CONSTITUTION WEALTH FAQ’S

While we do have offices around the country, we primarily utilize virtual meetings. We’ve found that this helps our clients use their valuable time most effectively. If you would like to meet your advisor in person, we will do our best.

No. Our clients can best be described as “patriots”. We have no religious litmus test. Keep in mind however that we believe the nation was founded by Christians and that our rights and values do come from God and the bible. As long as you are OK with that, you will be happy as a conservative client at Constitution Wealth.

If you are not a conservative, the investment choices we recommend may not meet your

specific needs.

Approximately three years. Our founders and partners have been giving financial advice for over 75 years combined. The idea to focus on the needs of conservatives required a new business entity, but we’re not new to this. We are accomplished, credentialed professionals.

No, your money will be custodied at a well-known third-party custodian for your, and our, safety.

No. We can only improve the chances that the companies you invest in will exhibit good behavior.

We ask you about your values. Are there certain aspects of corporate behavior that are hot-button issues for you? For most of us, there are. We then build a strategy around your values AND your investment objectives.

Constitution Wealth clients love traditional American values like freedom and liberty. They believe that God, family, community, and country are of primary importance in life. Ideally, our clients are married with children or are planning to do so soon.

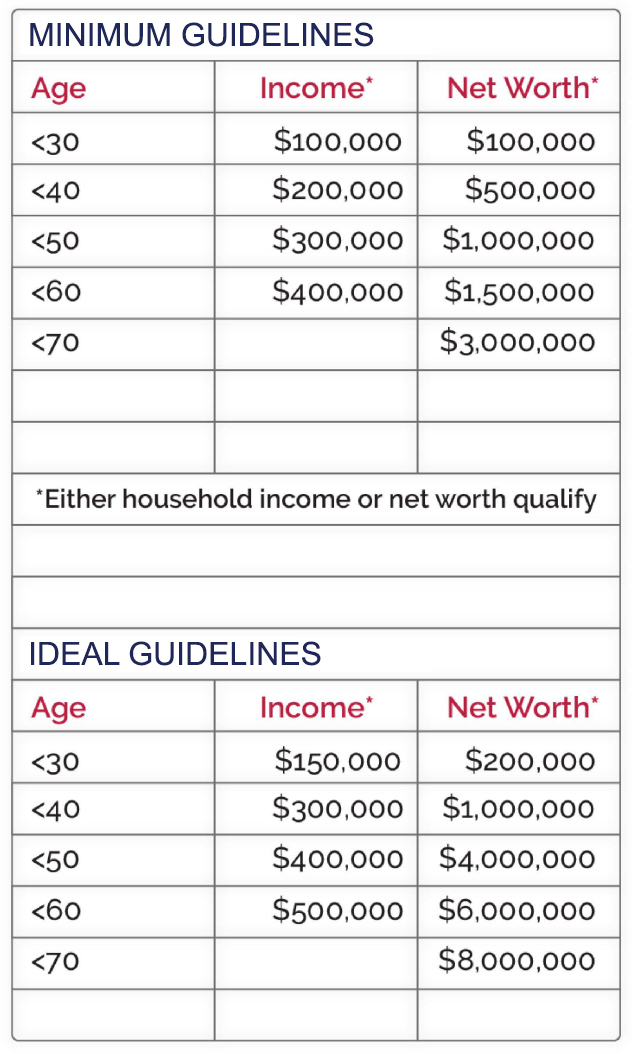

They are also driven, successful business leaders who are determined to be top in their field. Our ideal client is already successful relative to their peers and he will be successful in the future. What Constitution Wealth hopes to do is to optimize financial and life outcomes and help clients avoid disasters associated with death, disability, and asset forfeiture. Here are some basic age-adjusted metrics to help you decide if our services are likely to help you.

Gold is all the risk of stocks with the potential return of bonds. Many people have considered Gold a store of value and a safe haven asset for many years, but is investing in gold with a majority of your money a wise decision? In the blog post linked below, we discuss why a gold-dominated portfolio is un-diversified, the long-term returns of gold compared to other investments, the current amount owned in a stock portfolio, and why, in our opinion, gold falls into the category of speculation rather than investment.