Constitution Wealth 2025 Q3 Review: Prepare for the Impending Market Collapse

You clicked on this one pretty fast, didn’t you? This is a perfect example of ‘clickbait,’ and it’s a good example of how nefarious actors trying to sell you stuff might cause you to take action with your investments that might hurt you in the long run. It could also have been the opposite, something like “Don’t Miss Out On A Once In A Generation Investment : [Fill in the blank: Bitcoin, A.I., Gold, Quantum Computing, TikTok Marketing]”. As such, I’d like to talk about how biases could hurt your chances of financial success.

If you spend any time on the internet doing what you believe is research, you likely will have been inundated with articles of the same ilk. Unfortunately, many of the articles you read will come from sources with conflicts of interest. They are incentivized, often for money, likes, and clicks, and most likely to incite fear or greed in an effort to make you second-guess your current strategies. In the end, they are often trying to prey on your emotions to sell something. The key is finding impartial, unbiased sources that look to academics for long-term investment solutions.

Behavioral science is an important area of study in finance. Behavioral factors and our emotional state play a very significant role in wealth building and wealth preservation. These factors often become more significant as we age and during personal, political, social, or market turmoil, which, of course, are all constant factors that appear during the course of our lives.

I think we all understand that people have biases, but we often, to our own detriment, rationalize that our own biases are well-managed and our decisions are sound. I would posit that one of my most important duties as a financial advisor at WorthPointe is to manage and strengthen rational decision-making and guide you through times that might otherwise tempt you to make decisions today that would hurt you in the long run. This is done, amongst other ways, by knowing you as a person and investor, intimate knowledge of investment structures and historical market cycles, as well as years of experience.

We, as advisors, know that biases are potentially in play when we hear the following statement from an investor. “I want to [sell/buy] this [security/sector] because of [some reason]. Call it a trigger for us to roll up our sleeves and ramp up the education process. In truth, there may be valid reasons for the sentiment, and we are here to listen and discuss these things with our clients; however, from my experience, it’s often driven by personal biases, often created by headline news, or even valid intellectual curiosity that might make you question or validate your financial path forward.

Here’s a short paper worth reading by Russell Investments that summarizes some of the issues I’m discussing: “How To Avoid Common Behavioral Biases”.

One of the biases identified in the paper is stated as follows:

“Home Bias & Country Specific Risk Humans tend to prefer what is familiar or well-known. One of the common results of this in portfolios around the world is the home country bias: the tendency to allocate a greater portion of one’s portfolio to assets domiciled in your home country. The home country bias limits the amount of diversification in investor portfolios and exposes investors to significant country-specific risk. “

Overcoming this bias really sets the starting point for our investment philosophy and how we build portfolios for long-term opportunities for success and resiliency.

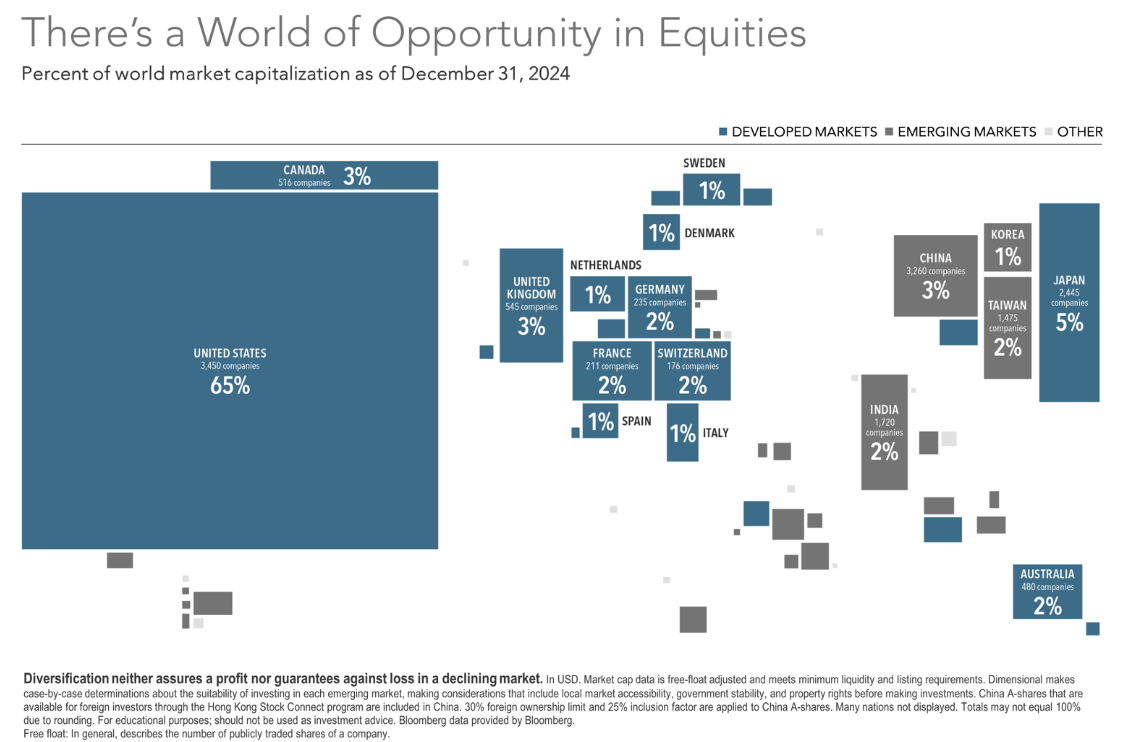

As a basis for resilient portfolio construction, we start by looking at the market capitalization(cap) of countries around the world. Think of market cap as adding up the value of all listed stocks in a country; this gets you the country’s total market cap. Here’s a good visual of the market caps of countries from around the world.

Many investors are 100% or mostly invested in U.S. securities, but as can be seen from the chart above, the U.S. “only” represented 65% of the global market cap as of 12/31/2024. Drilling further down into each country, you will have market weights to large companies, small companies, profitable companies, sectors, etc., so the analysis gets more complex than just country market cap. However, for a global allocation at the country level, having about 65% of your equity exposure in the U.S., and the rest proportionally invested in international and emerging markets, is a good place to start for most investors. There are many reasons to do this beyond the scope of this report, but the point is that we are facilitating strategies that help immunize against biases both today and into the future.

In summary, you want to build a portfolio resilient to future events from the start, rather than letting headlines drive any changes. That’s not to say that changes in investment strategy should not be made based on changes to your personal situation or investment due diligence. Excellent portfolio construction from the start helps breed confidence and peace of mind through headline and real-life volatility prior to the events occurring, and if done within the framework of a good financial plan, can help satisfy a higher probability of success.

Market Review: 2025 Q3

KEY TAKEAWAYS

- The broad market S&P 500 and tech-heavy Nasdaq both hit record highs in September. (Source: Morningstar)

- The Fed lowered interest rates by a quarter point, for the first time since December 2024. (Source: federalreserve.gov)

- Small-cap stocks outpaced large caps in the US and globally, but value lagged growth.

Stocks extended gains in the third quarter, with major indices in the US hitting new records, including the S&P 500 and Nasdaq, as trade negotiations proceeded and the US Federal Reserve cut interest rates.1 The rate reduction in September was the first in nearly a year. Stocks’ rise was a continuation of the gains that had preceded for much of 2025, aside from the market’s sharp fall and quick recovery during a volatile April. Developed international equities lagged the US in the third quarter, but emerging markets were higher, and both remained ahead of the US for the year. In the bond market, US Treasuries were slightly higher, with the benchmark 10-year yield just above 4%.2

The Fed cut the federal funds rate by 25 basis points to a range between 4%–4.25% in September, the first move lower since December.3 In August, the US core consumer price index, which excludes more-volatile food and energy items, was shown rising 3.1% from a year ago.4 That’s above the Fed’s target rate of 2%. The Fed’s September rate cut came with officials referencing their two goals of keeping inflation and unemployment in check but noting that “downside risks to employment have risen.”

Trade negotiations between the United States and other countries continued during the quarter, with the US administration reaching a number of trade deals, including with the European Union, the United Kingdom, and Japan. But questions remained about levies that may be imposed on goods from China, India, Mexico, and elsewhere.5 In the coming months, the US Supreme Court is also set to weigh in on a case to determine the validity of global tariffs that have been imposed by the current administration.6

Against this backdrop, US stocks advanced, with the S&P 500 Index rising 7.7% and the tech-heavy Nasdaq adding 11.3% as of September 19. Shares of NVIDIA stood out as the firm became the first public company to reach a market capitalization of $4 trillion, making it nearly 8% of the S&P 500 Index.7 Global equities, as measured by the MSCI All Country World Index, rose 7.2% as of September 19, trailing the US. Developed international stocks outside the US added 4.8%, as measured by the MSCI World ex USA Index. The MSCI Emerging Markets Index gained 10.2%.8

Small-cap stocks beat large caps in the US and globally through September 19, with US small caps having some of their best returns in recent years.9 Value stocks, or those with low relative prices, did not rise as much as growth stocks in the US and globally. High profitability stocks were outpaced by low profitability stocks in global developed markets as of September 19, while the opposite was true in emerging markets, with high profitability stocks beating their low profitability counterparts.10

In the bond market, US Treasuries were 1.5% higher, sending the yield on the benchmark 10-year Treasury down to 4.14%.11 The broader bond market also gained, with the Bloomberg US Aggregate Bond Index up 2.1% and the Bloomberg Global Aggregate Bond Index (hedged to USD)—a broad benchmark of sovereign and corporate debt—adding 1.2% as of September 19.12

Footnotes

- S&P data © 2025 S&P Dow Jones Indices LLC, a division of S&P Global. The S&P is a market capitalization-weighted index of 500 widely held stocks often used as a proxy for the stock market. Standard & Poor’s chooses the member companies for the S&P based on market size, liquidity, and industry group representation. Included are the common stocks of industrial, financial, utility, and transportation companies. All rights reserved. Data as of September 19, 2025. Indices are not available for direct investment. Connor Smith, “Stocks Hit New Records in a Rate Cut Rally,” Barron’s, September 18, 2025.

- Returns are based on the Bloomberg US Treasury Bond Index as of September 19, 2025. This is a family of indices that measure the performance of different segments of the U.S. Treasury market, including the total U.S. Treasury market (excluding bills) and specific maturity ranges like the 1-3 Year and 7-10 Year segments. These indices track US dollar-denominated, fixed-rate, nominal debt issued by the U.S. Treasury and are widely used as benchmarks for fixed-income investments and financial products like ETFs. Bloomberg data is provided by Bloomberg Finance LP. Source for US Treasuries: US Department of the Treasury.

- The federal-funds rate is the overnight interest rate at which one depository institution (like a bank) lends to another institution some of its funds that are held at the Federal Reserve. Source: “Federal Reserve Issues FOMC Statement,” US Federal Reserve, September 17, 2025; Colby Smith, “Fed Cuts Rates for First Time this Year,” The New York Times, September 17, 2025.

- Inflation data is as defined by the consumer price index from the US Bureau of Labor Statistics; the core CPI is an aggregate of prices paid by urban consumers for a typical basket of goods, excluding food and energy; Colby Smith, “Rise in US Inflation Is Likely to Keep Fed Cautious on Pace of Rate Cuts,” The New York Times, September 11, 2025; Colby Smith, “Fed Cuts Rates for First Time this Year,” The New York Times, September 17, 2025.

- Chao Deng and Drew An-Pham, “Trump’s Tariffs: Where He Started, What He Threatened, Where He Ended Up,” The Wall Street Journal, August 27, 2025.

- Louise Radnofsky, “Supreme Court Agrees to Fast-Track Trump’s Tariff Appeal,” The Wall Street Journal, September 9, 2025.

- Jeff Sommer, “How Long Can This Uncanny Stock Market Prosper?” The New York Times, August 22, 2025. This information should not be considered a recommendation to buy or sell a particular security. Named securities may be held in accounts managed by Dimensional. It should not be assumed that an investment in the securities identified was or would be profitable.

- MSCI data © MSCI 2025, all rights reserved. Data as of September 19, 2025. Indices are not available for direct investment.

- Jacob Sonenshine, “Small-Cap Stocks Are on a Roll. What Could Push Them Higher.” Barron’s, September 10, 2025

- The MSCI All Country World Value Index rose 5.6%, while the MSCI All Country World Growth Index rose 8.7% as of September 19, 2025; the MSCI All Country World Small Cap Index advanced 8.5%, while the larger-cap MSCI All Country World Index rose 7.2% as of September 19, 2025; the Russell 2000 Index of US small cap stocks returned 12.9% through September 19, 2025; Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes; the Fama/French Developed High Profitability Index rose 7.4% versus 9.1% for its low profitability counterpart as of September 19, 2025; the Fama/French Emerging Markets High Profitability Index rose 11.8%, and its low profitability counterpart rose 8.7% as of September 19, 2025. See “Index Descriptions” for descriptions of the Fama/French index data. Past performance is no guarantee of future results. Actual returns may be lower. The Fama/French indices represent academic concepts that may be used in portfolio construction and are not available for direct investment or for use as a benchmark. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment.

- “Daily Treasury Par Yield Curve Rates,” US Department of the Treasury. Data as of September 19, 2025.

- Bloomberg data provided by Bloomberg Finance LP.

Morgan H Smith Jr. is an investment advisor with Constitution Wealth. Constitution Wealth is a registered investment adviser in Wyoming. Constitution Wealth is registered with the Securities and Exchange Commission (SEC). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the commission. Constitution Wealth only transacts business in states in which the firm is properly registered or is excluded or exempted from registration. A copy of Constitution Wealth’s current written disclosure brochure filed with the SEC, which discusses among other things, Constitution Wealth’s business practices, services, and fees, is available through the SEC’s website at www.adviserinfo.sec.gov.

Please note, the information provided in this document is for informational purposes only and investors should determine for themselves whether a particular service or product is suitable for their investment needs. Please refer to the disclosure and offering documents for further information concerning specific products or services.

Any hypothetical, backtested performance has been provided for illustrative purposes only, and is not necessarily, and does not purport to be, indicative, or a guarantee, of future results or the adviser’s skill. Hypothetical, backtested performance does not represent actual performance. The results are prepared by retroactive application of a model, with the benefit of hindsight, and actual results may vary substantially. The preparation of such information is based on underlying assumptions, and does not represent the actual performance of any fund, portfolio, or investor, it is subject to risk and limitations that are not applicable to non-hypothetical performance presentations. Although advisor believes any hypothetical, backtested performance calculations described herein are based on reasonable assumptions, the use of different assumptions would produce different results. For the foregoing and other similar reasons, the comparability of hypothetical, backtested performance to the prior (or future) actual performance of a fund is limited, and prospective investors should not unduly rely on any such information in making an investment decision.

Nothing provided in this document constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation or an offer to sell (or solicitation of an offer to buy) securities in the U.S. or in any other jurisdiction.

This document may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions; changing levels of competition within certain industries and markets; changes in interest rates; changes in legislation or regulation; and other economic, competitive, governmental, regulatory, and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of Constitution Wealth or any of its affiliates or principals or any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events, or any other circumstances. All statements made herein speak only as of the date they were made.

Any indices and other financial benchmarks shown are provided for illustrative purposes only, are unmanaged, reflect reinvestment of income and dividends, and do not reflect the impact of advisory fees. Investors cannot invest directly in an index. Comparisons to indexes have limitations because indexes have volatility and other material characteristics that may differ from a particular hedge fund.

A Billion With a Purpose: Constitution Wealth and Its Affiliate Mark a Major Milestone

From humble beginnings rooted in America’s core values, the story of Constitution Wealth LLC is one of steadfast commitment, strategic growth, and a shared vision for patriotic financial stewardship. Established in Jackson, Wyoming, as an independent registered investment adviser, the firm was founded to address a critical need: providing financial guidance that aligns with conservative principles, allowing clients to invest in ways that support traditional family values, religious freedoms, gun rights, and limited government.

With headquarters initially in Jackson, WY, Constitution Wealth began as a small operation focused on personalized portfolio management and financial planning for individuals and small businesses.

Partners like Brooks Morgan and Matt Addington, along with advisors such as Morgan H. Smith Jr. and Joshua Young, CFA, CAIA, brought a blend of expertise in value-aligned investing, emphasizing fiduciary duty and client-centric strategies without ties to larger broker-dealers or external parents.

Serving a dedicated client base of high-net-worth patriots, veterans, faith-based communities, and conservative business owners frustrated by mainstream finance’s embrace of “woke” agendas.

The firm’s approach was simple yet powerful: using discretionary portfolio management to build diversified holdings in equities, ETFs, municipal securities, and other assets that reflected clients’ beliefs, while offering financial planning to secure legacies rooted in integrity.

They charged asset-based and net-worth-based fees, elevating transparency as a fee-only adviser, and provided tools like daily account monitoring and restrictions on investments that clashed with core values. This resonated deeply, attracting clients primarily via conservative talk radio such as the Glenn Beck Show.

As investors sought refuge from volatile markets and ideologically misaligned corporations, Constitution Wealth capitalized on demand for principled investing.

They expanded services to include trust and estate planning (via their unique wealth management process), partnering with custodians for secure asset handling while maintaining independence—no commissions, no brokerage affiliations, just pure politically conservative fiduciary advice.

Growth surged, fueled by referrals from conservative radio. By early 2025, inflows from new clients—drawn to the firm’s opposition to controversial causes and focus on America-first strategies—pushed assets higher. Strategic enhancements, such as digital tools for portfolio customization, further broadened appeal.

In mid-2025, as bullish trends favored sectors aligned with traditional values, Constitution Wealth and its affiliate parent, WorthPointe, crossed the threshold: 1 billion in assets under management.

This achievement wasn’t merely numerical; it validated that ethical, value-driven investing could deliver competitive returns while upholding freedom and family.

Today, Constitution Wealth continues to empower clients, proving independent firms can thrive by staying true to patriotic principles.

Constitution Wealth 2025 Q2 Review: Healthy Finances & Healthy Life

At Constitution Wealth, we have a dedicated team of financial advisors who are focused on aligning our clients’ conservative values with their financial lives. They are a tight-knit group with shared conservative, family, and faith-based values and meet weekly to support each other. They share their expertise for best practices, talk about life, and how to be successful not only financially but spiritually and physically as well. This is just one advisor’s perspective on healthy investing and living, and will hopefully provide you with insights into some of the topics they discuss on a weekly basis. Truth be told, they are all focused not only on their clients’ financial health but their own financial and physical health as well. Simply stated, they are trying to lead by example.

I was speaking with a prospective client the other day. He is a physician, had been through a divorce years back, and is doing well, but admittedly “playing catchup” financially while working and maintaining his household with his new family. He has been trying to manage his investments and financial affairs on his own, but just didn’t know how he was tracking towards retirement, which he’d like to do in about 10 years. His question for me was, “Is now the right time to be working with a financial advisor?”

At that moment, I just thought about his role as a doctor and thought about life and health. If you want to have a vibrant life in the future with the prospects of fulfilling your dreams, whether that means travelling, exploring, spending quality time with family, or all of the above, not living healthy today and waiting to change your lifestyle choices years down the road is not a good way of working towards your goals.

As it turns out, long-term physical health requires a disciplined daily lifestyle approach, but it can be enjoyable at the same time. Waiting for years until it feels like the right time or a serious medical condition arises is not the right approach. People who are most successful in achieving an active and fulfilling life rarely do it on their own. They utilize coaches, doctors, trainers, and activities to keep them on track and teach them things they otherwise might not have known. Most importantly, these relationships can keep us on track when we are feeling not so motivated or so busy that it becomes difficult to stay on course. Some of us might be very self-disciplined and can accomplish much with our own motivation, but everyone can get off track. That’s when a doctor, coach, or advisor really earns their keep.

All of these ideas pertain to your financial health and partnering with a financial advisor as well, and this is what I communicated to this doctor. He chuckled and agreed. He’s an expert, how could he not? While there’s no perfect time, the right time is when you have a solid plan, sufficient resources, and a strong belief in your idea. Ultimately, the “right time” is often a decision based on your own motivations and willingness to take action.

If you look around, I think you’ll find that most successful/wealthy families have financial advisors and a team of folks they rely on to outsource activities they don’t have expertise in. Even if they have expertise in finance, they’ll most likely admit that they don’t know what they don’t know, don’t have the time and resources to focus on the never-ending challenges and changes in wealth management, and they have more important things they want to focus on; the experiences of living. And, very importantly, many spouses/partners that are primarily handling investments for their families are rightly concerned about things falling apart should they pass away. And as we know, life is short and things like children growing up and retirement sneak up quickly. If we recognize that, we’ll understand the need to plan early.

With a nod to my conversation with the doctor, rather than give you some tips on financial health, I’ll give you some of my tips for physical health. Consider this a high-level summary of some of the ways I try to maintain my physical health. Of course, I’m not a doctor, and this is not medical advice, so please consult your doctor for anything health-related.

- Night to mid-day fast: No food after 8-9pm until 12 noon the next day. This is a good rule of thumb I think unless you are getting up in the morning and working out, you might want to have some protein after the workout but not absolutely necessary.

- Morning Routine In Order

- 1) Hydrate: Drink a glass of water as soon as you wake up. I mix collagen peptides and super greens powder with probiotics in my water.

- 2) Hot chocolate with powdered milk and organic unsweetened cacao

- 3) Ginger tea – I’m a tea guy, not a coffee achiever so this works well for me. I brew some black tea with minced ginger and a healthy dose of milk.

- I’ll add a multi-vitamin, and depending how I’m feeling I’ll add some tumeric curcumin pills, zinc, fish oil etc.

- This routine gets me through to lunch no problem.

- Morning Routine In Order

- Physical Exercise & Weight: There is plenty of research showing that keeping the weight off and having an appropriate amount of muscle mass is very beneficial to longevity. There are scales that not only measure weight, but also measure body fat, muscle mass etc. I don’t use these too much but my son got into his own workout program and was monitoring his progress every day. Understanding there is a myriad of body types, I recommend you set targets and a program that is appropriate for your age and body type. This is my program.

- Intense physical activity: I’m a black belt in Brazilian Jiu Jitsu and train at least 3 times a week. This training involves everything physical (and mental); strength, endurance, cardio, flexibility, recovery resilience.

- Hydration – For my intense physical training when I’m sweating a lot I’ll often add hydration powder.

- Strength & Endurance for workouts: I found an immediate benefit taking Taurine about an hour prior to my workouts.

- Recovery: I need protein after hard workouts or it can take me a while to recover. Until recently I’ve taken whey protein but lately have switched to this protein shake. I like the vanilla option and it fills me up more.

- Weight Training: Training with weights and resistance to build and maintain muscle is very important especially as you get older. I only need a full body workout one to two times a week.

- Stretching: One of the most important elements of my lifestyle for staying mobile. Some prefer intense yoga but have a quick routine I do at home at least four times a week that focuses on hip and back mobility.

- Walking/Hiking: In my opinion walking and hiking are somewhat underrated. If you’re not in good enough physical condition to do more intense workouts, walking and hiking is probably all you need. Long walks are a great way to lower body fat as well.

As I mentioned earlier, I’m not a doctor and this is not medical advice so please consult your doctor for anything health related. However, I am a CERTIFIED FINANCIAL PLANNER® and experienced professional in my field so you can certainly come to me for investment and financial planning advice.

Market Review: 2025 Q2

A volatile second quarter ended with major stock indices at record levels even as the quarter began with sharp declines following the Trump administration’s announcement of global tariffs, driving the Chicago Board Options Exchange’s CBOE Volatility Index (VIX) to its highest levels since 20201. Despite trade policy uncertainty and increased geopolitical tensions as conflict between Israel and Iran dominated news, US stocks ended the quarter with the S&P 500 Index up 10.9%2. Global stock markets fared even better with the MSCI All Country World ex USA IMI Index (net div.) up 12.7%3.

The Federal Reserve continued to leave interest rates on hold citing uncertainty around the impact of tariffs on prices. The European Central Bank and Bank of England both diverged from the Fed by cutting their target rates again. Both emerging and developed non-US stock indices outperformed the US market with both the MSCI World ex USA IMI Index (net div.) and the MSCI Emerging Markets IMI Index (net div.) returning 12.7%4.

Global Asset Class Returns Chart: Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio.

Global Asset Class Returns Chart: Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio.

See disclaimers below for Market segment (index representation) below.

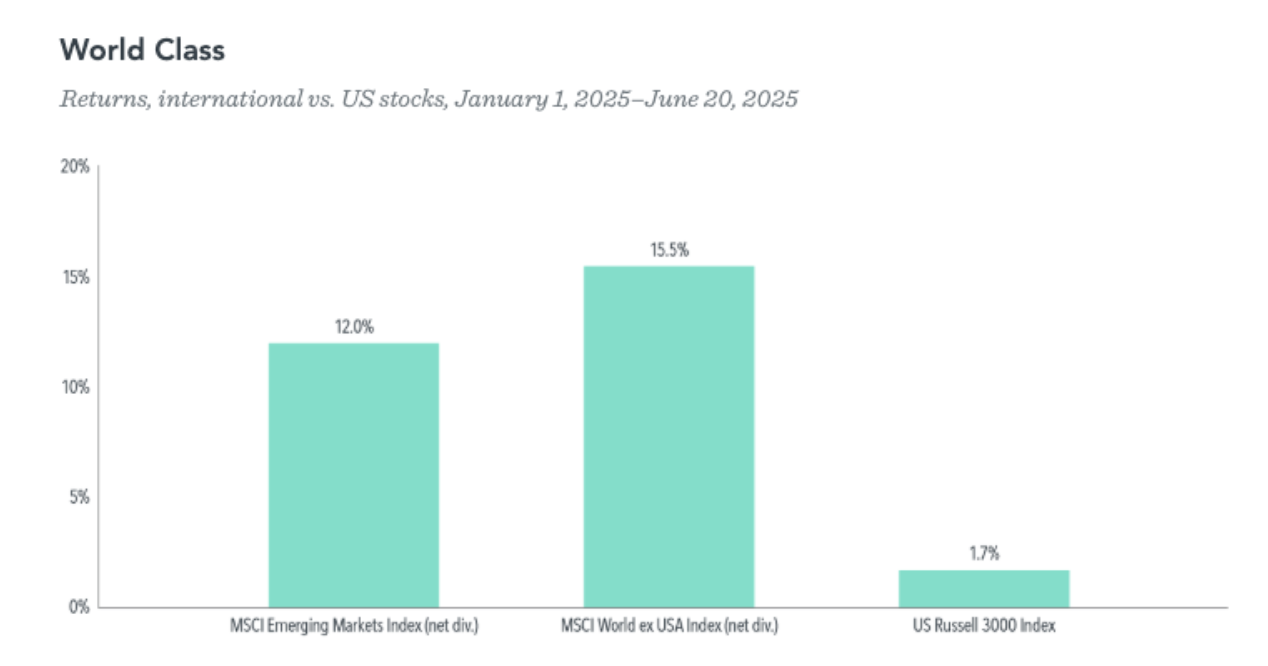

An important theme from Q1 2025 that continued through Q2 2025 was the outperformance of international vs US markets. I just want to emphasize the importance of sticking to a diversified allocation even when there are times that certain components of your portfolio are underperforming vs other indexes. Due to the very nature of diversified portfolios, this will always be the case and hopefully, as an insightful investor, you understand that it’s times like these where the benefit of discipline can reward a long term perspective. When you look at the outperformance of international markets over U.S. markets year-to-date, this concept really stands out.

World Class Chart: Past performance is not a guarantee of future results. Sources: MSCI Emerging Markets Index (net div.), MSCI World ex USA Index (net div.), Russell 3000 Index. MSCI data © MSCI 2025, all rights reserved. In USD. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.

Morgan H Smith Jr. is an investment advisor with Constitution Wealth. Constitution Wealth is a registered investment adviser in Wyoming. Constitution Wealth is registered with the Securities and Exchange Commission (SEC). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the commission. Constitution Wealth only transacts business in states in which the firm is properly registered or is excluded or exempted from registration. A copy of Constitution Wealth’s current written disclosure brochure filed with the SEC, which discusses among other things, Constitution Wealth’s business practices, services, and fees, is available through the SEC’s website at www.adviserinfo.sec.gov.

Please note, the information provided in this document is for informational purposes only and investors should determine for themselves whether a particular service or product is suitable for their investment needs. Please refer to the disclosure and offering documents for further information concerning specific products or services.

Any hypothetical, backtested performance has been provided for illustrative purposes only, and is not necessarily, and does not purport to be, indicative, or a guarantee, of future results or the adviser’s skill. Hypothetical, backtested performance does not represent actual performance. The results are prepared by retroactive application of a model, with the benefit of hindsight, and actual results may vary substantially. The preparation of such information is based on underlying assumptions, and does not represent the actual performance of any fund, portfolio, or investor, it is subject to risk and limitations that are not applicable to non-hypothetical performance presentations. Although advisor believes any hypothetical, backtested performance calculations described herein are based on reasonable assumptions, the use of different assumptions would produce different results. For the foregoing and other similar reasons, the comparability of hypothetical, backtested performance to the prior (or future) actual performance of a fund is limited, and prospective investors should not unduly rely on any such information in making an investment decision.

Nothing provided in this document constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation or an offer to sell (or solicitation of an offer to buy) securities in the U.S. or in any other jurisdiction.

This document may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions; changing levels of competition within certain industries and markets; changes in interest rates; changes in legislation or regulation; and other economic, competitive, governmental, regulatory, and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of Constitution Wealth or any of its affiliates or principals or any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events, or any other circumstances. All statements made herein speak only as of the date they were made.

Any indices and other financial benchmarks shown are provided for illustrative purposes only, are unmanaged, reflect reinvestment of income and dividends, and do not reflect the impact of advisory fees. Investors cannot invest directly in an index. Comparisons to indexes have limitations because indexes have volatility and other material characteristics that may differ from a particular hedge fund.

The Constitution Wealth Quarterly Report 2024 Q1 Review: Missing Out On A Feeling

After periods of robust stock market performance, many investors feel like they might want to reduce their risk or exposure to stocks as they foresee an inevitable downturn right around the corner. They may be right, they may be wrong, they really can’t know but as a financial advisor, these are the types of concerns I need to genuinely listen to and address either by education, planning, investment adjustments, or a combination therein. As such I’d like to lay out when and how you might want to reduce risk in your portfolio.

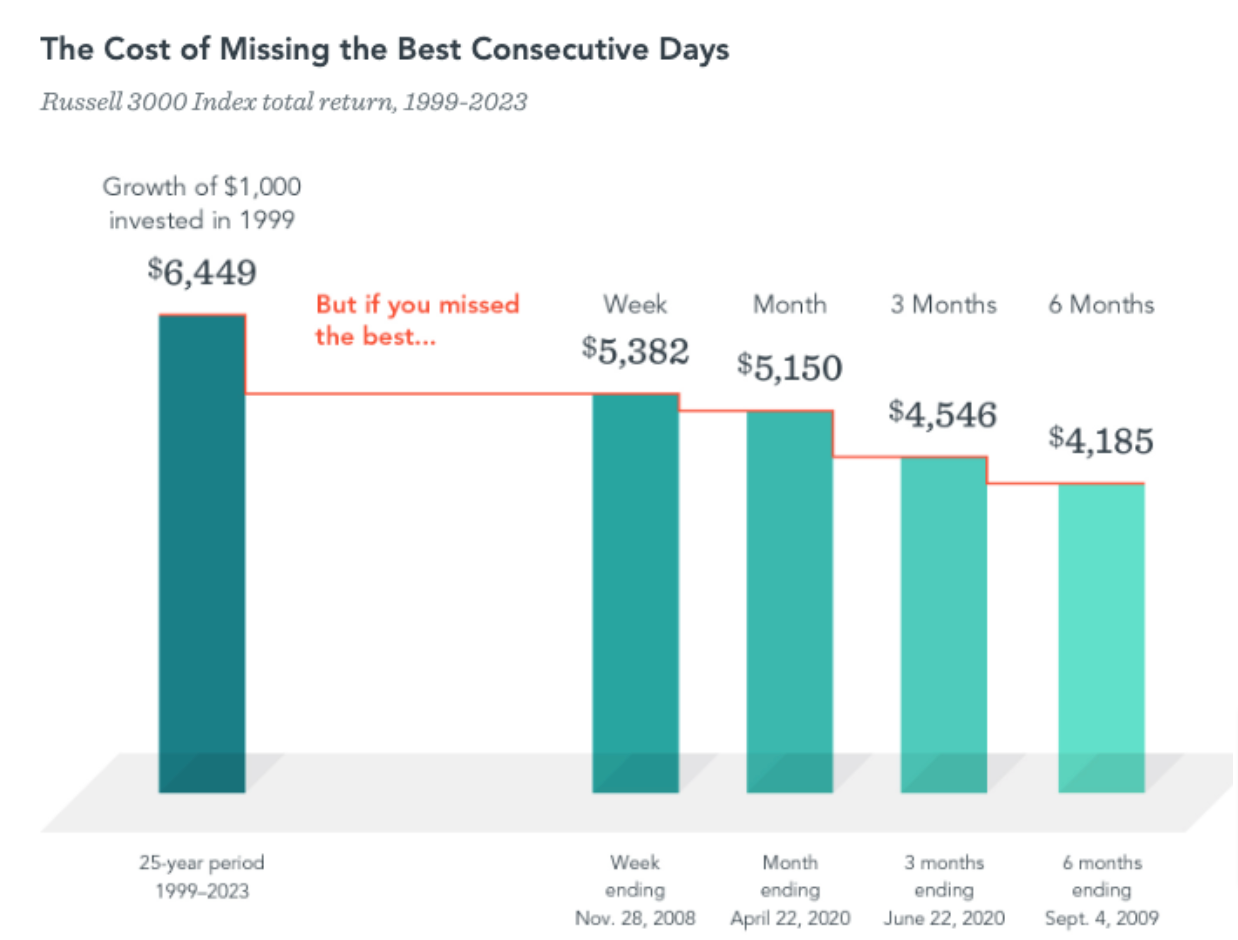

First I’d like to emphasize a reason why you should not reduce risk in your portfolio and one scenario is that your investment strategy still aligns with your long-term goals and you are fine with accepting the short-term magnitude of fluctuations of the market. Many investors have gotten out of the market because of a “feeling” which is not a way to develop or manage your financial future. Here’s why: if you miss the best periods in any given year, you can severely hinder your long-term wealth experience. These robust periods are often very short and unexpected. This next chart illustrates the potential issues with going with a feeling and the effect of missing out on robust periods.

Past performance is no guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.

For a better perspective, let’s put three zeroes at the end of each number from the chart above. $1,000,000 invested in the Russell 3000 index in 1999 turned into $6,449,000 by 2023. If you missed just the best week ending November 28, 2008, the portfolio would have been worth “only” $5,382,000; that’s a $1,067,000 reduction in value. That’s a lot of money to leave on the table. At the other end of the spectrum, if you decided to get on the sidelines in cash for a longer period (which often happens) and missed out on the best six-month period ending September 4, 2009, your portfolio would be $2,311,000 less valuable. I don’t think it’s a stretch to imagine the benefits an extra $2.3 million would have for your life and family goals.

Hopefully, I’ve been able to illustrate that reducing risk in a portfolio should not be driven by a feeling of what the market might do in the near future, so now we can move on to an effective strategy that investors can potentially utilize to reduce risk if needed- for valid reasons. There are always good reasons to manage risk in a portfolio and there may be very good reasons to reduce risk in a portfolio at a particular time such as: changes to your personal or financial goals, changes to your income needs, or an evolution and better understanding of your personal ability to accept risk.

This is a well-proven strategy with a lot of academic and real-world traction that we’ve implemented in our portfolio construction methodologies for many years. Having said that, it’s critical to understand how to build a bond portfolio that actually lowers risk and volatility. If you get it wrong, you might not see any benefits. This is because there are some bonds (and bond funds) that can have as much volatility as stocks such as bonds with low credit quality and longer durations. In summary, our philosophy on bond allocation as an overall risk-reduction component has three important characteristics that we usually allocate to:

- Higher Credit Quality

- Appropriate duration as projected by the current yield curve

- Global Diversification

For investors concerned about aligning their values with investment options, there will most likely be a need to adjust strategies slightly to deliver a higher probability that you are not investing in companies that are not aligned with your conservative values. The goal of course is to make these adjustments while maintaining the opportunity for growth and the reduction of risk as necessary.

2024 Q1 Review

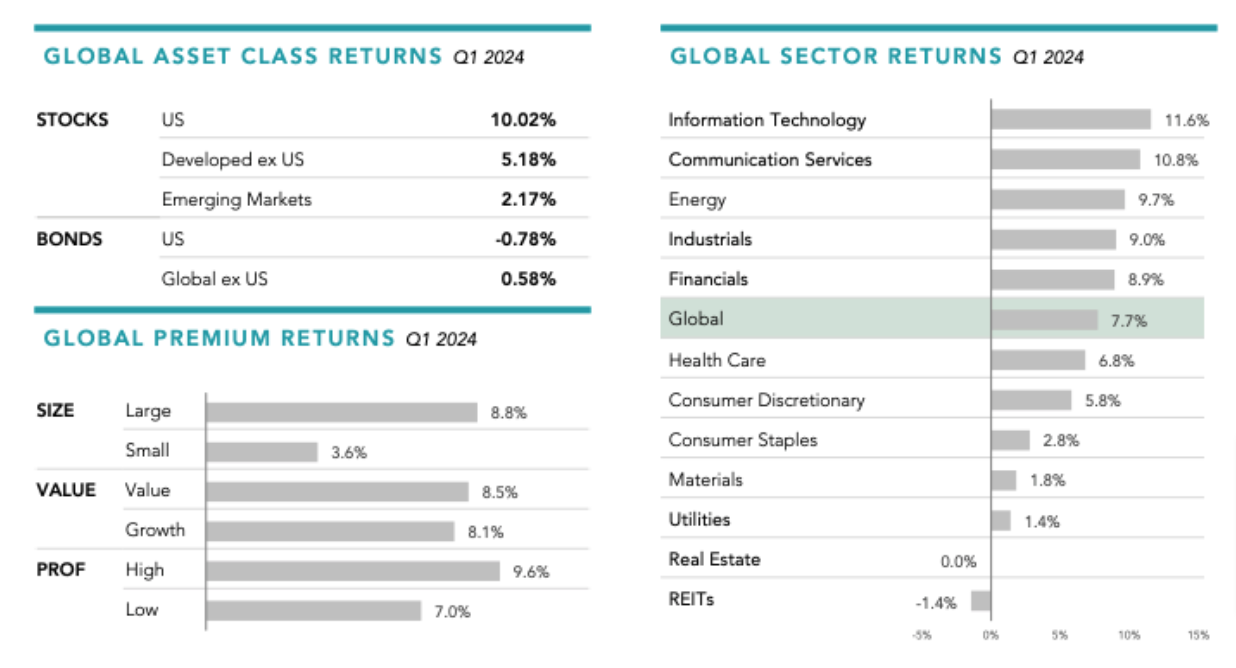

Global stocks had an impressive start to the year, returning 8% in the first quarter. The prospect of an AI-driven productivity boom drove stocks higher, especially in the US, outweighing areas of uncertainty such as higher-for-longer interest rates and upcoming US elections.

Japan made headlines as the Nikkei reached new record highs for the first time since 1989. And major US indices, including the Russell 3000 and S&P 500 Index, ended the quarter at all-time highs. IT and Communication Services stocks led the stock market gains but it wasn’t concentrated in the “Magnificent 7” names that led the US market last year. While Nvidia, Microsoft, Meta and Amazon all contributed to market returns, both Apple and Tesla detracted. REITs were the only sector to post negative returns for the quarter, falling after a strong fourth quarter last year.

Globally, value stocks trailed growth stocks and small caps trailed large caps. However, profitability offered a ballast against these negative premiums, as stocks with higher profitability generally outperformed their lower profitability counterparts.

Past performance is no guarantee of future results. This information is provided for registered investment advisors and institutional investors and is not intended for public use. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. Market segment (index representation) as follows: US Stock Market (Russell 3000 Index), Developed ex US Stocks (MSCI World ex USA IMI Index [net div.]), Emerging Markets (MSCI Emerging Markets IMI Index [net div.]), US Bond Market (Bloomberg US Aggregate Bond Index), and Global Bond Market ex US (Bloomberg Global Aggregate ex-USD Bond Index [hedged to USD]), Global Stock Market (MSCI All Country World IMI Index [net div.]). Sector returns are derived by Dimensional using constituent data from the MSCI All Country World IMI Index. Returns for specific securities are sourced from the MSCI All Country World IMI Index using daily security returns. Securities without a GICS sector are excluded. Sectors are classified according to GICS Industry code. GICS was developed by and is the exclusive property of MSCI and S&P Dow Jones Indices LLC, a division of S&P Global. S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2024, all rights reserved. Bloomberg data provided by Bloomberg. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. References to specific company securities should not be construed as a recommendation or investment advice. Global Premium Returns are computed from MSCI All Country World IMI Index published security weights and Dimensional computed security returns and Dimensional classification of securities based on size, value, and profitability parameters. Within the US, Large Cap is defined as approximately the largest 90% of market capitalization in each country or region; Small Cap is approximately the smallest 10%. Within the non-US developed markets, Large Cap is defined as approximately the largest 87.5% of market capitalization in each country or region; Small Cap is approximately the smallest 12.5%. Within emerging markets, Large Cap is defined as approximately the largest 85% of market capitalization in each country or region; Small Cap is approximately the smallest 15%. Designations between value and growth are based on price-to-book ratios. Value is defined as the 50% of market cap with the lowest price-to-book ratios by size category and growth is the highest 50%. Profitability is measured as operating income before depreciation and amortization minus interest expense scaled by book. High profitability is defined as the 50% of market cap with the highest profitability by size category and low profitability is the lowest 50%. REITs and utilities, identified by GICS code, and stocks without size, relative price, or profitability metrics are excluded from this analysis. Countries not in the Dimensional investable universe are excluded from the analysis. Their performance does not reflect the expenses associated with the management of an actual portfolio. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. Named securities may be held in accounts managed by Dimensional.

Morgan H Smith Jr. is an investment advisor with Constitution Wealth. Constitution Wealth is a registered investment adviser in Wyoming. Constitution Wealth is registered with the Securities and Exchange Commission (SEC). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the commission. Constitution Wealth only transacts business in states in which the firm is properly registered or is excluded or exempted from registration. A copy of Constitution Wealth’s current written disclosure brochure filed with the SEC, which discusses among other things, Constitution Wealth’s business practices, services, and fees, is available through the SEC’s website at www.adviserinfo.sec.gov.

Please note, the information provided in this document is for informational purposes only and investors should determine for themselves whether a particular service or product is suitable for their investment needs. Please refer to the disclosure and offering documents for further information concerning specific products or services.

Any hypothetical, backtested performance has been provided for illustrative purposes only, and is not necessarily, and does not purport to be, indicative, or a guarantee, of future results or the adviser’s skill. Hypothetical, backtested performance does not represent actual performance. The results are prepared by retroactive application of a model, with the benefit of hindsight, and actual results may vary substantially. The preparation of such information is based on underlying assumptions, and does not represent the actual performance of any fund, portfolio, or investor, it is subject to risk and limitations that are not applicable to non-hypothetical performance presentations. Although advisor believes any hypothetical, backtested performance calculations described herein are based on reasonable assumptions, the use of different assumptions would produce different results. For the foregoing and other similar reasons, the comparability of hypothetical, backtested performance to the prior (or future) actual performance of a fund is limited, and prospective investors should not unduly rely on any such information in making an investment decision.

Nothing provided in this document constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation or an offer to sell (or solicitation of an offer to buy) securities in the U.S. or in any other jurisdiction.

This document may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions; changing levels of competition within certain industries and markets; changes in interest rates; changes in legislation or regulation; and other economic, competitive, governmental, regulatory, and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties, and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of Constitution Wealth or any of its affiliates or principals or any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events, or any other circumstances. All statements made herein speak only as of the date they were made.

Any indices and other financial benchmarks shown are provided for illustrative purposes only, are unmanaged, reflect reinvestment of income and dividends, and do not reflect the impact of advisory fees. Investors cannot invest directly in an index. Comparisons to indexes have limitations because indexes have volatility and other material characteristics that may differ from a particular hedge fund.