Smith Jr. and Joshua Young, CFA, CAIA, brought a blend of expertise in value-aligned investing, emphasizing fiduciary duty and client-centric strategies without ties to larger broker-dealers or external parents.

Serving a dedicated client base of high-net-worth patriots, veterans, faith-based communities, and conservative business owners frustrated by mainstream finance’s embrace of “woke” agendas.

The firm’s approach was simple yet powerful: using discretionary portfolio management to build diversified holdings in equities, ETFs, municipal securities, and other assets that reflected clients’ beliefs, while offering financial planning to secure legacies rooted in integrity.

They charged asset-based and net-worth-based fees, elevating transparency as a fee-only adviser, and provided tools like daily account monitoring and restrictions on investments that clashed with core values. This resonated deeply, attracting clients primarily via conservative talk radio such as the Glenn Beck Show.

As investors sought refuge from volatile markets and ideologically misaligned corporations, Constitution Wealth capitalized on demand for principled investing.

They expanded services to include trust and estate planning (via their unique wealth management process), partnering with custodians for secure asset handling while maintaining independence—no commissions, no brokerage affiliations, just pure politically conservative fiduciary advice.

Growth surged, fueled by referrals from conservative radio. By early 2025, inflows from new clients—drawn to the firm’s opposition to controversial causes and focus on America-first strategies—pushed assets higher. Strategic enhancements, such as digital tools for portfolio customization, further broadened appeal.

In mid-2025, as bullish trends favored sectors aligned with traditional values, Constitution Wealth and its affiliate parent, WorthPointe, crossed the threshold: 1 billion in assets under management.

This achievement wasn’t merely numerical; it validated that ethical, value-driven investing could deliver competitive returns while upholding freedom and family.

Today, Constitution Wealth continues to empower clients, proving independent firms can thrive by staying true to patriotic principles.

Constitution Wealth 2025 Q2 Review: Healthy Finances & Healthy Life

At Constitution Wealth, we have a dedicated team of financial advisors who are focused on aligning our clients’ conservative values with their financial lives. They are a tight-knit group with shared conservative, family, and faith-based values and meet weekly to support each other. They share their expertise for best practices, talk about life, and how to be successful not only financially but spiritually and physically as well. This is just one advisor’s perspective on healthy investing and living, and will hopefully provide you with insights into some of the topics they discuss on a weekly basis. Truth be told, they are all focused not only on their clients’ financial health but their own financial and physical health as well. Simply stated, they are trying to lead by example.

I was speaking with a prospective client the other day. He is a physician, had been through a divorce years back, and is doing well, but admittedly “playing catchup” financially while working and maintaining his household with his new family. He has been trying to manage his investments and financial affairs on his own, but just didn’t know how he was tracking towards retirement, which he’d like to do in about 10 years. His question for me was, “Is now the right time to be working with a financial advisor?”

At that moment, I just thought about his role as a doctor and thought about life and health. If you want to have a vibrant life in the future with the prospects of fulfilling your dreams, whether that means travelling, exploring, spending quality time with family, or all of the above, not living healthy today and waiting to change your lifestyle choices years down the road is not a good way of working towards your goals.

As it turns out, long-term physical health requires a disciplined daily lifestyle approach, but it can be enjoyable at the same time. Waiting for years until it feels like the right time or a serious medical condition arises is not the right approach. People who are most successful in achieving an active and fulfilling life rarely do it on their own. They utilize coaches, doctors, trainers, and activities to keep them on track and teach them things they otherwise might not have known. Most importantly, these relationships can keep us on track when we are feeling not so motivated or so busy that it becomes difficult to stay on course. Some of us might be very self-disciplined and can accomplish much with our own motivation, but everyone can get off track. That’s when a doctor, coach, or advisor really earns their keep.

All of these ideas pertain to your financial health and partnering with a financial advisor as well, and this is what I communicated to this doctor. He chuckled and agreed. He’s an expert, how could he not? While there’s no perfect time, the right time is when you have a solid plan, sufficient resources, and a strong belief in your idea. Ultimately, the “right time” is often a decision based on your own motivations and willingness to take action.

If you look around, I think you’ll find that most successful/wealthy families have financial advisors and a team of folks they rely on to outsource activities they don’t have expertise in. Even if they have expertise in finance, they’ll most likely admit that they don’t know what they don’t know, don’t have the time and resources to focus on the never-ending challenges and changes in wealth management, and they have more important things they want to focus on; the experiences of living. And, very importantly, many spouses/partners that are primarily handling investments for their families are rightly concerned about things falling apart should they pass away. And as we know, life is short and things like children growing up and retirement sneak up quickly. If we recognize that, we’ll understand the need to plan early.

With a nod to my conversation with the doctor, rather than give you some tips on financial health, I’ll give you some of my tips for physical health. Consider this a high-level summary of some of the ways I try to maintain my physical health. Of course, I’m not a doctor, and this is not medical advice, so please consult your doctor for anything health-related.

- Night to mid-day fast: No food after 8-9pm until 12 noon the next day. This is a good rule of thumb I think unless you are getting up in the morning and working out, you might want to have some protein after the workout but not absolutely necessary.

- Morning Routine In Order

- 1) Hydrate: Drink a glass of water as soon as you wake up. I mix collagen peptides and super greens powder with probiotics in my water.

- 2) Hot chocolate with powdered milk and organic unsweetened cacao

- 3) Ginger tea – I’m a tea guy, not a coffee achiever so this works well for me. I brew some black tea with minced ginger and a healthy dose of milk.

- I’ll add a multi-vitamin, and depending how I’m feeling I’ll add some tumeric curcumin pills, zinc, fish oil etc.

- This routine gets me through to lunch no problem.

- Morning Routine In Order

- Physical Exercise & Weight: There is plenty of research showing that keeping the weight off and having an appropriate amount of muscle mass is very beneficial to longevity. There are scales that not only measure weight, but also measure body fat, muscle mass etc. I don’t use these too much but my son got into his own workout program and was monitoring his progress every day. Understanding there is a myriad of body types, I recommend you set targets and a program that is appropriate for your age and body type. This is my program.

- Intense physical activity: I’m a black belt in Brazilian Jiu Jitsu and train at least 3 times a week. This training involves everything physical (and mental); strength, endurance, cardio, flexibility, recovery resilience.

- Hydration – For my intense physical training when I’m sweating a lot I’ll often add hydration powder.

- Strength & Endurance for workouts: I found an immediate benefit taking Taurine about an hour prior to my workouts.

- Recovery: I need protein after hard workouts or it can take me a while to recover. Until recently I’ve taken whey protein but lately have switched to this protein shake. I like the vanilla option and it fills me up more.

- Weight Training: Training with weights and resistance to build and maintain muscle is very important especially as you get older. I only need a full body workout one to two times a week.

- Stretching: One of the most important elements of my lifestyle for staying mobile. Some prefer intense yoga but have a quick routine I do at home at least four times a week that focuses on hip and back mobility.

- Walking/Hiking: In my opinion walking and hiking are somewhat underrated. If you’re not in good enough physical condition to do more intense workouts, walking and hiking is probably all you need. Long walks are a great way to lower body fat as well.

As I mentioned earlier, I’m not a doctor and this is not medical advice so please consult your doctor for anything health related. However, I am a CERTIFIED FINANCIAL PLANNER® and experienced professional in my field so you can certainly come to me for investment and financial planning advice.

Market Review: 2025 Q2

A volatile second quarter ended with major stock indices at record levels even as the quarter began with sharp declines following the Trump administration’s announcement of global tariffs, driving the Chicago Board Options Exchange’s CBOE Volatility Index (VIX) to its highest levels since 20201. Despite trade policy uncertainty and increased geopolitical tensions as conflict between Israel and Iran dominated news, US stocks ended the quarter with the S&P 500 Index up 10.9%2. Global stock markets fared even better with the MSCI All Country World ex USA IMI Index (net div.) up 12.7%3.

The Federal Reserve continued to leave interest rates on hold citing uncertainty around the impact of tariffs on prices. The European Central Bank and Bank of England both diverged from the Fed by cutting their target rates again. Both emerging and developed non-US stock indices outperformed the US market with both the MSCI World ex USA IMI Index (net div.) and the MSCI Emerging Markets IMI Index (net div.) returning 12.7%4.

Global Asset Class Returns Chart: Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio.

Global Asset Class Returns Chart: Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio.

See disclaimers below for Market segment (index representation) below.

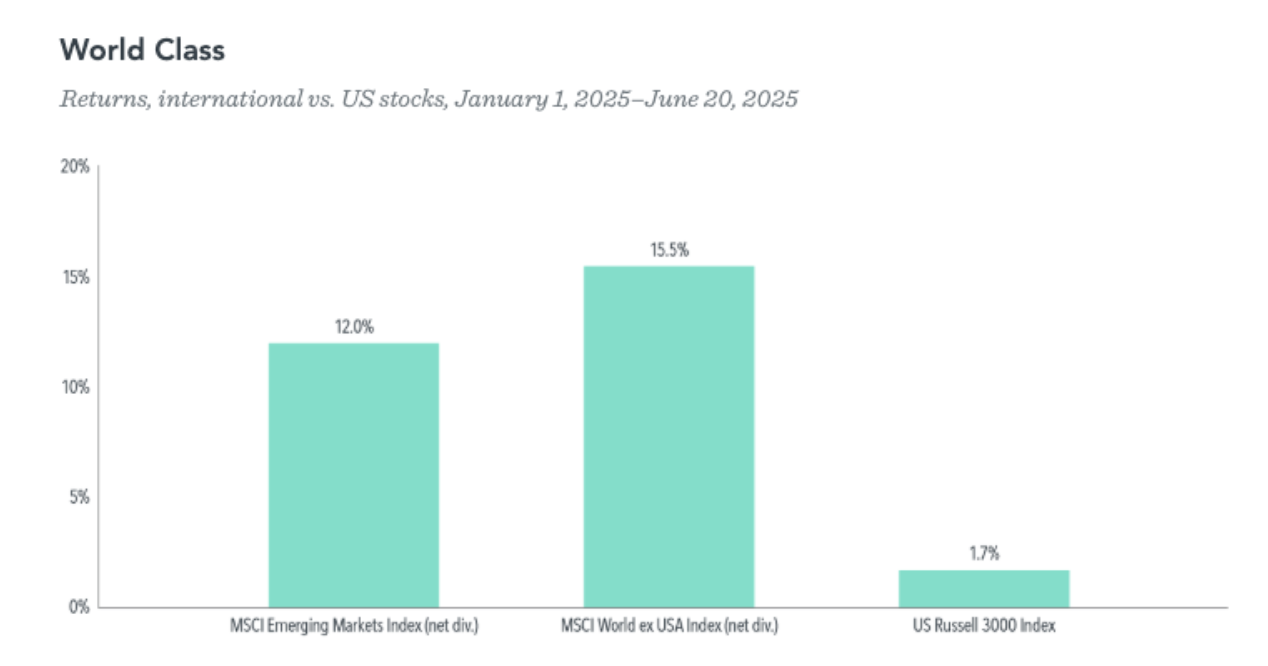

An important theme from Q1 2025 that continued through Q2 2025 was the outperformance of international vs US markets. I just want to emphasize the importance of sticking to a diversified allocation even when there are times that certain components of your portfolio are underperforming vs other indexes. Due to the very nature of diversified portfolios, this will always be the case and hopefully, as an insightful investor, you understand that it’s times like these where the benefit of discipline can reward a long term perspective. When you look at the outperformance of international markets over U.S. markets year-to-date, this concept really stands out.

World Class Chart: Past performance is not a guarantee of future results. Sources: MSCI Emerging Markets Index (net div.), MSCI World ex USA Index (net div.), Russell 3000 Index. MSCI data © MSCI 2025, all rights reserved. In USD. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.

Morgan H Smith Jr. is an investment advisor with Constitution Wealth. Constitution Wealth is a registered investment adviser in Wyoming. Constitution Wealth is registered with the Securities and Exchange Commission (SEC). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the commission. Constitution Wealth only transacts business in states in which the firm is properly registered or is excluded or exempted from registration. A copy of Constitution Wealth’s current written disclosure brochure filed with the SEC, which discusses among other things, Constitution Wealth’s business practices, services, and fees, is available through the SEC’s website at www.adviserinfo.sec.gov.

Please note, the information provided in this document is for informational purposes only and investors should determine for themselves whether a particular service or product is suitable for their investment needs. Please refer to the disclosure and offering documents for further information concerning specific products or services.

Any hypothetical, backtested performance has been provided for illustrative purposes only, and is not necessarily, and does not purport to be, indicative, or a guarantee, of future results or the adviser’s skill. Hypothetical, backtested performance does not represent actual performance. The results are prepared by retroactive application of a model, with the benefit of hindsight, and actual results may vary substantially. The preparation of such information is based on underlying assumptions, and does not represent the actual performance of any fund, portfolio, or investor, it is subject to risk and limitations that are not applicable to non-hypothetical performance presentations. Although advisor believes any hypothetical, backtested performance calculations described herein are based on reasonable assumptions, the use of different assumptions would produce different results. For the foregoing and other similar reasons, the comparability of hypothetical, backtested performance to the prior (or future) actual performance of a fund is limited, and prospective investors should not unduly rely on any such information in making an investment decision.

Nothing provided in this document constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation or an offer to sell (or solicitation of an offer to buy) securities in the U.S. or in any other jurisdiction.

This document may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions; changing levels of competition within certain industries and markets; changes in interest rates; changes in legislation or regulation; and other economic, competitive, governmental, regulatory, and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of Constitution Wealth or any of its affiliates or principals or any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events, or any other circumstances. All statements made herein speak only as of the date they were made.

Any indices and other financial benchmarks shown are provided for illustrative purposes only, are unmanaged, reflect reinvestment of income and dividends, and do not reflect the impact of advisory fees. Investors cannot invest directly in an index. Comparisons to indexes have limitations because indexes have volatility and other material characteristics that may differ from a particular hedge fund.

Constitution Wealth 2025 Q1 Review: A Tale of Two Countries

We are all emotional creatures with a touch of what we like to think of as data-driven logic sprinkled in. But you have to admit that there are differences across the population as to the ratio of the mix. Some are more emotional to the point of hysterics at their worst. Some are more logical to the point of heartless analysis-paralysis at their worst.

To wit, we all have biases, many unknown, that imbue an emotional taint into our thoughts and decision making. One of my most important duties is to help investors keep a balance between emotion and logic in an environment of trust and integrity. This essentially means keeping you on track during times of over-exuberance and times of under-enthusiasm.

This quarter, let’s take a look at “home” bias and how it affects many investors. Investors often get focused on domestic events, forgetting that there is a world of opportunity often not reflected in their investment portfolios. Over the last several years, the U.S. market had indeed performed well to the point that many investors forgot about opportunities abroad. Let’s take a look at some indexes for the quarter.

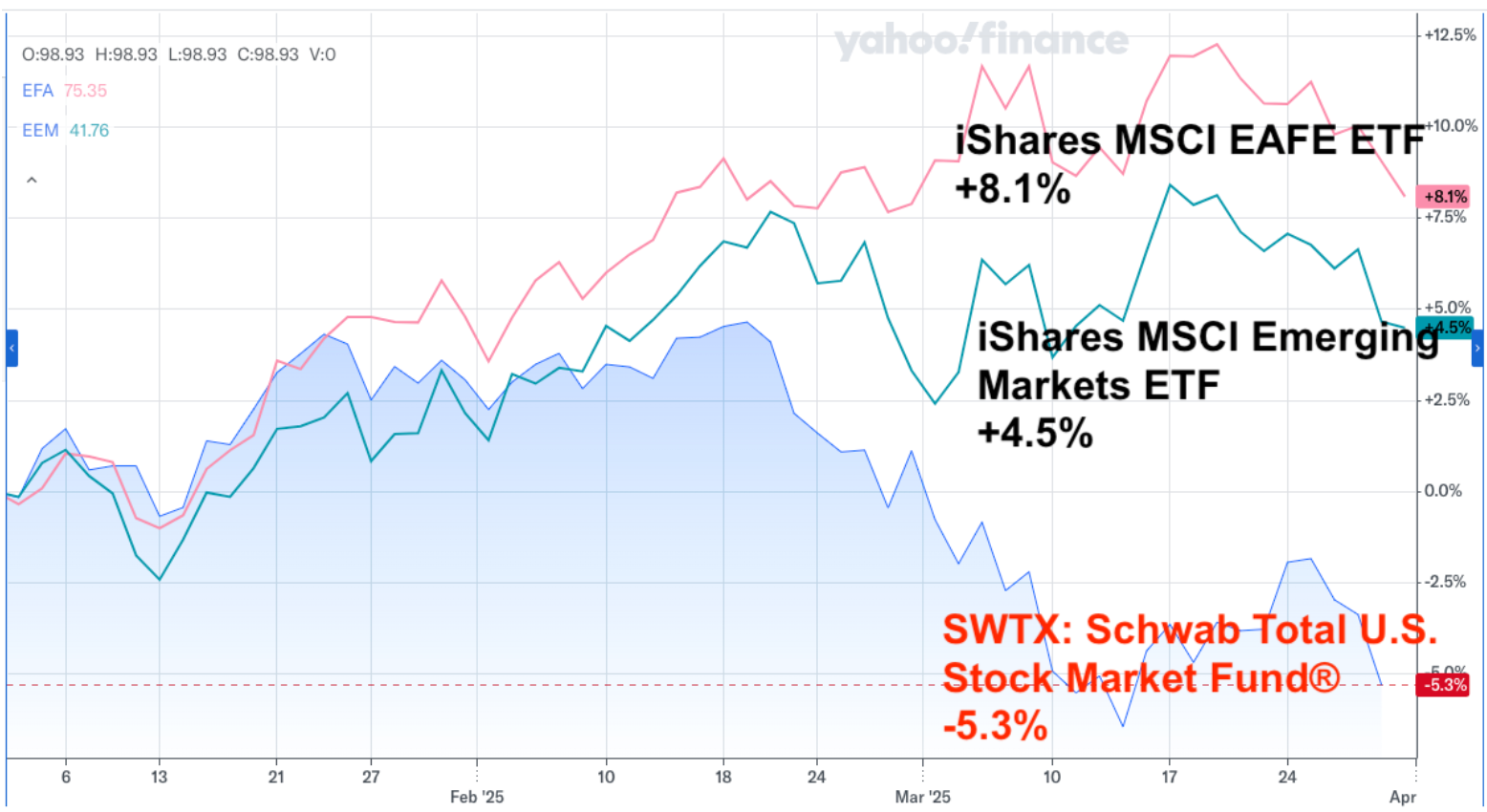

Chart Note: “EAFE” refers to developed international markets and stands for “Europe Asia Far East”

01/01/2025 through 03/31/2025 © Past performance is no guarantee of future results. Any fund holdings shown should not be considered a recommendation of any security by the investment adviser. Chart © 2025 Yahoo. All rights reserved. In partnership with ChartIQ. https://www.schwabassetmanagement.com/products/swtsx, https://www.ishares.com/us/products/239637/ishares-msci-emerging-markets-etf, https://www.ishares.com/us/products/239623/ishares-msci-eafe-etf

As can be seen from the chart, SWTX (representative of the overall U.S. stock market) performed at a negative -5.3% for Q1 2025. For those investors who were home-biased and focused on U.S. markets, this trend would have negatively influenced their portfolio significantly and perhaps solidified a negative sentiment moving forward.

On the other hand, iShares MSCI EAFE ETF returned +8.3% while iShares Emerging Markets ETF returned +4.5% for the quarter. So those investors with globally diversified portfolios would most likely have benefited from the strong YTD push from international markets allocations.

I titled this article as “A Tale of Two Countries” for obvious reasons, but it’s also “A Tale of Two Investors” for the quarter. This quarter was a perfect example of why we want to structure our investment allocation based on sound academics and instill discipline over time to take advantage of global opportunities that can benefit us when we least expect them to.

Market Review: 2025 Q1

The Fed kept the federal-funds rate unchanged in the 4.25%–4.5% range in March, citing elevated inflation and an uncertain economic outlook.1 On inflation, the US core consumer price index, which excludes more-volatile food and energy items, showed prices rose 3.1% from a year earlier in February, the most recent data available, which is more than a percentage point higher than the Fed’s target of 2%.2 Meanwhile, the unemployment rate edged slightly higher, to 4.1%, in February.3

1. The federal-funds rate is the overnight interest rate at which one depository institution (like a bank) lends to another institution some of its funds that are held at the Federal Reserve. “Federal Reserve Issues FOMC Statement,” Federal Reserve, March 19, 2025.

2. Inflation data as defined by the consumer price index (CPI) from the US Bureau of Labor Statistics; the core CPI is an aggregate of prices paid by urban consumers for a typical basket of goods that excludes food and energy; Megan Leonhardt, “Markets Celebrate Softer Inflation, but Fed Will Remain on Pause,” Barron’s, March 12, 2025.

3. Derek Saul, “US Added 151,000 Jobs as Unemployment Rose to 4.1% in February,” Forbes, March 7, 2025.

Tariff Trepidation

The threat of tariffs is liable to loom over markets for the foreseeable future, with levies on China already in place and those on Canada and Mexico set to take effect in early April and there’s no assurance as to what the results of any coming actions will be.

One period offering perspective on this issue is President Trump’s first term in office. Beginning in 2017, the administration eyed China as a target and, by 2018, began imposing tariffs across a range of products. The next couple of years saw back and forth trade discussions that eventually led to an agreement, though pre-existing tariffs remained in place. Despite all this uncertainty, both China and the US posted higher cumulative returns than the MSCI World ex USA Index over the four years of Trump’s term.

Past performance is not a guarantee of future results. Tariffs are only one of many factors that can impact security prices. Investors may be better off sticking with the plan rather than trying to outguess the market based on potential tariff policy changes.

And finally, I’ve been seeing headlines pop up on “stagflation” which in my view is most likely click-bait, feeding on investor fears. But, let’s hypothesize for a moment that we are in fact in for a period of stagflation. Should investors act on this concern with their investments?

Since 1930, the US has seen 12 years when negative GDP growth coincided with positive changes in the consumer price index (CPI). The US stock market’s real return—its return in excess of inflation—was positive in nine out of those 12. That hit rate is close to the frequency of positive real returns across all years between 1930 and 2024, which is 68%.

This is another example demonstrating how concerns over the economy shouldn’t drive investment decisions. Predictions about the direction of the economy are continuously forming, but the market itself remains the best predictor of the future. That means market prices are set to levels to deliver positive expected returns even amid concerns over future economic outcomes.

In USD. Sources: Bureau of Labor Statistics, US Bureau of Economic Analysis, S&P 500 Index: January 1990–Present, Standard & Poor’s Index Services Group; January 1930–December 1989, Ibbotson data courtesy of © Stocks, Bonds, Bills, and Inflation Yearbook® Stocks, Bonds, Bills, and Inflation Yearbook®, Ibbotson Associates, Chicago. S&P data © 2025 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. US inflation is the annual rate of change in the consumer price index for all urban consumers (CPI-U, not seasonally adjusted) from the Bureau of Labor Statistics. Annual GDP growth rates obtained from the US Bureau of Economic Analysis. GDP growth numbers are adjusted to 2012 USD terms to remove the effects of inflation. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

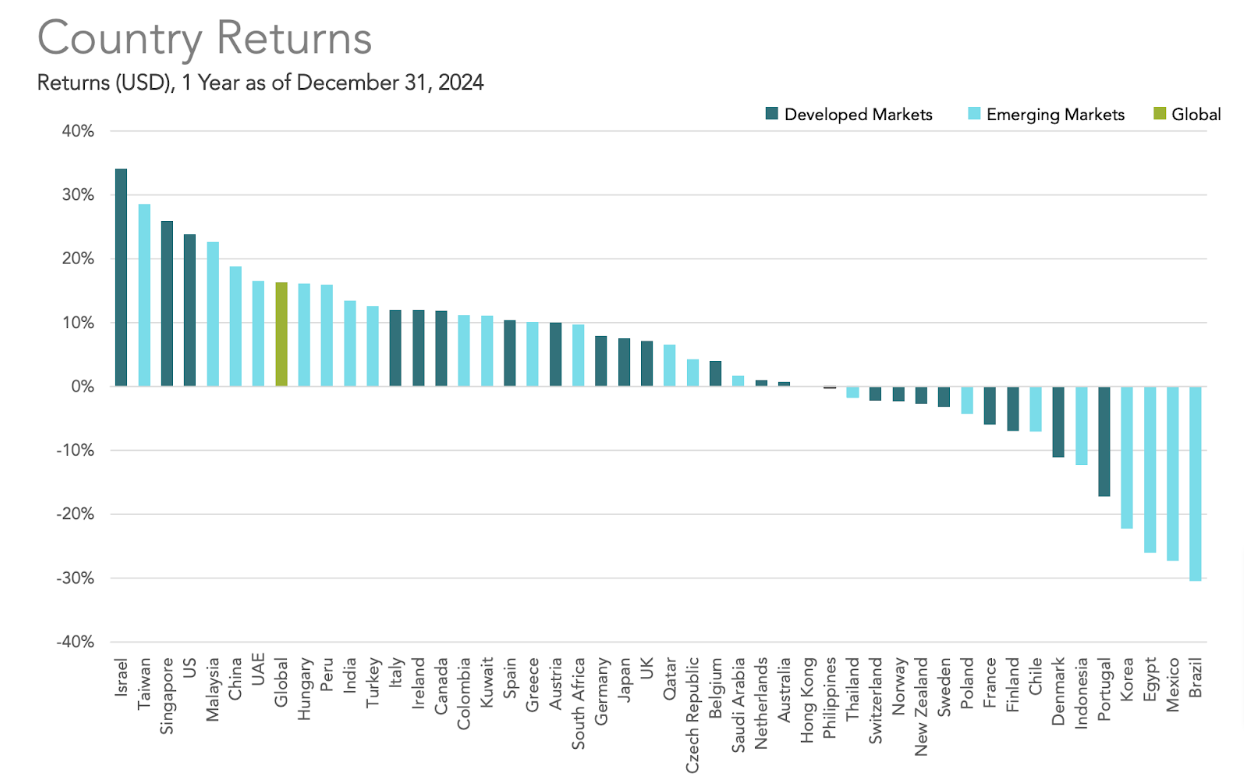

To wrap things up, the theme at the beginning of this report was about global opportunities and I think this graphic of country returns for the first quarter helps bolster the idea of global diversification.

Past performance is no guarantee of future results. Country returns are the country component indices of the MSCI All Country World IMI Index for all countries except the United States, where the Russell 3000 Index is used instead. Global is the return of the MSCI All Country World IMI Index. MSCI index returns are net dividend. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. MSCI data © MSCI 2025, all rights reserved.

Morgan H Smith Jr. is an investment advisor with Constitution Wealth. Constitution Wealth is a registered investment adviser in Wyoming. Constitution Wealth is registered with the Securities and Exchange Commission (SEC). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the commission. Constitution Wealth only transacts business in states in which the firm is properly registered or is excluded or exempted from registration. A copy of Constitution Wealth’s current written disclosure brochure filed with the SEC, which discusses among other things, Constitution Wealth’s business practices, services, and fees, is available through the SEC’s website at www.adviserinfo.sec.gov.

Please note, the information provided in this document is for informational purposes only and investors should determine for themselves whether a particular service or product is suitable for their investment needs. Please refer to the disclosure and offering documents for further information concerning specific products or services.

Any hypothetical, backtested performance has been provided for illustrative purposes only, and is not necessarily, and does not purport to be, indicative, or a guarantee, of future results or the adviser’s skill. Hypothetical, backtested performance does not represent actual performance. The results are prepared by retroactive application of a model, with the benefit of hindsight, and actual results may vary substantially. The preparation of such information is based on underlying assumptions, and does not represent the actual performance of any fund, portfolio, or investor, it is subject to risk and limitations that are not applicable to non-hypothetical performance presentations. Although advisor believes any hypothetical, backtested performance calculations described herein are based on reasonable assumptions, the use of different assumptions would produce different results. For the foregoing and other similar reasons, the comparability of hypothetical, backtested performance to the prior (or future) actual performance of a fund is limited, and prospective investors should not unduly rely on any such information in making an investment decision.

Nothing provided in this document constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation or an offer to sell (or solicitation of an offer to buy) securities in the U.S. or in any other jurisdiction.

This document may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions; changing levels of competition within certain industries and markets; changes in interest rates; changes in legislation or regulation; and other economic, competitive, governmental, regulatory, and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of Constitution Wealth or any of its affiliates or principals or any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events, or any other circumstances. All statements made herein speak only as of the date they were made.

Any indices and other financial benchmarks shown are provided for illustrative purposes only, are unmanaged, reflect reinvestment of income and dividends, and do not reflect the impact of advisory fees. Investors cannot invest directly in an index. Comparisons to indexes have limitations because indexes have volatility and other material characteristics that may differ from a particular hedge fund.

Trump Rescues Conservative-Values Investors? Problem solved? Not so fast...

Under the leadership of President Donald Trump, we believe significant strides have been made in reversing the insidious Diversity, Equity, and Inclusion (DEI) policies that have infiltrated our society.

In our opinion, these policies, which have been woven into the fabric of corporate HR departments, government agencies, and university bureaucracies, pose a direct threat to the conservative principles that we feel form the bedrock of our nation.

Despite what we see as progress made by the Trump administration, it is crucial to recognize that we think the fight against DEI is far from over, and aligning one’s investments with conservative values remains an ongoing challenge. In our view, the pervasive nature of DEI policies cannot be underestimated, as they have been strategically embedded in key institutions over the course of several years.

This calculated approach has allowed DEI to gain a strong foothold, we believe, making it difficult to completely eradicate its influence. As conservatives, we aim to remain vigilant and committed to the cause of dismantling these policies, which we feel seek to undermine our traditional values and promote a leftist agenda.

While the political road ahead may be arduous, we believe it is imperative that we strive to align our investments with our conservative principles.

By actively seeking out and supporting companies, organizations, and initiatives that share our values, we believe we can contribute to the gradual erosion of DEI’s influence. This process will require patience, determination, and an unwavering commitment to our beliefs, but the end result – a society free from the shackles of DEI – is well worth the effort, in our view.

As we navigate this challenging landscape, let us remember that our collective actions, no matter how small, can make a significant difference in the fight against what we see as the insidious spread of DEI policies.

Ask yourself this…

Can you trust your investments and your family’s legacy with a firm that has supported DEI and what you may view as anti-family and anti-faith-based policies for years and all of a sudden have switched their stance due to political expediency?

Or, would you prefer to work with a trusted advisor at a firm that has been committed to conservative-values based investors from day one?

At Constitution Wealth, we have always believed that your financial decisions should be a reflection of your personal values.

When you invest in alignment with your beliefs, you not only have the potential to grow your wealth, but you can also stay true to what matters most—your integrity.

That’s why we’re dedicated to helping you build a portfolio that strives to support your core conservative values, allowing you to invest with purpose and pride. That mission statement has never changed, and never will.

Morgan H Smith Jr. is an investment advisor with Constitution Wealth. Constitution Wealth is a registered investment adviser in Wyoming. Constitution Wealth is registered with the Securities and Exchange Commission (SEC). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the commission. Constitution Wealth only transacts business in states in which the firm is properly registered or is excluded or exempted from registration. A copy of Constitution Wealth’s current written disclosure brochure filed with the SEC, which discusses among other things, Constitution Wealth’s business practices, services, and fees, is available through the SEC’s website at www.adviserinfo.sec.gov.

Please note, the information provided in this document is for informational purposes only and investors should determine for themselves whether a particular service or product is suitable for their investment needs. Please refer to the disclosure and offering documents for further information concerning specific products or services.

Any hypothetical, backtested performance has been provided for illustrative purposes only, and is not necessarily, and does not purport to be, indicative, or a guarantee, of future results or the adviser’s skill. Hypothetical, backtested performance does not represent actual performance. The results are prepared by retroactive application of a model, with the benefit of hindsight, and actual results may vary substantially. The preparation of such information is based on underlying assumptions, and does not represent the actual performance of any fund, portfolio, or investor, it is subject to risk and limitations that are not applicable to non-hypothetical performance presentations. Although advisor believes any hypothetical, backtested performance calculations described herein are based on reasonable assumptions, the use of different assumptions would produce different results. For the foregoing and other similar reasons, the comparability of hypothetical, backtested performance to the prior (or future) actual performance of a fund is limited, and prospective investors should not unduly rely on any such information in making an investment decision.

Nothing provided in this document constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation or an offer to sell (or solicitation of an offer to buy) securities in the U.S. or in any other jurisdiction.

This document may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions; changing levels of competition within certain industries and markets; changes in interest rates; changes in legislation or regulation; and other economic, competitive, governmental, regulatory, and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of Constitution Wealth or any of its affiliates or principals or any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events, or any other circumstances. All statements made herein speak only as of the date they were made.

Any indices and other financial benchmarks shown are provided for illustrative purposes only, are unmanaged, reflect reinvestment of income and dividends, and do not reflect the impact of advisory fees. Investors cannot invest directly in an index. Comparisons to indexes have limitations because indexes have volatility and other material characteristics that may differ from a particular hedge fund.

Constitution Wealth 2024 Q4 Review: When Stats & Facts Don't Add Up

Our mission at Constitution Wealth is to align your conservative values with your family wealth strategies. But of course, we don’t want to do that at the expense of sound investment principles.

This quarter’s report will be a little different. We’ll provide you with some interesting statistics and facts on the overall economy that may give you perspective as we head into 2025. In truth, we find this type of information to be very interesting and intellectually stimulating and thought it might be helpful for our readers as we begin the new year.

So, let’s have a look at some of the current economic indicators from sources that we deem reliable. Rather than publish a stack of graphs, I’ll list the economic data in a table and link to the data.

| Indicator | Description | Value | Link To Chart/Data/Description |

| 5 Year Breakeven Inflation Rate | represents a measure of expected inflation | 2.40% | Click here to see data. |

| 2024 Q4 Real GDP Growth | forecast the growth of real GDP | 1.21% | Click here to see data. |

| Consumer Price Index | price index of a basket of goods and services paid by urban consumer | rising | Click here to see data. |

| Credit Card Debt Tops $1 Trillion | In 2023, outstanding credit card balances in the United States surpassed $1 trillion for the first time. | Click here to see data. | |

| Unemployment Rate | the number of unemployed as a percentage of the labor force | 4.20% | Click here to see data. |

| Economic News Sentiment | measure of economic sentiment based on lexical analysis of economics-related news articles | positive | Click here to see data. |

| VIX Volatility Index | a popular measure of the stock market’s expectation of volatility based on S&P 500 index options. | lower vs year | Click here to see data. |

| Mortgage Rates | Freddi Mac 30 & 15 Year Fixed | rising Q4 | Click here to see data. |

The catch is, if one were not educated and wise to the academics of investing, you might be inclined to start making changes in your portfolio based on this information. The markets are forward thinking and it is very difficult to take advantage of information like this as a basis for investment decisions because as far as the market is concerned, this data, although interesting, is stale and the markets have most likely reacted to it already. Another way to say this is that all of the information you can read will have already been incorporated into the pricing of securities in the markets.

How so? Remember, the market is an effective information-processing machine. Each day, the world equity markets process billions of dollars in trades between buyers and sellers—and the real-time information they bring helps set prices. Per the graphic below, there was $633.9 BILLION worth of world equity DAILY trading volume in 2023. I think you’d have to be somewhat delusional to think that you could outsmart that amount of sellers and buyers consistently over time.

Exhibit 1: In USD. Source: Dimensional, using data from Bloomberg LP. Includes primary and secondary exchange trading volume globally for equities. Funds are excluded. Daily averages were computed by calculating the trading volume of each stock daily as the closing price multiplied by shares traded that day. All such trading volume is summed up and divided by 252 as an approximate number of annual trading days.

The moral of this article is this: don’t try to make predictions on what will happen with the markets in 2025 based on current data and indicators. Rather, construct your strategic investment strategy such that it is based on your personal situation and has historically been shown to be resilient over time through unpredicted cycles despite the news and data. And of course – Happy New Year. I hope it is a happy, healthy, and wealthy 2025 for you and your family.

Market Review: 2024 Q4

Past performance is no guarantee of future results. Market segment (index representation) as follows: US Stock Market (Russell 3000 Index), Developed ex US Stocks (MSCI World ex USA IMI Index [net div.]), Emerging Markets (MSCI Emerging Markets IMI Index [net div.]), Global REITs (S&P Global REIT Index [net div.]), US Bond Market (Bloomberg US Aggregate Bond Index), and Global Bond Market ex US (Bloomberg Global Aggregate ex-USD Bond Index [hedged to USD]). S&P data © 2025 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2025, all rights reserved. Bloomberg data provided by Bloomberg. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio.

The fourth quarter saw Developed ex US, Emerging Markets, and Global REIT’s pull back by -7.49%, -7.89%, and -9.02% respectively although these markets did provide positive returns for the year. Another way to say this is that the U.S. market was the only market listed to provide a positive return for Q4 albeit a modest 2.63%.

Past performance is no guarantee of future results. Country returns are the country component indices of the MSCI All Country World IMI Index for all countries except the United States, where the Russell 3000 Index is used instead. Global is the return of the MSCI All Country World IMI Index. MSCI index returns are net dividend. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. MSCI data © MSCI 2025, all rights reserved

For the year, there were more countries whose markets had positive returns than negative. Interestingly the U.S. was not the best country market with Israel being the highest with Brazil being the lowest. This is yet another indicator that global diversification can be a good thing over time.

Within the US Treasury market, interest rates generally increased during the quarter.

On the short end of the yield curve, the 1-Month US Treasury Bill yield decreased 53 basis points (bps) to 4.40%, while the 1-Year US Treasury Bill yield increased 18 bps to 4.16%. The yield on the 2-Year US Treasury Note increased 59 bps to 4.25%.

In terms of total returns, short-term US treasury bonds returned -0.83% while intermediate-term US treasury bonds returned -1.70%. Short-term corporate bonds returned -0.40% and intermediate-term corporate bonds returned -1.40%.1

1. Bloomberg US Treasury and US Corporate Bond Indices.

2. Bloomberg Municipal Bond Index.

One basis point (bps) equals 0.01%. Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Yield curve data from Federal Reserve. State and local bonds and the Yield to Worst are from the S&P National AMT-Free Municipal Bond Index. AAA-AA Corporates represent the ICE BofA US Corporates, AA-AAA rated. A-BBB Corporates represent the ICE BofA Corporates, BBB-A rated. Bloomberg data provided by Bloomberg. US long-term bonds, bills, inflation, and fixed income factor data © Stocks, Bonds, Bills, and Inflation (SBBI) Yearbook™, Ibbotson Associates, Chicago (annually updated work by Roger G. Ibbotson and Rex A. Sinquefield). FTSE fixed income indices © 2025 FTSE Fixed Income LLC, all rights reserved. ICE BofA index data © 2025 ICE Data Indices, LLC. S&P data © 2025 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Bloomberg data provided by Bloomberg.

A final note on commodities and gold. The Bloomberg Commodity Total Return Index returned -0.45% for the fourth quarter of 2024. Sugar and Nickel were the worst performers, returning -14.29% and -13.81% during the quarter, respectively. Coffee and WTI Crude Oil were the best performers, returning +18.51% and +7.10% during the quarter, respectively with gold being slightly negative for the quarter

Past performance is not a guarantee of future results. Index is not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Commodities returns represent the return of the Bloomberg Commodity Total Return Index. Individual commodities are sub-index values of the Bloomberg Commodity Total Return Index. Data provided by Bloomberg.

Morgan H Smith Jr. is an investment advisor with Constitution Wealth. Constitution Wealth is a registered investment adviser in Wyoming. Constitution Wealth is registered with the Securities and Exchange Commission (SEC). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the commission. Constitution Wealth only transacts business in states in which the firm is properly registered or is excluded or exempted from registration. A copy of Constitution Wealth’s current written disclosure brochure filed with the SEC, which discusses among other things, Constitution Wealth’s business practices, services, and fees, is available through the SEC’s website at www.adviserinfo.sec.gov.

Please note, the information provided in this document is for informational purposes only and investors should determine for themselves whether a particular service or product is suitable for their investment needs. Please refer to the disclosure and offering documents for further information concerning specific products or services.

Any hypothetical, backtested performance has been provided for illustrative purposes only, and is not necessarily, and does not purport to be, indicative, or a guarantee, of future results or the adviser’s skill. Hypothetical, backtested performance does not represent actual performance. The results are prepared by retroactive application of a model, with the benefit of hindsight, and actual results may vary substantially. The preparation of such information is based on underlying assumptions, and does not represent the actual performance of any fund, portfolio, or investor, it is subject to risk and limitations that are not applicable to non-hypothetical performance presentations. Although advisor believes any hypothetical, backtested performance calculations described herein are based on reasonable assumptions, the use of different assumptions would produce different results. For the foregoing and other similar reasons, the comparability of hypothetical, backtested performance to the prior (or future) actual performance of a fund is limited, and prospective investors should not unduly rely on any such information in making an investment decision.

Nothing provided in this document constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation or an offer to sell (or solicitation of an offer to buy) securities in the U.S. or in any other jurisdiction.

This document may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions; changing levels of competition within certain industries and markets; changes in interest rates; changes in legislation or regulation; and other economic, competitive, governmental, regulatory, and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of Constitution Wealth or any of its affiliates or principals or any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events, or any other circumstances. All statements made herein speak only as of the date they were made.

Any indices and other financial benchmarks shown are provided for illustrative purposes only, are unmanaged, reflect reinvestment of income and dividends, and do not reflect the impact of advisory fees. Investors cannot invest directly in an index. Comparisons to indexes have limitations because indexes have volatility and other material characteristics that may differ from a particular hedge fund.

The Worst Thing An Investor With Conservative Values Can Do

A good rule of thumb in life is to never provide your adversary with additional resources they could use against you. But you may be doing just that if you are investing with the status quo investment firms.

You may not know it, but when you invest in public companies either directly by purchasing stock or indirectly through funds, you might just be giving these organizations more resources to fight against your conservative values.

You may think that your investment portfolio is not significant in the grand scheme of things but collectively across many conservative investors, the amount of self-sabotage they can inflict in terms of dollars is astounding.

For example, According to OpenSecrets.org, in the 2020 election cycle, the top 100 contributors to liberal PACs donated a total of $96.9 million. The exact breakdown of individual contributions can vary, but this data provides a rough estimate of the annual contribution amount from public U.S. companies to liberal PACs.

According to OpenSecrets.org, in 2020, businesses and other private sector interests spent a total of $3.3 billion on lobbying in the United States. This includes contributions from public U.S. companies. The exact amount contributed by each company can vary, but this figure provides a rough estimate of the annual contribution amount from public U.S. companies for lobbying purposes.

According to a study by the National Association of Corporate Directors, 86% of public companies in the United States have Corporate Social Responsibility (CSR) programs. This equates to approximately 4,000 companies, considering there are around 4,650 publicly traded companies in the U.S. However, the exact number can vary based on the specific criteria used to define CSR programs. And it doesn’t stop there.

Companies often use their profits to support liberal policies through various means. This includes:

- Political Contributions: Many companies donate money directly to political candidates, parties, or PACs that support liberal policies. This can include donations to Democratic candidates, progressive causes, or organizations that advocate for liberal policies.

- Lobbying: Companies may hire lobbyists to influence legislation in their favor or to promote liberal policies. These lobbyists can be former politicians, government officials, or other influential figures who can sway public opinion or decision-makers.

- Charitable Donations: Companies may donate money to non-profit organizations that support liberal causes, such as environmental groups, civil rights organizations, or social justice initiatives.

- Corporate Social Responsibility (CSR) Programs: Some companies implement CSR programs that focus on promoting liberal policies or addressing social issues. This can include initiatives related to diversity, inclusion, sustainability, or social justice.

- Public Relations and Marketing: Companies may use their marketing and public relations efforts to promote liberal policies or portray themselves as socially responsible entities. This can include sponsoring events, creating advertisements, or engaging in public relations campaigns that align with liberal values.

- Employee Advocacy: Companies may encourage their employees to support liberal policies through volunteer programs, employee resource groups, or other initiatives that foster a culture of activism within the organization.