Our mission at Constitution Wealth is to align your conservative values with your family wealth strategies. But of course, we don’t want to do that at the expense of sound investment principles.

This quarter’s report will be a little different. We’ll provide you with some interesting statistics and facts on the overall economy that may give you perspective as we head into 2025. In truth, we find this type of information to be very interesting and intellectually stimulating and thought it might be helpful for our readers as we begin the new year.

So, let’s have a look at some of the current economic indicators from sources that we deem reliable. Rather than publish a stack of graphs, I’ll list the economic data in a table and link to the data.

| Indicator | Description | Value | Link To Chart/Data/Description |

| 5 Year Breakeven Inflation Rate | represents a measure of expected inflation | 2.40% | Click here to see data. |

| 2024 Q4 Real GDP Growth | forecast the growth of real GDP | 1.21% | Click here to see data. |

| Consumer Price Index | price index of a basket of goods and services paid by urban consumer | rising | Click here to see data. |

| Credit Card Debt Tops $1 Trillion | In 2023, outstanding credit card balances in the United States surpassed $1 trillion for the first time. | Click here to see data. | |

| Unemployment Rate | the number of unemployed as a percentage of the labor force | 4.20% | Click here to see data. |

| Economic News Sentiment | measure of economic sentiment based on lexical analysis of economics-related news articles | positive | Click here to see data. |

| VIX Volatility Index | a popular measure of the stock market’s expectation of volatility based on S&P 500 index options. | lower vs year | Click here to see data. |

| Mortgage Rates | Freddi Mac 30 & 15 Year Fixed | rising Q4 | Click here to see data. |

The catch is, if one were not educated and wise to the academics of investing, you might be inclined to start making changes in your portfolio based on this information. The markets are forward thinking and it is very difficult to take advantage of information like this as a basis for investment decisions because as far as the market is concerned, this data, although interesting, is stale and the markets have most likely reacted to it already. Another way to say this is that all of the information you can read will have already been incorporated into the pricing of securities in the markets.

How so? Remember, the market is an effective information-processing machine. Each day, the world equity markets process billions of dollars in trades between buyers and sellers—and the real-time information they bring helps set prices. Per the graphic below, there was $633.9 BILLION worth of world equity DAILY trading volume in 2023. I think you’d have to be somewhat delusional to think that you could outsmart that amount of sellers and buyers consistently over time.

Exhibit 1: In USD. Source: Dimensional, using data from Bloomberg LP. Includes primary and secondary exchange trading volume globally for equities. Funds are excluded. Daily averages were computed by calculating the trading volume of each stock daily as the closing price multiplied by shares traded that day. All such trading volume is summed up and divided by 252 as an approximate number of annual trading days.

The moral of this article is this: don’t try to make predictions on what will happen with the markets in 2025 based on current data and indicators. Rather, construct your strategic investment strategy such that it is based on your personal situation and has historically been shown to be resilient over time through unpredicted cycles despite the news and data. And of course – Happy New Year. I hope it is a happy, healthy, and wealthy 2025 for you and your family.

Market Review: 2024 Q4

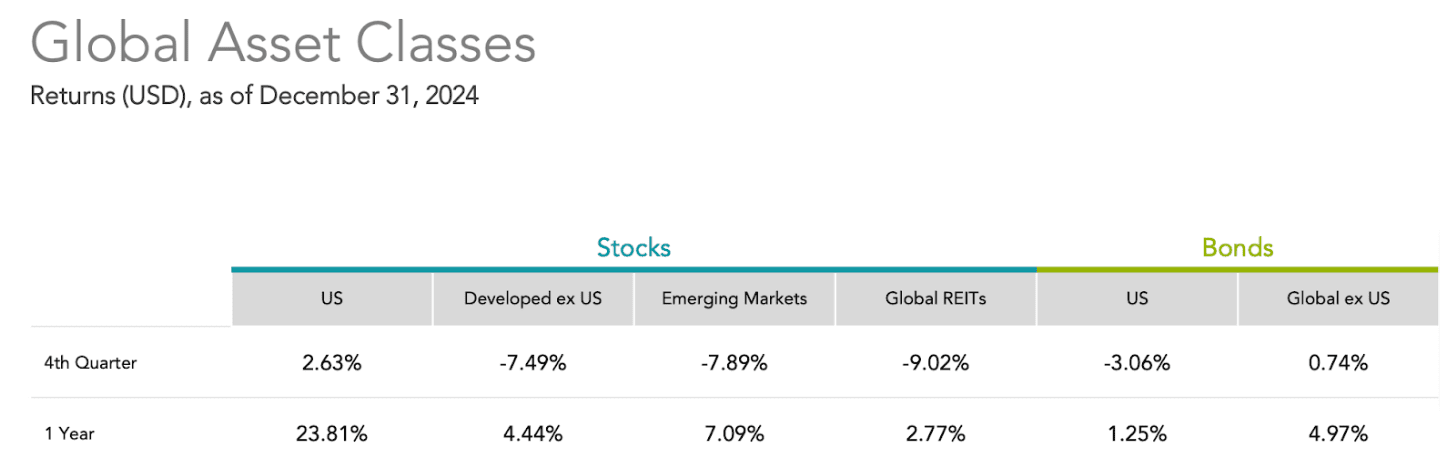

Past performance is no guarantee of future results. Market segment (index representation) as follows: US Stock Market (Russell 3000 Index), Developed ex US Stocks (MSCI World ex USA IMI Index [net div.]), Emerging Markets (MSCI Emerging Markets IMI Index [net div.]), Global REITs (S&P Global REIT Index [net div.]), US Bond Market (Bloomberg US Aggregate Bond Index), and Global Bond Market ex US (Bloomberg Global Aggregate ex-USD Bond Index [hedged to USD]). S&P data © 2025 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2025, all rights reserved. Bloomberg data provided by Bloomberg. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio.

The fourth quarter saw Developed ex US, Emerging Markets, and Global REIT’s pull back by -7.49%, -7.89%, and -9.02% respectively although these markets did provide positive returns for the year. Another way to say this is that the U.S. market was the only market listed to provide a positive return for Q4 albeit a modest 2.63%.

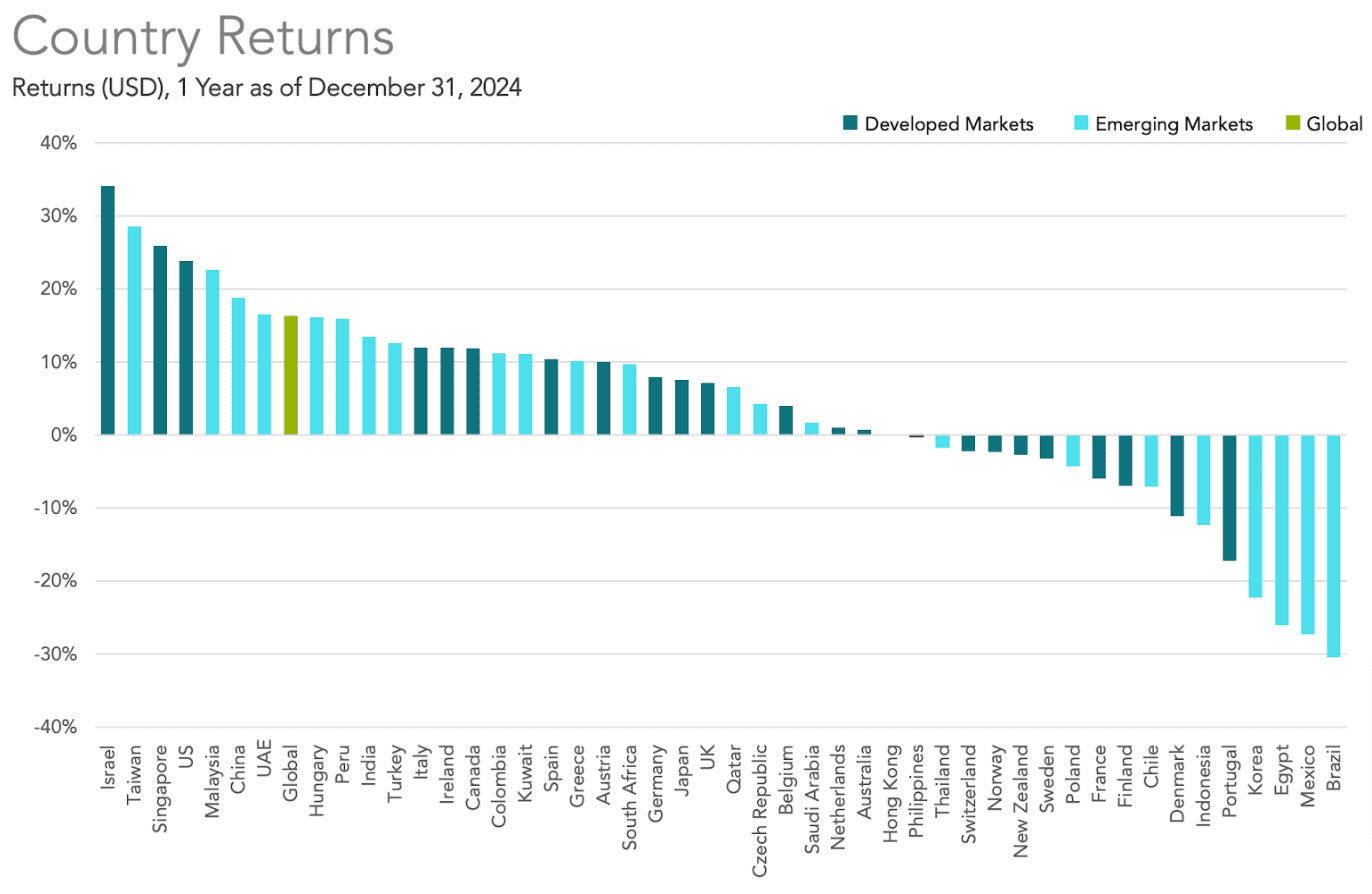

Past performance is no guarantee of future results. Country returns are the country component indices of the MSCI All Country World IMI Index for all countries except the United States, where the Russell 3000 Index is used instead. Global is the return of the MSCI All Country World IMI Index. MSCI index returns are net dividend. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. MSCI data © MSCI 2025, all rights reserved

For the year, there were more countries whose markets had positive returns than negative. Interestingly the U.S. was not the best country market with Israel being the highest with Brazil being the lowest. This is yet another indicator that global diversification can be a good thing over time.

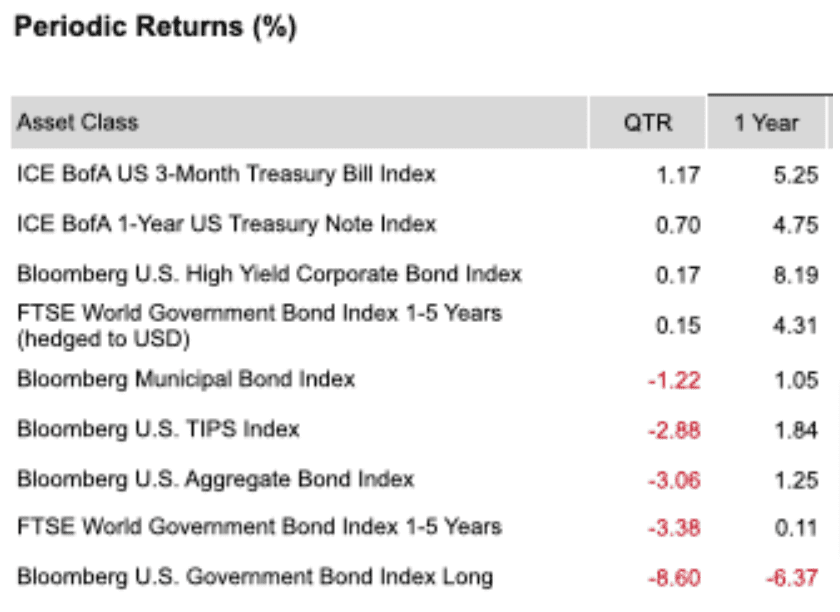

Within the US Treasury market, interest rates generally increased during the quarter.

On the short end of the yield curve, the 1-Month US Treasury Bill yield decreased 53 basis points (bps) to 4.40%, while the 1-Year US Treasury Bill yield increased 18 bps to 4.16%. The yield on the 2-Year US Treasury Note increased 59 bps to 4.25%.

In terms of total returns, short-term US treasury bonds returned -0.83% while intermediate-term US treasury bonds returned -1.70%. Short-term corporate bonds returned -0.40% and intermediate-term corporate bonds returned -1.40%.1

1. Bloomberg US Treasury and US Corporate Bond Indices.

2. Bloomberg Municipal Bond Index.

One basis point (bps) equals 0.01%. Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Yield curve data from Federal Reserve. State and local bonds and the Yield to Worst are from the S&P National AMT-Free Municipal Bond Index. AAA-AA Corporates represent the ICE BofA US Corporates, AA-AAA rated. A-BBB Corporates represent the ICE BofA Corporates, BBB-A rated. Bloomberg data provided by Bloomberg. US long-term bonds, bills, inflation, and fixed income factor data © Stocks, Bonds, Bills, and Inflation (SBBI) Yearbook™, Ibbotson Associates, Chicago (annually updated work by Roger G. Ibbotson and Rex A. Sinquefield). FTSE fixed income indices © 2025 FTSE Fixed Income LLC, all rights reserved. ICE BofA index data © 2025 ICE Data Indices, LLC. S&P data © 2025 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Bloomberg data provided by Bloomberg.

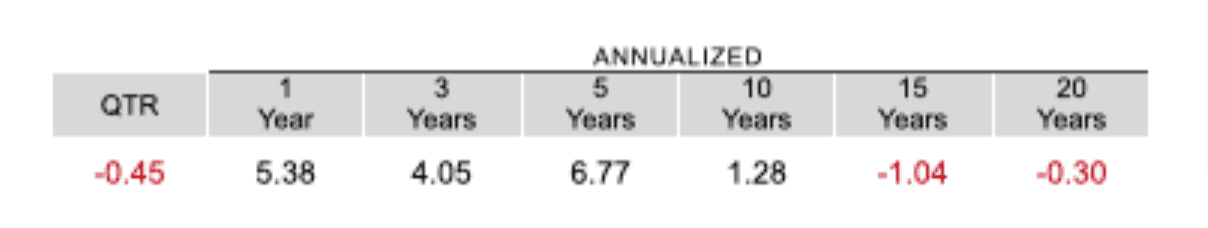

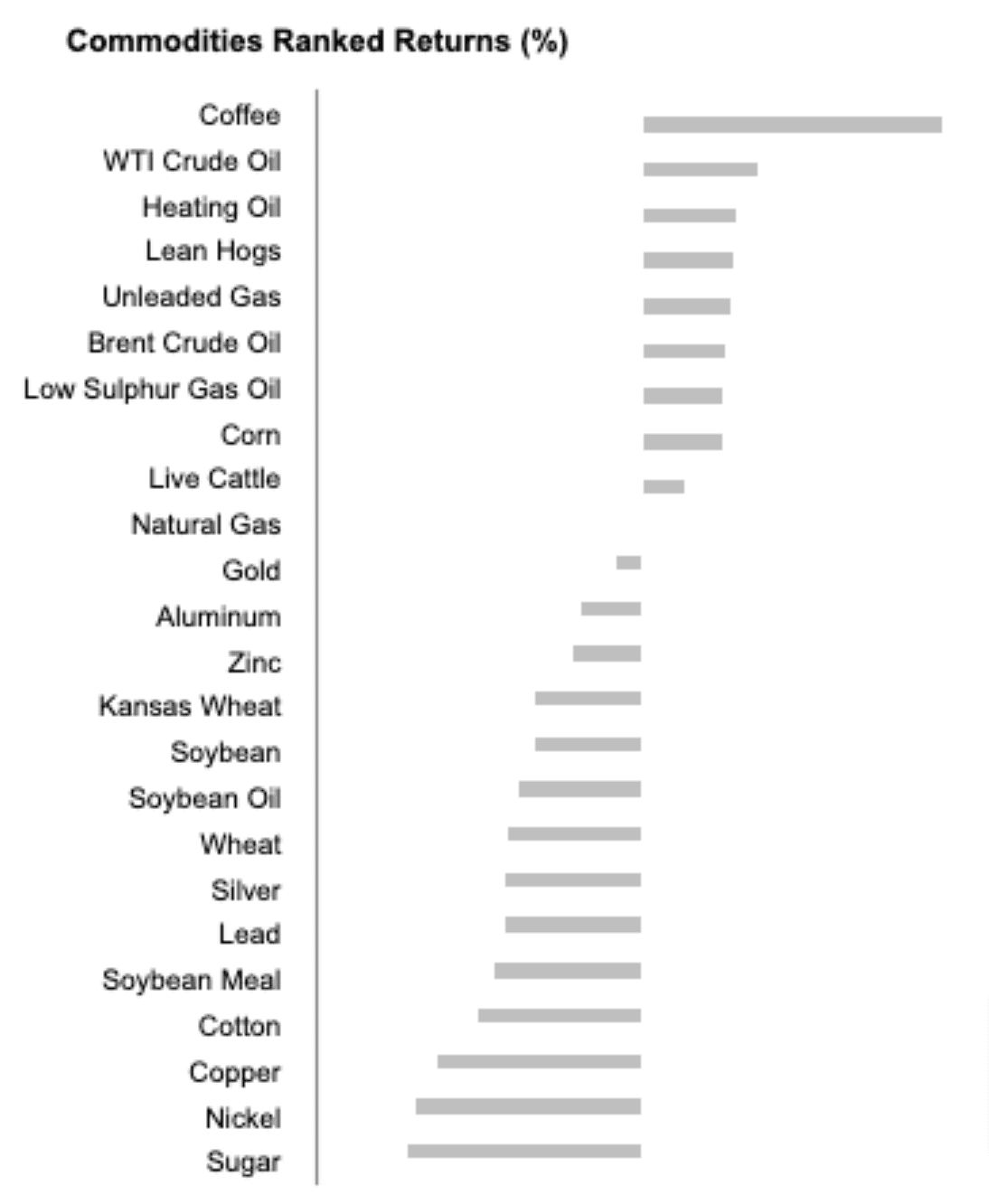

A final note on commodities and gold. The Bloomberg Commodity Total Return Index returned -0.45% for the fourth quarter of 2024. Sugar and Nickel were the worst performers, returning -14.29% and -13.81% during the quarter, respectively. Coffee and WTI Crude Oil were the best performers, returning +18.51% and +7.10% during the quarter, respectively with gold being slightly negative for the quarter

Past performance is not a guarantee of future results. Index is not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Commodities returns represent the return of the Bloomberg Commodity Total Return Index. Individual commodities are sub-index values of the Bloomberg Commodity Total Return Index. Data provided by Bloomberg.

Morgan H Smith Jr. is an investment advisor with Constitution Wealth. Constitution Wealth is a registered investment adviser in Wyoming. Constitution Wealth is registered with the Securities and Exchange Commission (SEC). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the commission. Constitution Wealth only transacts business in states in which the firm is properly registered or is excluded or exempted from registration. A copy of Constitution Wealth’s current written disclosure brochure filed with the SEC, which discusses among other things, Constitution Wealth’s business practices, services, and fees, is available through the SEC’s website at www.adviserinfo.sec.gov.

Please note, the information provided in this document is for informational purposes only and investors should determine for themselves whether a particular service or product is suitable for their investment needs. Please refer to the disclosure and offering documents for further information concerning specific products or services.

Any hypothetical, backtested performance has been provided for illustrative purposes only, and is not necessarily, and does not purport to be, indicative, or a guarantee, of future results or the adviser’s skill. Hypothetical, backtested performance does not represent actual performance. The results are prepared by retroactive application of a model, with the benefit of hindsight, and actual results may vary substantially. The preparation of such information is based on underlying assumptions, and does not represent the actual performance of any fund, portfolio, or investor, it is subject to risk and limitations that are not applicable to non-hypothetical performance presentations. Although advisor believes any hypothetical, backtested performance calculations described herein are based on reasonable assumptions, the use of different assumptions would produce different results. For the foregoing and other similar reasons, the comparability of hypothetical, backtested performance to the prior (or future) actual performance of a fund is limited, and prospective investors should not unduly rely on any such information in making an investment decision.

Nothing provided in this document constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation or an offer to sell (or solicitation of an offer to buy) securities in the U.S. or in any other jurisdiction.

This document may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions; changing levels of competition within certain industries and markets; changes in interest rates; changes in legislation or regulation; and other economic, competitive, governmental, regulatory, and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of Constitution Wealth or any of its affiliates or principals or any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events, or any other circumstances. All statements made herein speak only as of the date they were made.

Any indices and other financial benchmarks shown are provided for illustrative purposes only, are unmanaged, reflect reinvestment of income and dividends, and do not reflect the impact of advisory fees. Investors cannot invest directly in an index. Comparisons to indexes have limitations because indexes have volatility and other material characteristics that may differ from a particular hedge fund.